What a brutal six months it’s been for Edgewell Personal Care. The stock has dropped 37.2% and now trades at $16.43, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Edgewell Personal Care, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Edgewell Personal Care Will Underperform?

Despite the more favorable entry price, we don't have much confidence in Edgewell Personal Care. Here are three reasons we avoid EPC and a stock we'd rather own.

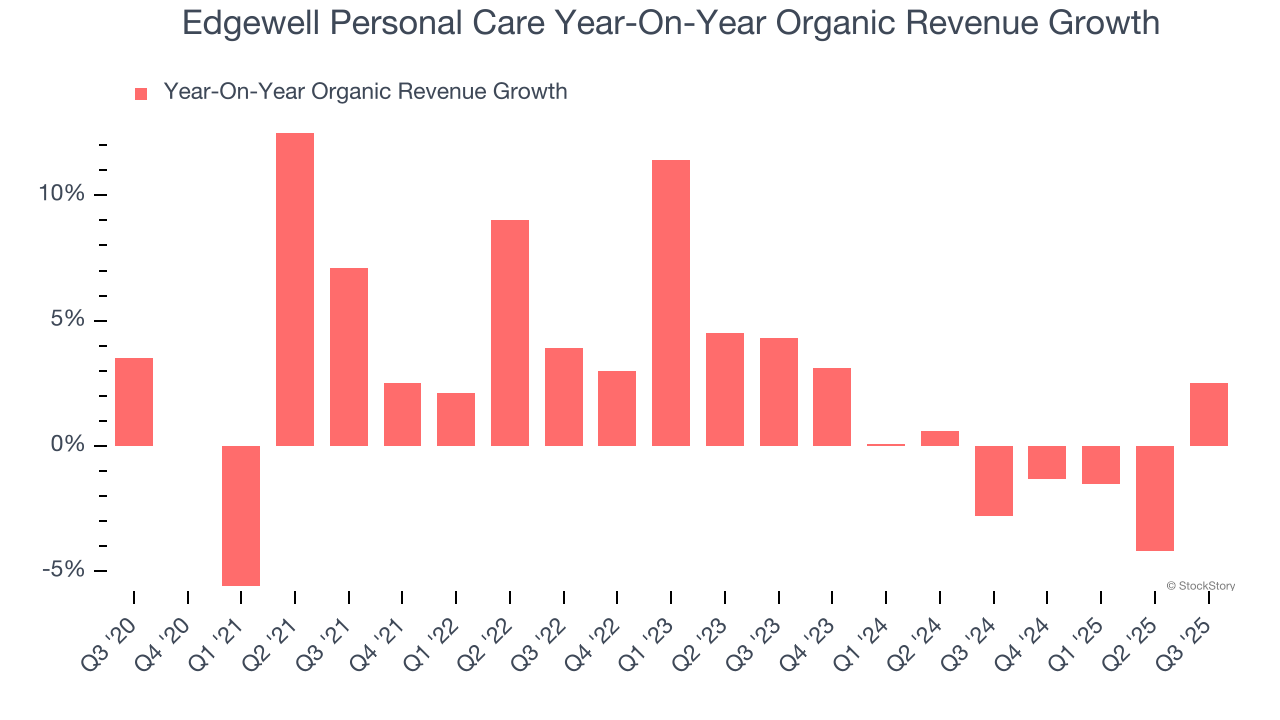

1. Core Business Falling Behind as Organic Growth Slumps

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Edgewell Personal Care’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

