Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Endeavor (NYSE:EDR) and its peers.

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

The 9 media stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 0.8%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and media stocks have held roughly steady amidst all this, with share prices up 0.9% on average since the previous earnings results.

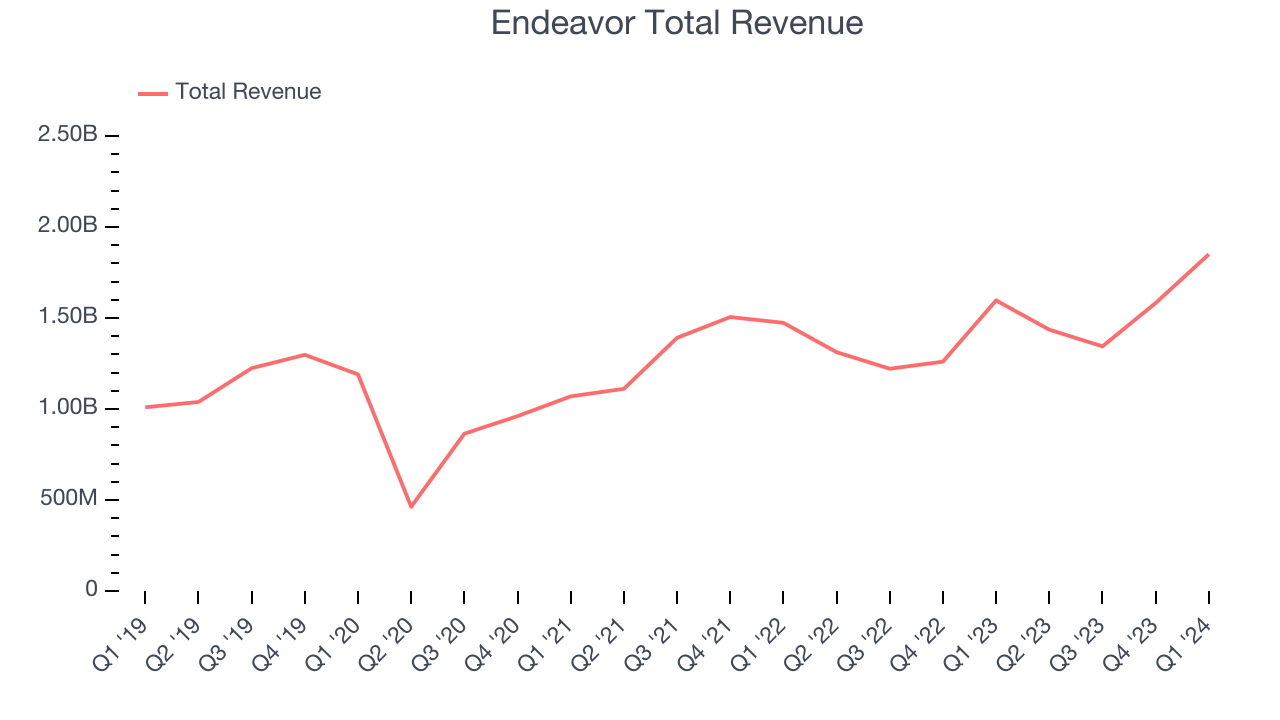

Endeavor (NYSE:EDR)

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE:EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Endeavor reported revenues of $1.85 billion, up 15.9% year on year, falling short of analysts' expectations by 1.1%. Overall, it was a mixed quarter for the company with a decent beat of analysts' earnings estimates but a miss of analysts' Sports revenue estimates.

“This quarter, Endeavor benefited from brisk demand for our sports and entertainment content, live events, and premium experiences,” said Ariel Emanuel, CEO, Endeavor.

The stock is up 3.3% since reporting and currently trades at $27.36.

Read our full report on Endeavor here, it's free.

