Darden has been treading water for the past six months, recording a small loss of 2.9% while holding steady at $198.93. The stock also fell short of the S&P 500’s 10% gain during that period.

Is now the time to buy Darden, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Darden Not Exciting?

We don't have much confidence in Darden. Here are three reasons there are better opportunities than DRI and a stock we'd rather own.

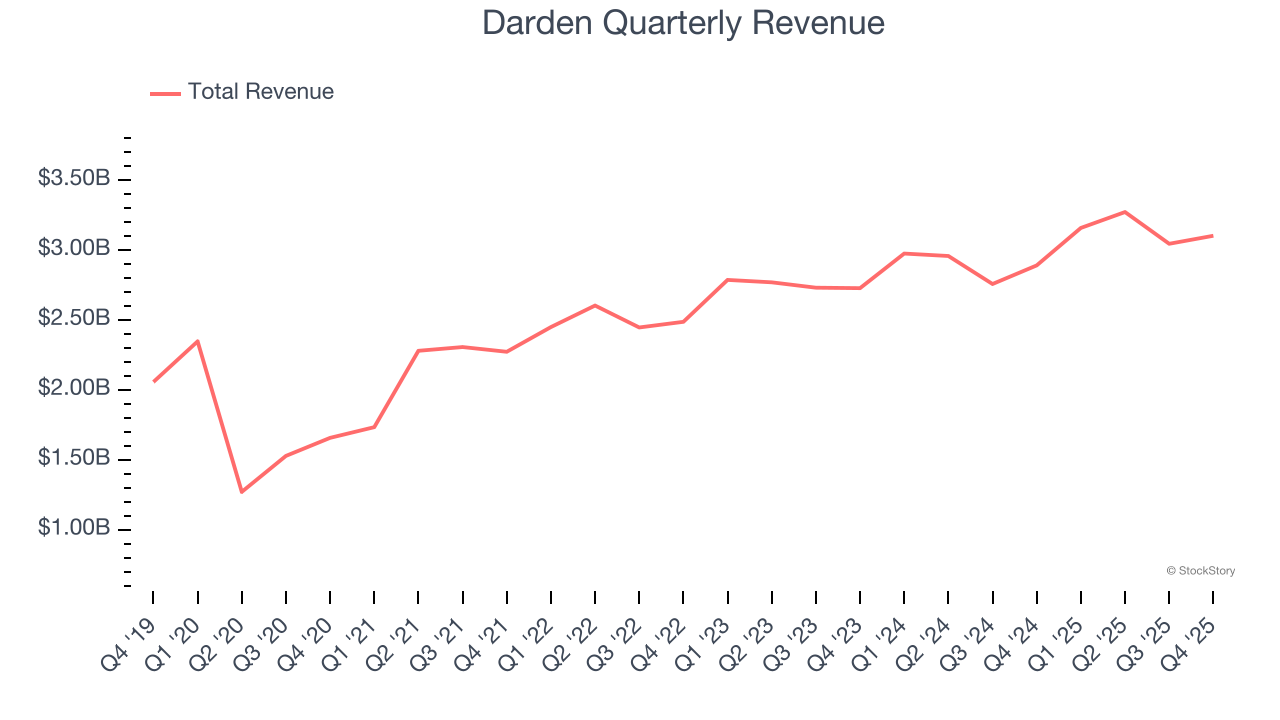

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last six years, Darden grew its sales at a mediocre 6.4% compounded annual growth rate. This was below our standard for the restaurant sector.

