As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the general merchandise retail industry, including Dillard's (NYSE:DDS) and its peers.

General merchandise retailers–also called broadline retailers–know you’re busy and don’t want to drive around wasting time and gas, so they offer a one-stop shop. Convenience is the name of the game, so these stores may sell clothing in one section, toys in another, and home decor in a third. This concept has evolved over time from department stores to more niche concepts targeting bargain hunters or young adults, and e-commerce has forced these retailers to be extra sharp in their value propositions to consumers, whether that’s unique product or competitive prices.

The 8 general merchandise retail stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 3.5% below.

Thankfully, share prices of the companies have been resilient as they are up 7% on average since the latest earnings results.

Best Q3: Dillard's (NYSE:DDS)

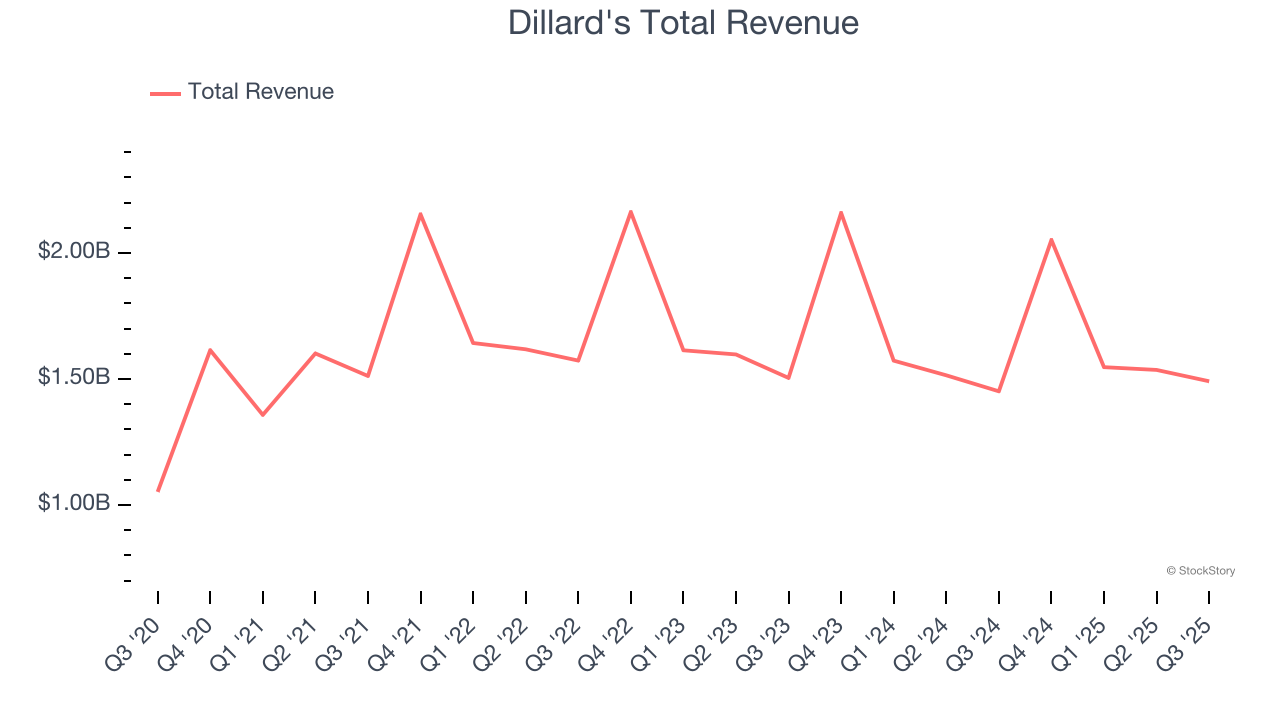

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Dillard's reported revenues of $1.49 billion, up 2.7% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Dillard’s Chief Executive Officer William T. Dillard, II commented on the quarter, “We were happy to see sales strength continue through the third quarter, ending up 3%. We look forward to seeing and serving our customers this holiday season.”

Interestingly, the stock is up 5.8% since reporting and currently trades at $641.06.

Is now the time to buy Dillard's? Access our full analysis of the earnings results here, it’s free.