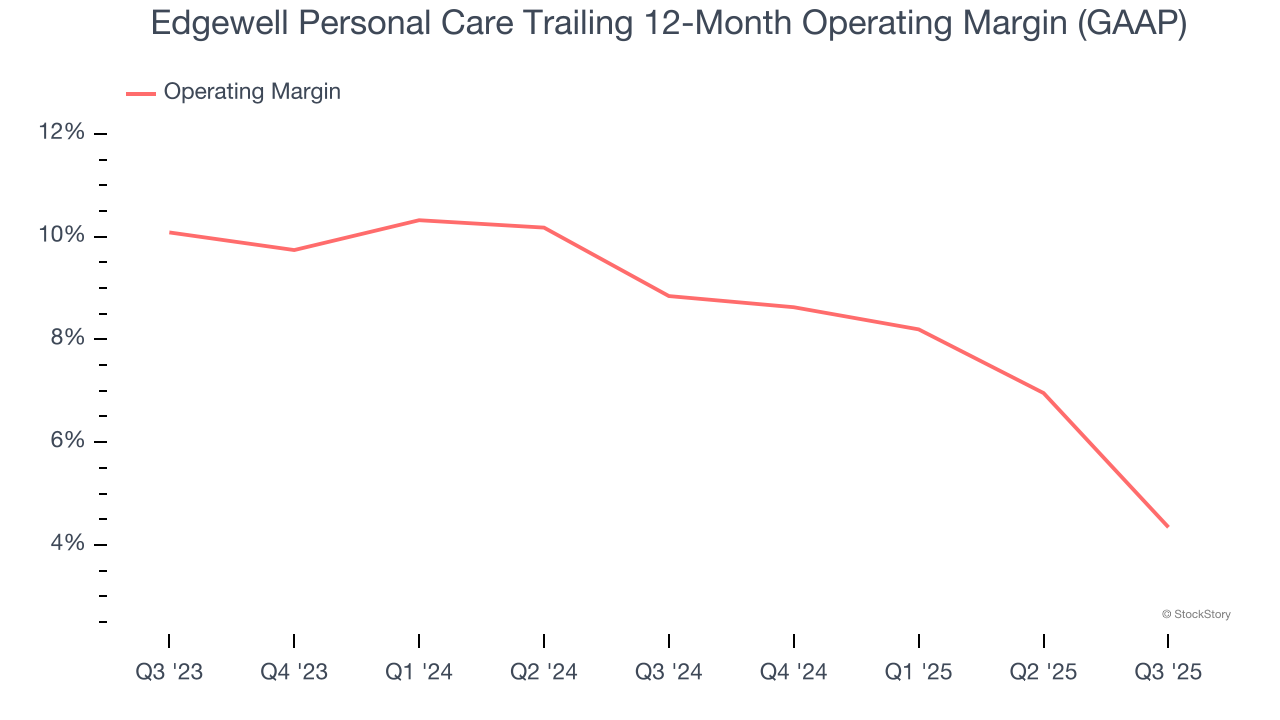

2. Shrinking Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Analyzing the trend in its profitability, Edgewell Personal Care’s operating margin decreased by 4.5 percentage points over the last year. Edgewell Personal Care’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 4.3%.

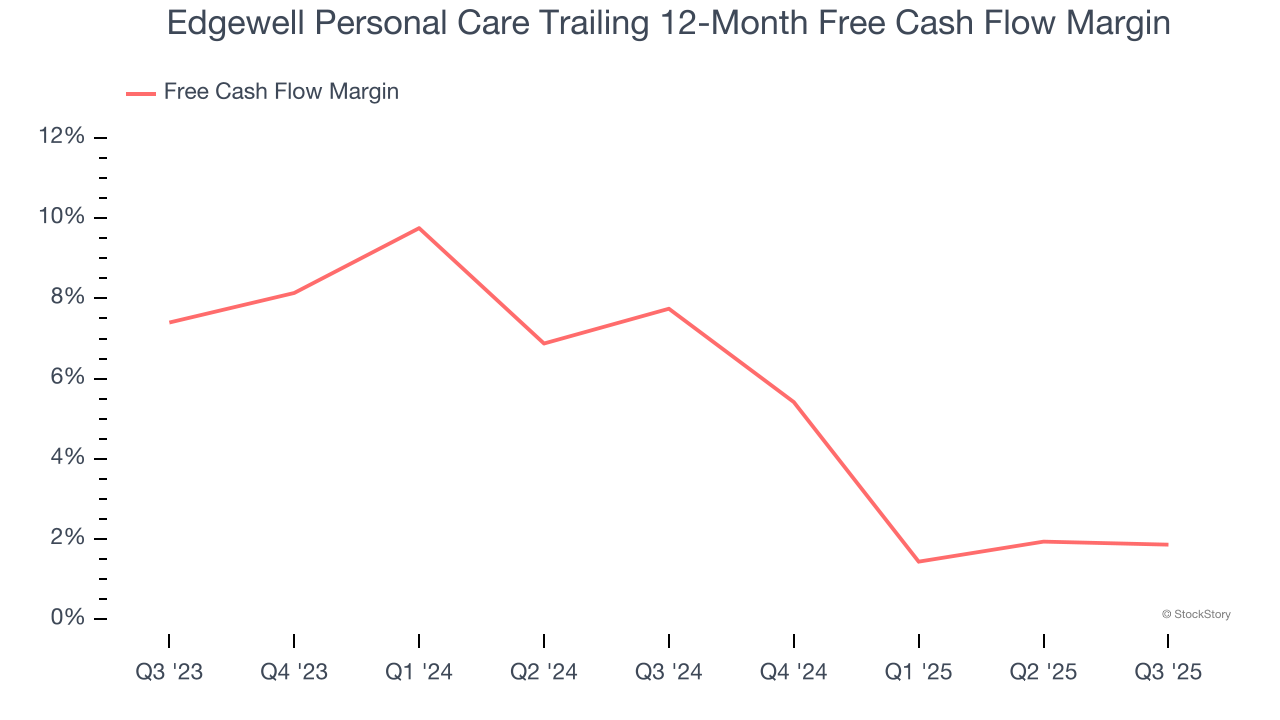

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Edgewell Personal Care’s margin dropped by 5.9 percentage points over the last year. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Edgewell Personal Care’s free cash flow margin for the trailing 12 months was 1.9%.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Edgewell Personal Care, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 6.7× forward P/E (or $16.43 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Edgewell Personal Care

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.