Coty has gotten torched over the last six months - since July 2025, its stock price has dropped 35.8% to $3.19 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Coty, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Coty Will Underperform?

Even with the cheaper entry price, we don't have much confidence in Coty. Here are three reasons you should be careful with COTY and a stock we'd rather own.

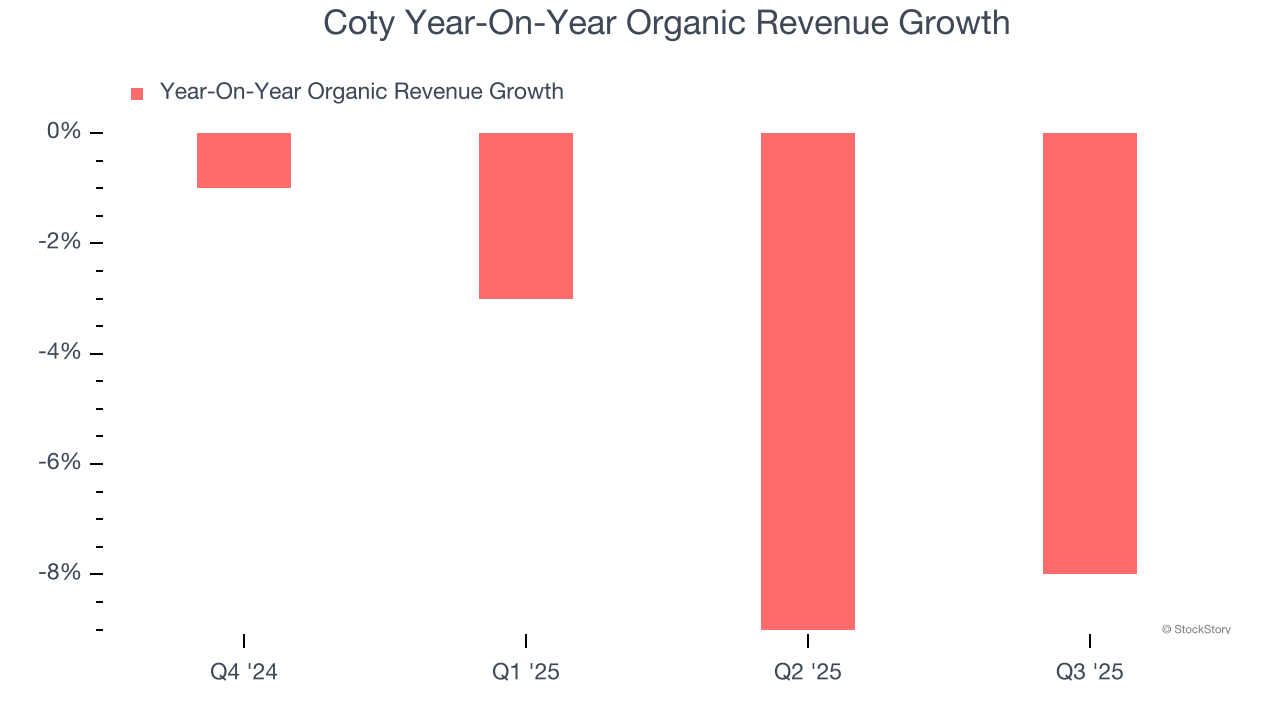

1. Core Business Falling Behind as Organic Sales Decline

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Coty’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 5.3% year on year.