Kohl's (NYSE:KSS)

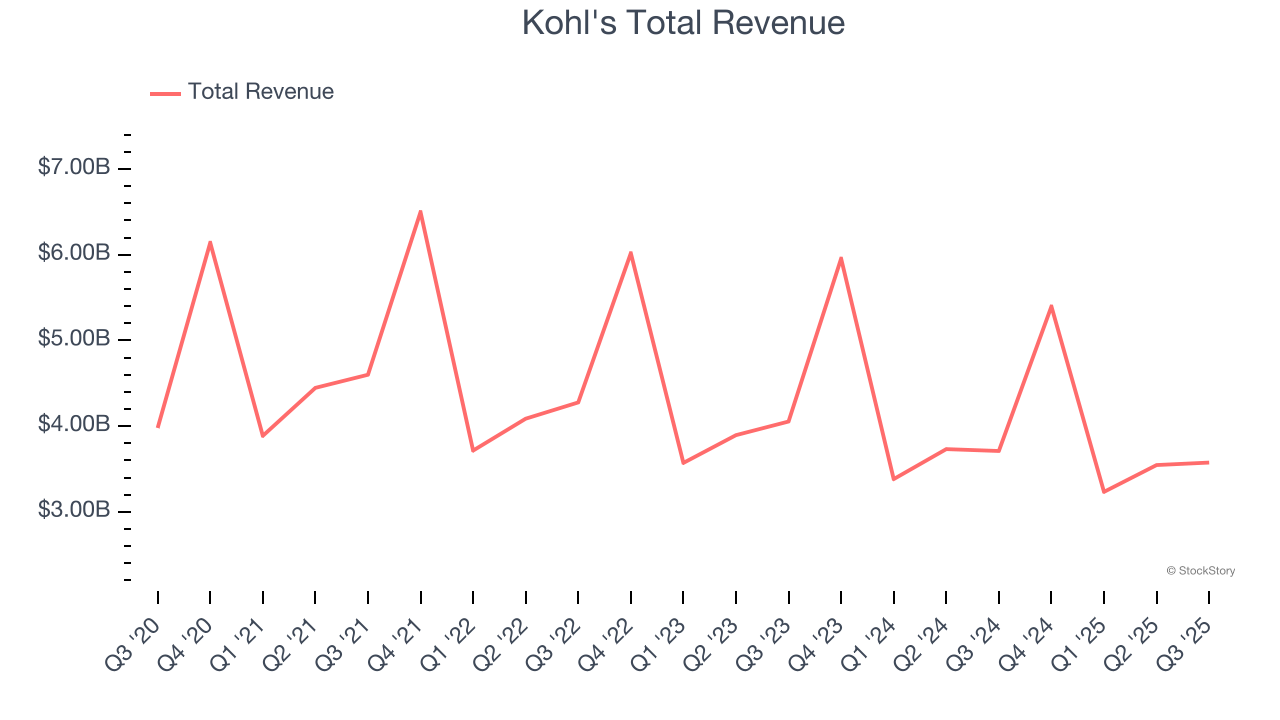

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $3.58 billion, down 3.6% year on year, outperforming analysts’ expectations by 2.5%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ gross margin estimates.

The market seems happy with the results as the stock is up 15.4% since reporting. It currently trades at $18.16.

Is now the time to buy Kohl's? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Ollie's (NASDAQ:OLLI)

Often located in suburban or semi-rural shopping centers, Ollie’s Bargain Outlet (NASDAQ:OLLI) is a discount retailer that acquires excess inventory then sells at meaningful discounts.

Ollie's reported revenues of $613.6 million, up 18.6% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a narrow beat of analysts’ EBITDA estimates but revenue in line with analysts’ estimates.

As expected, the stock is down 8.4% since the results and currently trades at $108.83.

Read our full analysis of Ollie’s results here.

Macy's (NYSE:M)

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Macy's reported revenues of $4.91 billion, flat year on year. This print topped analysts’ expectations by 3.4%. Overall, it was a stunning quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ gross margin estimates.

The stock is down 6% since reporting and currently trades at $21.35.

Read our full, actionable report on Macy's here, it’s free.

TJX (NYSE:TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $15.12 billion, up 7.5% year on year. This number beat analysts’ expectations by 1.5%. It was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ gross margin estimates.

The stock is up 4.2% since reporting and currently trades at $151.74.

Read our full, actionable report on TJX here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.