As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the heavy transportation equipment industry, including Cummins (NYSE:CMI) and its peers.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 13 heavy transportation equipment stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

Luckily, heavy transportation equipment stocks have performed well with share prices up 11.3% on average since the latest earnings results.

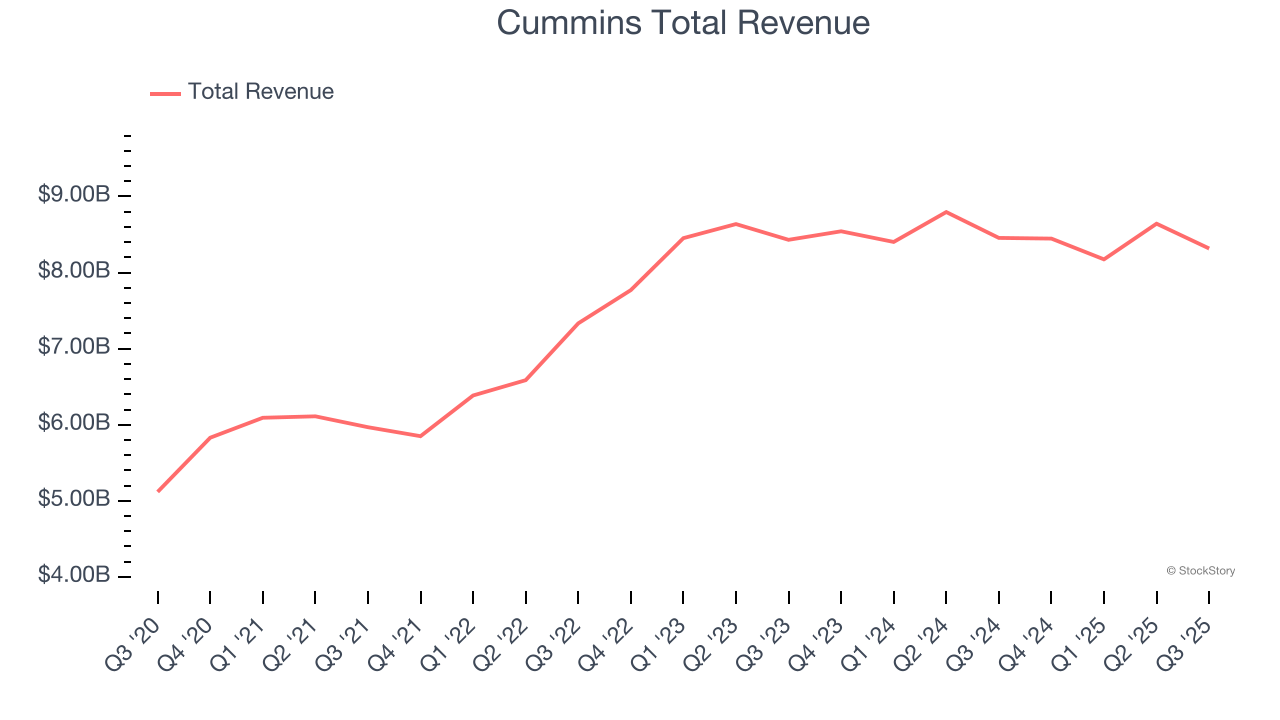

Cummins (NYSE:CMI)

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE:CMI) offers engines and power systems.

Cummins reported revenues of $8.32 billion, down 1.6% year on year. This print exceeded analysts’ expectations by 5%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

“Cummins delivered strong operating results in the third quarter, driven by profitable growth in our Power Systems and Distribution segments, due in part to continued rising demand for backup power for data centers. Effective cost management across the company helped navigate through the anticipated sharp decline in the North American truck market,” said Jennifer Rumsey, Chair and CEO.

Interestingly, the stock is up 25.9% since reporting and currently trades at $553.13.

Is now the time to buy Cummins? Access our full analysis of the earnings results here, it’s free.