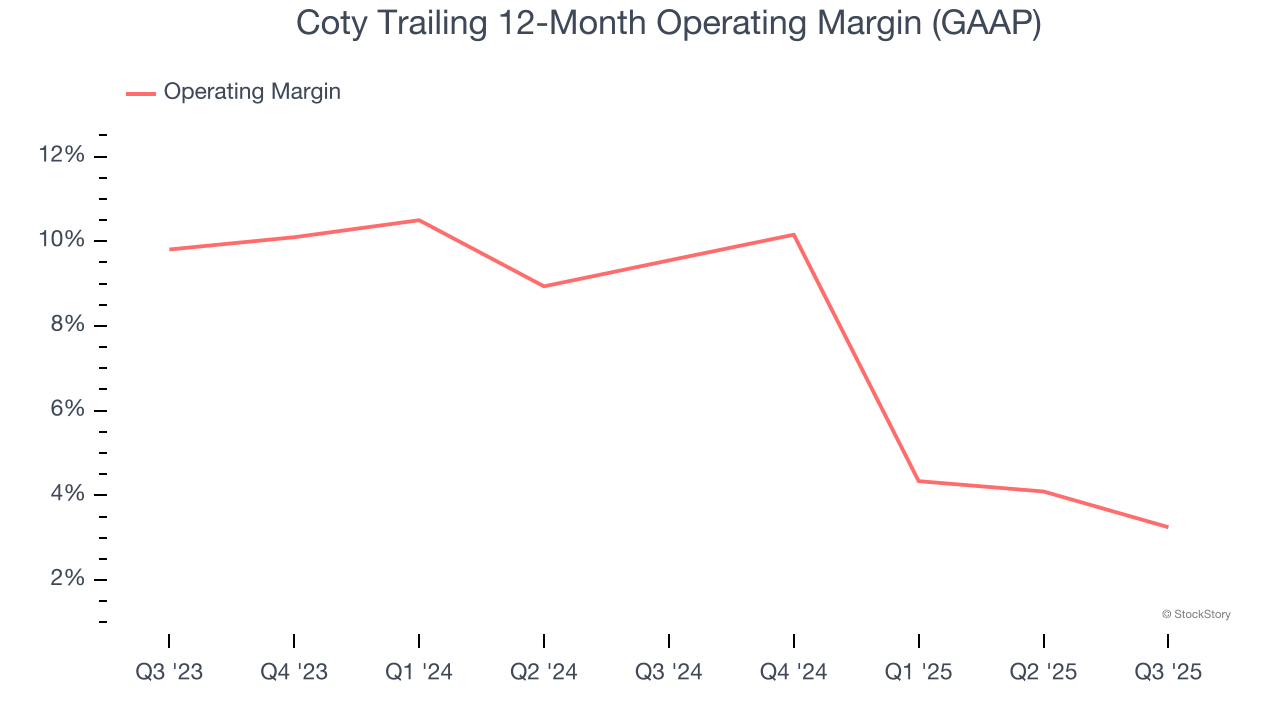

2. Shrinking Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, Coty’s operating margin decreased by 6.3 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Coty’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 3.2%.

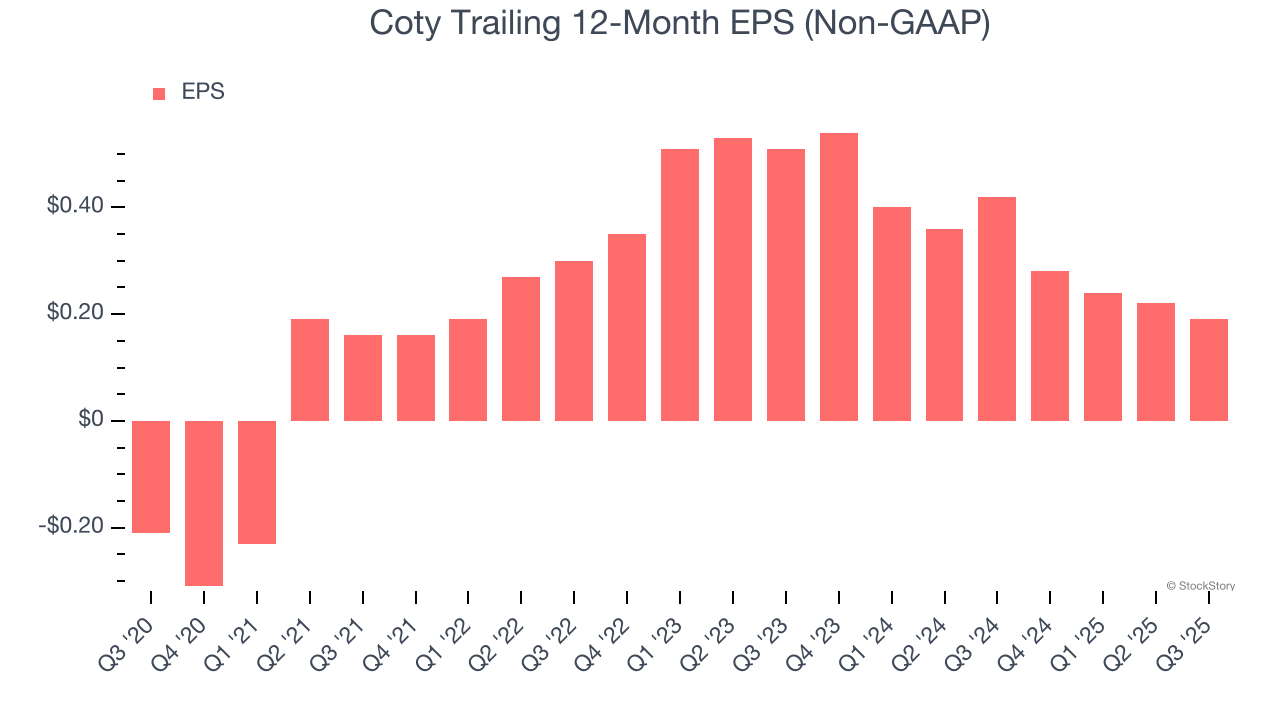

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Coty, its EPS declined by 14.1% annually over the last three years while its revenue grew by 2.9%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Coty doesn’t pass our quality test. After the recent drawdown, the stock trades at 7× forward P/E (or $3.19 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.