Looking back on sales and marketing software stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Sprinklr (NYSE:CXM) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 22 sales and marketing software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.9% on average since the latest earnings results.

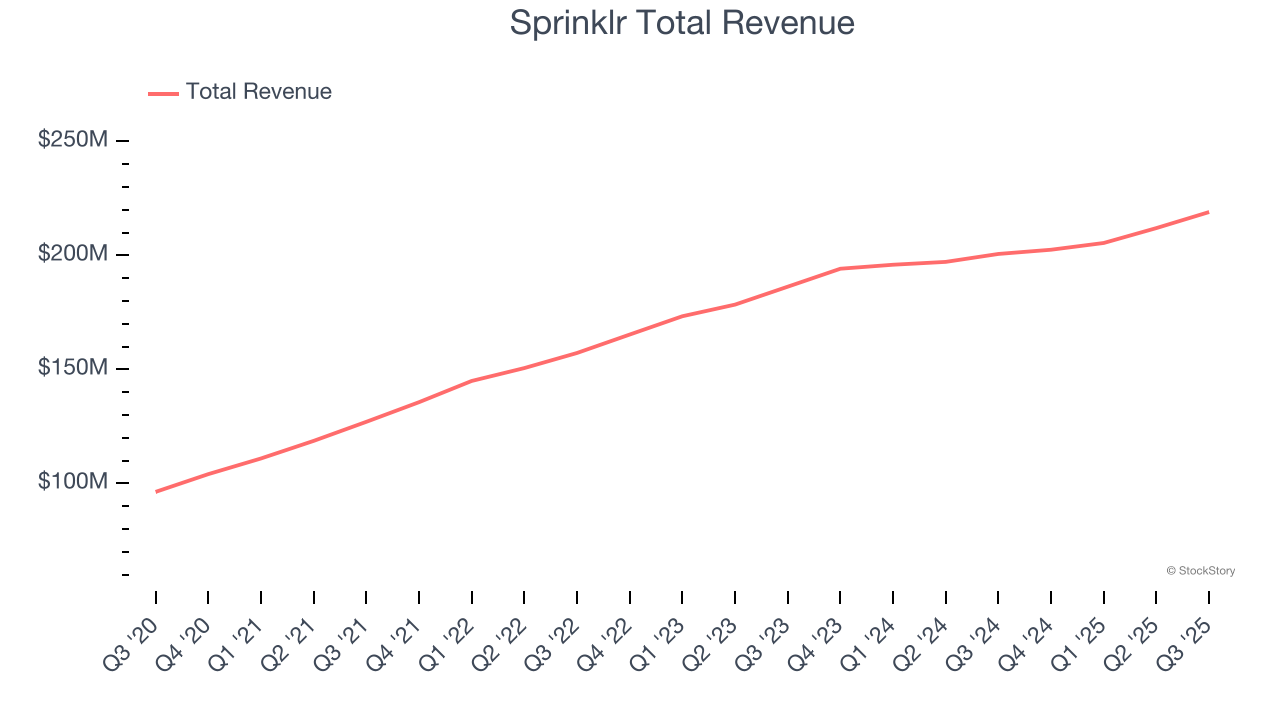

Best Q3: Sprinklr (NYSE:CXM)

With a proprietary AI engine processing 450 million data points daily across 30+ digital channels, Sprinklr (NYSE:CXM) provides cloud-based software that helps large enterprises manage customer experiences across social, messaging, chat, and voice channels.

Sprinklr reported revenues of $219.1 million, up 9.2% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

“Our Q3 results reflect continued progress in our transformation to better serve customers and partners. While there’s more work ahead, we’re encouraged by the improving quality of customer engagements and remain focused on closing the year with momentum to establish a strong foundation for FY27,” said Rory Read, Sprinklr President and CEO.

Sprinklr scored the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 7.1% since reporting and currently trades at $8.07.

Is now the time to buy Sprinklr? Access our full analysis of the earnings results here, it’s free for active Edge members.