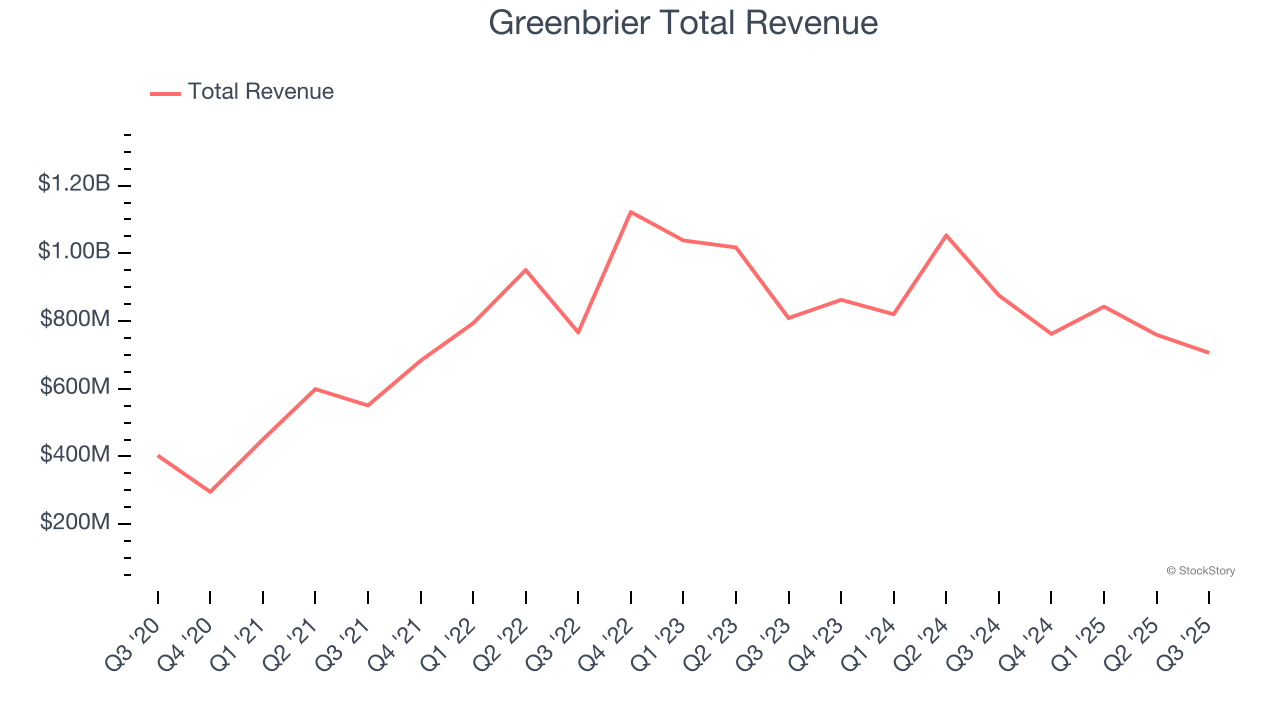

Best Q3: Greenbrier (NYSE:GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE:GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $706.1 million, down 19.4% year on year, outperforming analysts’ expectations by 7.7%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 9.7% since reporting. It currently trades at $48.31.

Is now the time to buy Greenbrier? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Wabash (NYSE:WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $381.6 million, down 17.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EPS guidance missing analysts’ expectations significantly.

Wabash delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 24.2% since the results and currently trades at $10.33.

Read our full analysis of Wabash’s results here.

Oshkosh (NYSE:OSK)

Oshkosh (NYSE:OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

Oshkosh reported revenues of $2.69 billion, down 1.9% year on year. This result missed analysts’ expectations by 5.8%. Overall, it was a slower quarter as it also recorded a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

The stock is up 10.9% since reporting and currently trades at $150.48.

Read our full, actionable report on Oshkosh here, it’s free.

Federal Signal (NYSE:FSS)

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE:FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

Federal Signal reported revenues of $555 million, up 17% year on year. This number surpassed analysts’ expectations by 1.9%. It was a strong quarter as it also put up full-year EPS guidance beating analysts’ expectations and a solid beat of analysts’ revenue estimates.

The stock is down 10.2% since reporting and currently trades at $116.57.

Read our full, actionable report on Federal Signal here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.