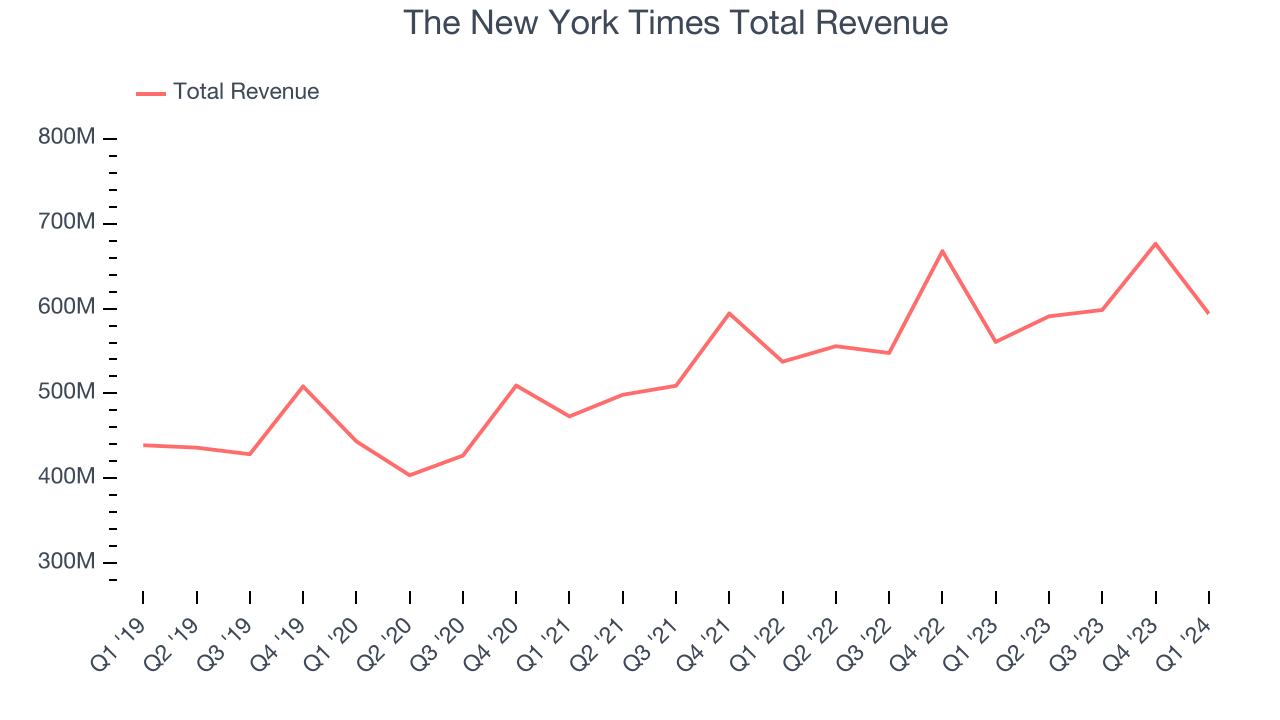

Best Q1: The New York Times (NYSE:NYT)

Founded in 1851, The New York Times (NYSE:NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

The New York Times reported revenues of $594 million, up 5.9% year on year, in line with analysts' expectations. It was a strong quarter for the company with an impressive beat of analysts' earnings estimates.

The market seems happy with the results as the stock is up 14.4% since reporting. It currently trades at $52.92.

Is now the time to buy The New York Times? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Warner Bros. Discovery (NASDAQ:WBD)

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ:WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Warner Bros. Discovery reported revenues of $9.96 billion, down 6.9% year on year, falling short of analysts' expectations by 2.6%. It was a weak quarter for the company with a miss of analysts' earnings estimates and a miss of analysts' Distribution revenue estimates.

Warner Bros. Discovery posted the weakest performance against analyst estimates in the group. As expected, the stock is down 4.7% since the results and currently trades at $7.42.

Read our full analysis of Warner Bros. Discovery's results here.

Disney (NYSE:DIS)

Founded by brothers Walt and Roy, Disney (NYSE:DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Disney reported revenues of $22.08 billion, up 1.2% year on year, in line with analysts' expectations. More broadly, it was a weak quarter for the company with a miss of analysts' earnings estimates and a miss of analysts' Experiences revenue estimates.

The stock is down 16.4% since reporting and currently trades at $97.41.

Read our full, actionable report on Disney here, it's free.

Scholastic (NASDAQ:SCHL)

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

Scholastic reported revenues of $323.7 million, flat year on year, falling short of analysts' expectations by 1.7%. More broadly, it was a weak quarter for the company with a miss of analysts' earnings estimates.

The stock is down 2.3% since reporting and currently trades at $37.03.

Read our full, actionable report on Scholastic here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.