Although DXC (currently trading at $15.17 per share) has gained 5% over the last six months, it has trailed the S&P 500’s 11.1% return during that period. This may have investors wondering how to approach the situation.

Is there a buying opportunity in DXC, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think DXC Will Underperform?

We're cautious about DXC. Here are three reasons you should be careful with DXC and a stock we'd rather own.

1. Core Business Falling Behind as Demand Declines

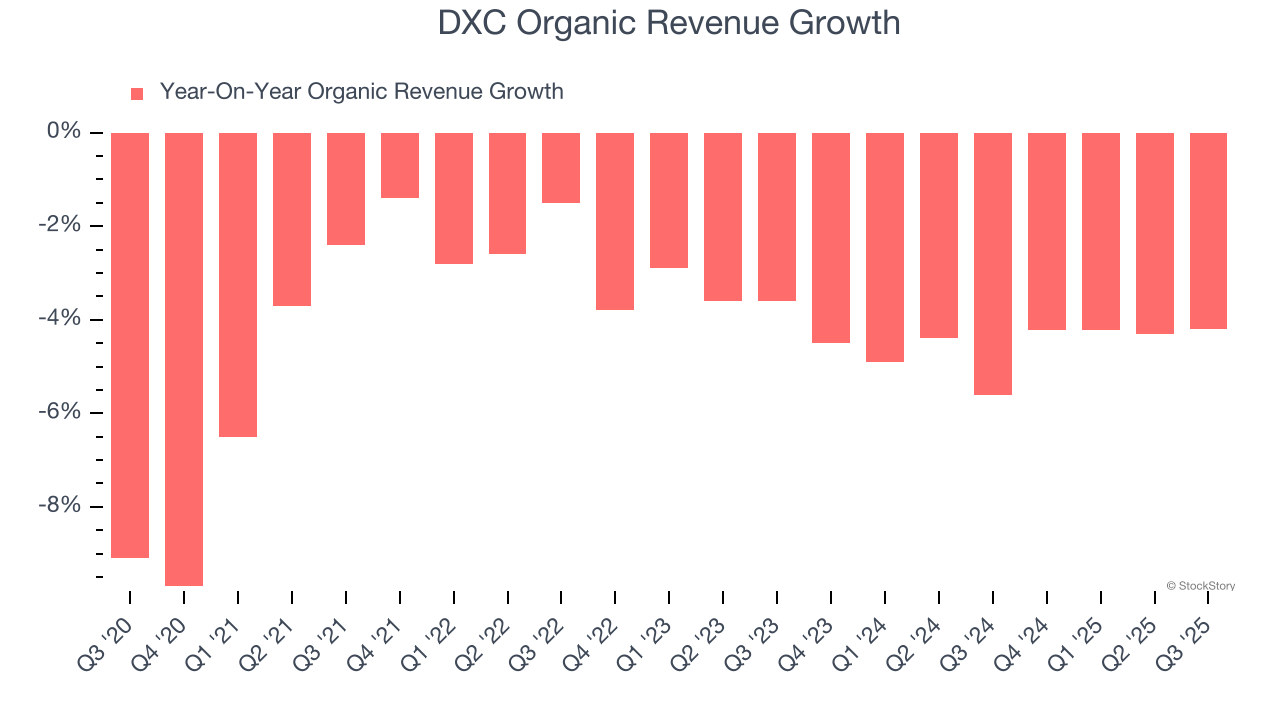

We can better understand IT Services & Consulting companies by analyzing their organic revenue. This metric gives visibility into DXC’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, DXC’s organic revenue averaged 4.5% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests DXC might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Growth Has Stalled