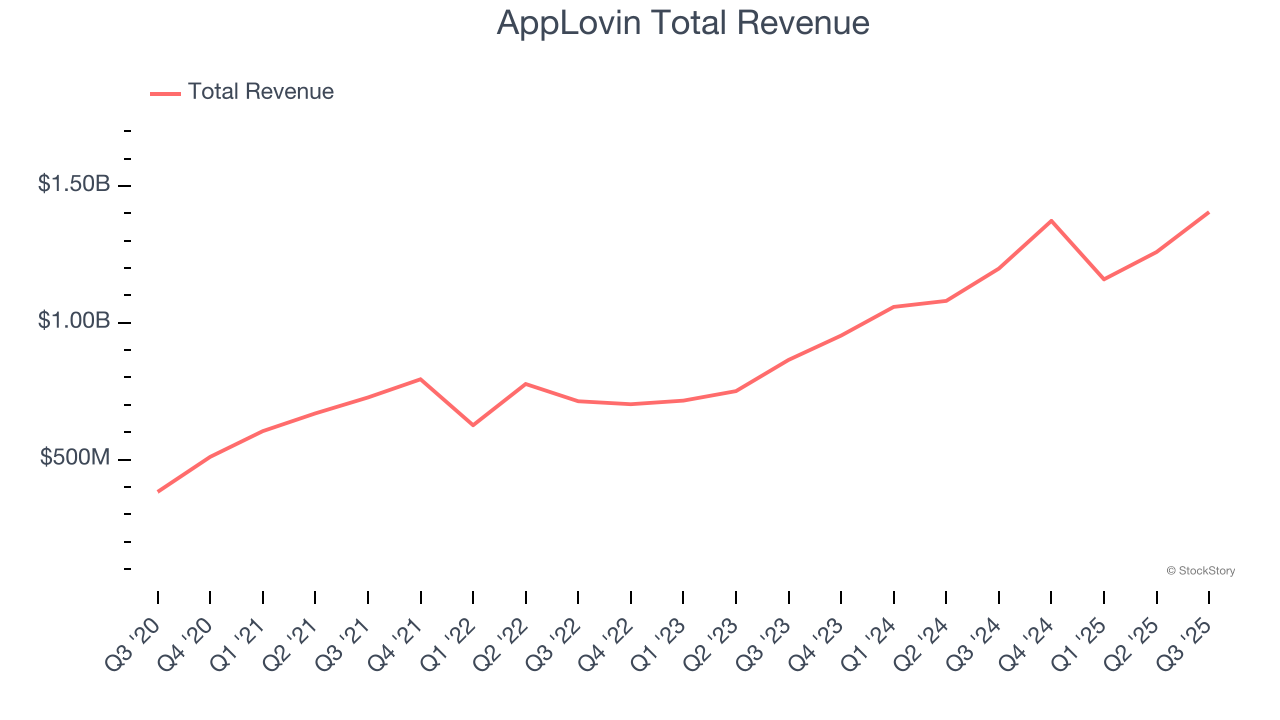

AppLovin (NASDAQ:APP)

Sitting at the crossroads of the mobile advertising ecosystem with over 200 free-to-play games in its portfolio, AppLovin (NASDAQ:APP) provides software solutions that help mobile app developers market, monetize, and grow their apps through AI-powered advertising and analytics tools.

AppLovin reported revenues of $1.41 billion, up 17.3% year on year, outperforming analysts’ expectations by 4.5%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 17% since reporting. It currently trades at $715.00.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Upland Software (NASDAQ:UPLD)

Operating under the mantra "land and expand," Upland Software (NASDAQ:UPLD) provides cloud-based applications that help organizations manage projects, workflows, and digital transformation across various business functions.

Upland Software reported revenues of $50.53 million, down 24.2% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Upland Software delivered the slowest revenue growth in the group. As expected, the stock is down 14.6% since the results and currently trades at $1.64.

Read our full analysis of Upland Software’s results here.

LiveRamp (NYSE:RAMP)

Serving as the digital middleman in an increasingly privacy-conscious world, LiveRamp (NYSE:RAMP) provides technology that helps companies securely share and connect their customer data with trusted partners while maintaining privacy compliance.

LiveRamp reported revenues of $199.8 million, up 7.7% year on year. This result beat analysts’ expectations by 1%. It was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and a narrow beat of analysts’ annual recurring revenue estimates.

The company added 5 enterprise customers paying more than $1 million annually to reach a total of 132. The stock is up 10.5% since reporting and currently trades at $30.30.

Read our full, actionable report on LiveRamp here, it’s free for active Edge members.

Zeta Global (NYSE:ZETA)

Powered by an AI engine that processes over one trillion consumer signals monthly, Zeta Global (NYSE:ZETA) operates a data-driven cloud platform that helps companies target, connect, and engage with consumers through personalized marketing across channels like email, social media, and video.

Zeta Global reported revenues of $337.2 million, up 25.7% year on year. This number topped analysts’ expectations by 2.7%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Zeta Global had the weakest full-year guidance update among its peers. The stock is up 16.4% since reporting and currently trades at $19.51.

Read our full, actionable report on Zeta Global here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.