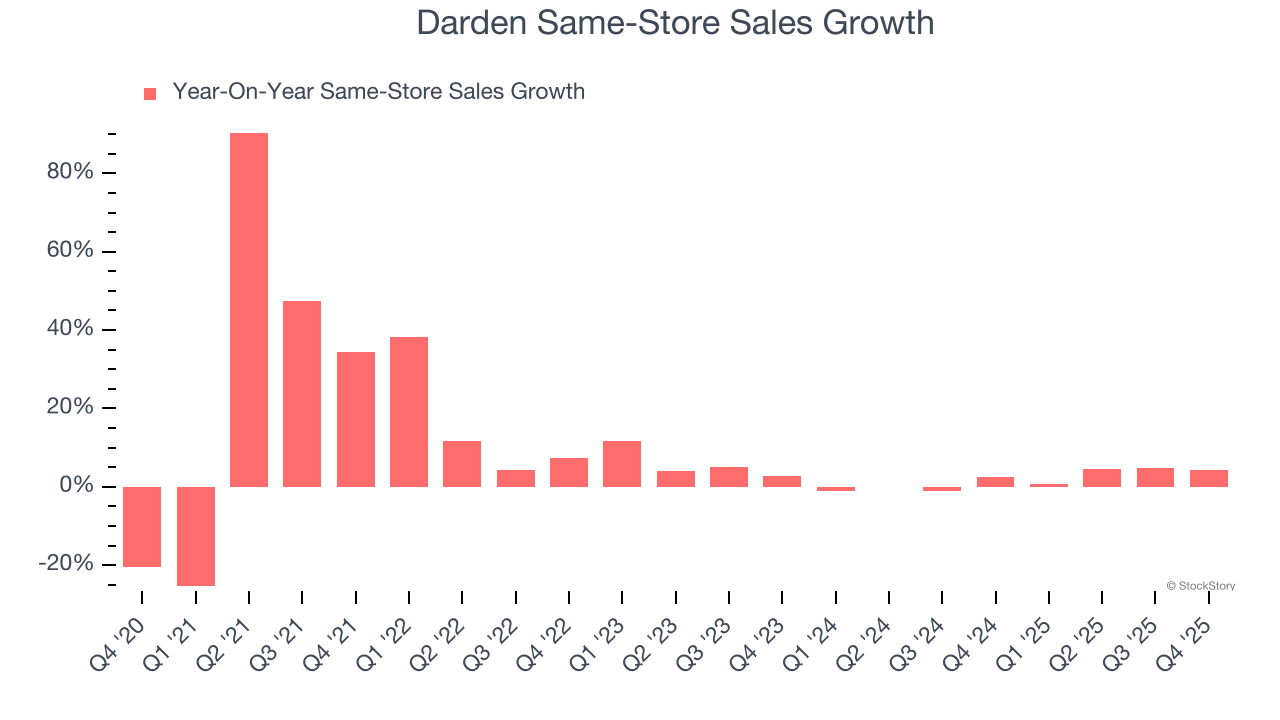

2. Same-Store Sales Falling Behind Peers

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Darden’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.8% per year.

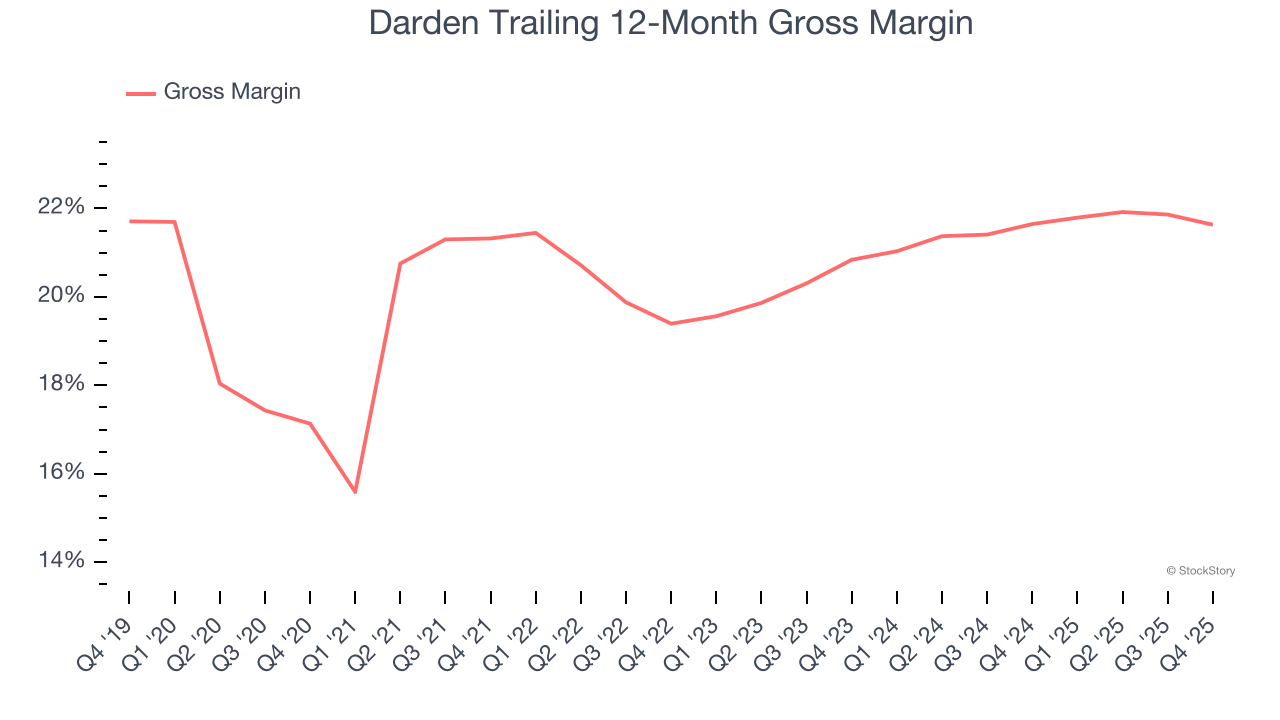

3. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margins are an important measure of a restaurant’s pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Darden has bad unit economics for a restaurant company, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 21.6% gross margin over the last two years. Said differently, Darden had to pay a chunky $78.36 to its suppliers for every $100 in revenue.

Final Judgment

Darden isn’t a terrible business, but it isn’t one of our picks. With its shares underperforming the market lately, the stock trades at 18× forward P/E (or $198.93 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.