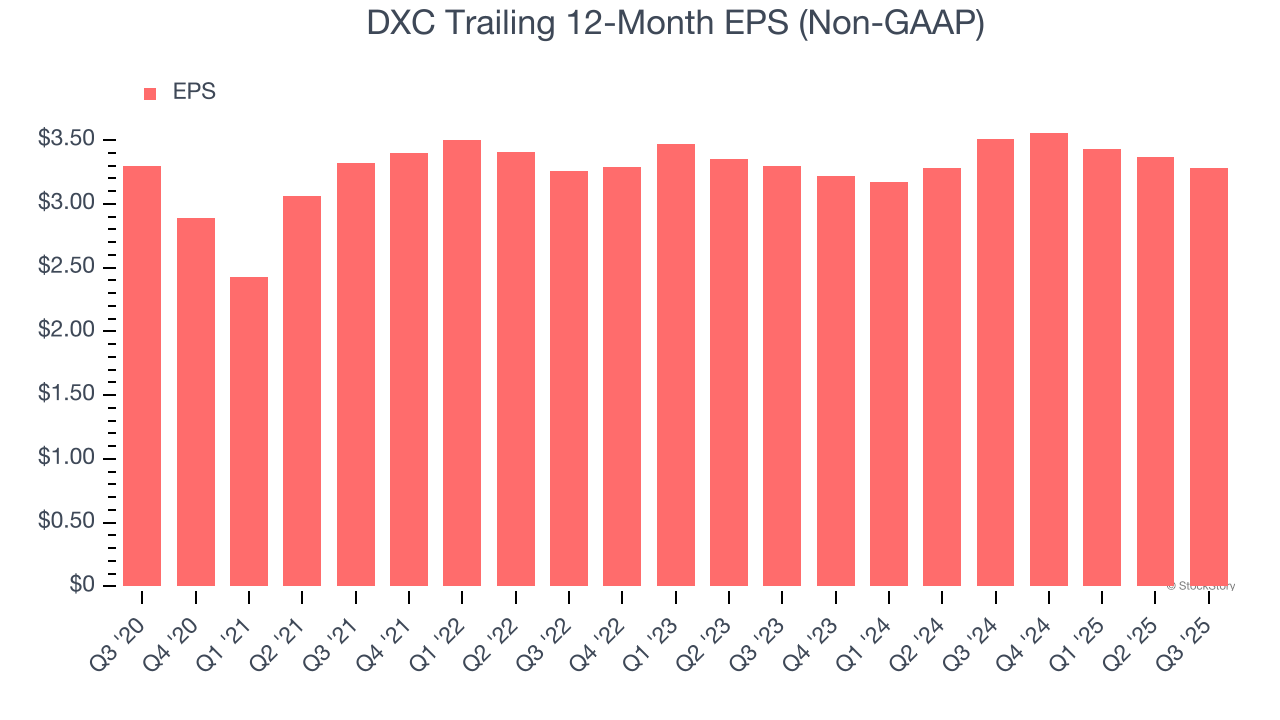

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

DXC’s flat EPS over the last five years was weak. On the bright side, this performance was better than its 7.6% annualized revenue declines.

3. Previous Growth Initiatives Haven’t Impressed

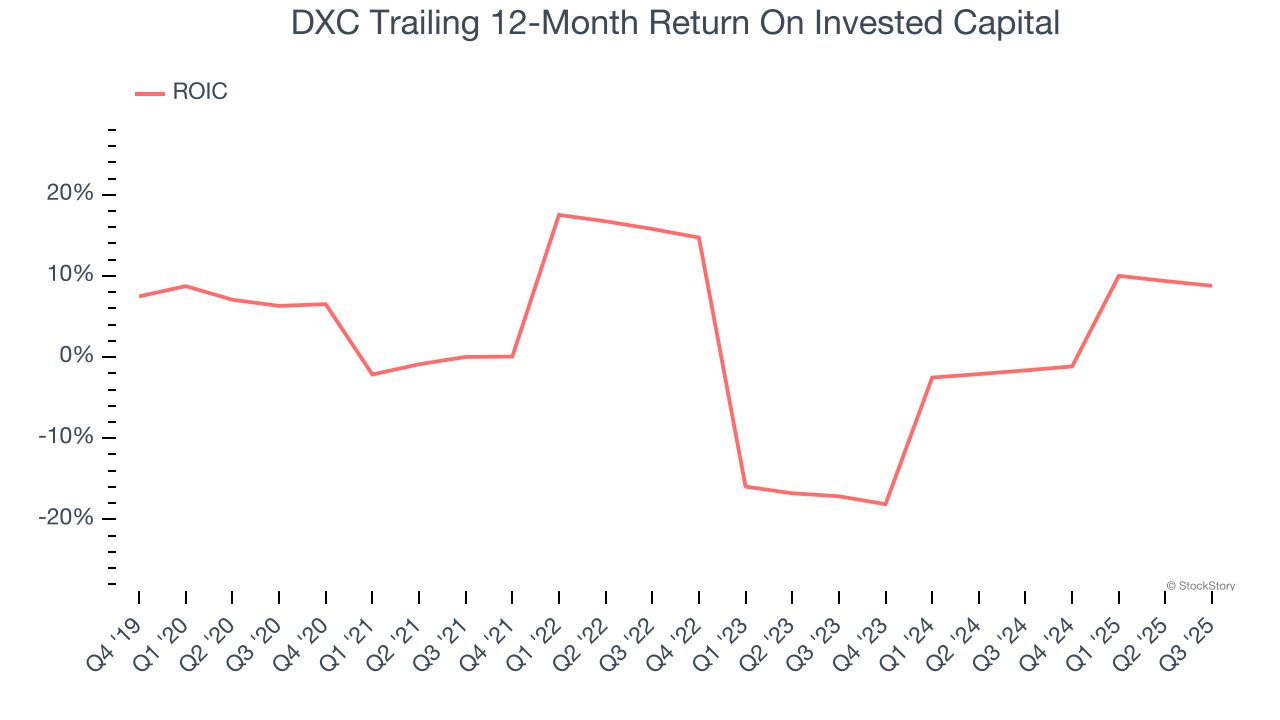

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

DXC historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.2%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

Final Judgment

DXC doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 5× forward P/E (or $15.17 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than DXC

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.