First American Financial currently trades at $64.71 per share and has shown little upside over the past six months, posting a middling return of 4.4%. The stock also fell short of the S&P 500’s 10.2% gain during that period.

Is now the time to buy First American Financial, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think First American Financial Will Underperform?

We don't have much confidence in First American Financial. Here are three reasons you should be careful with FAF and a stock we'd rather own.

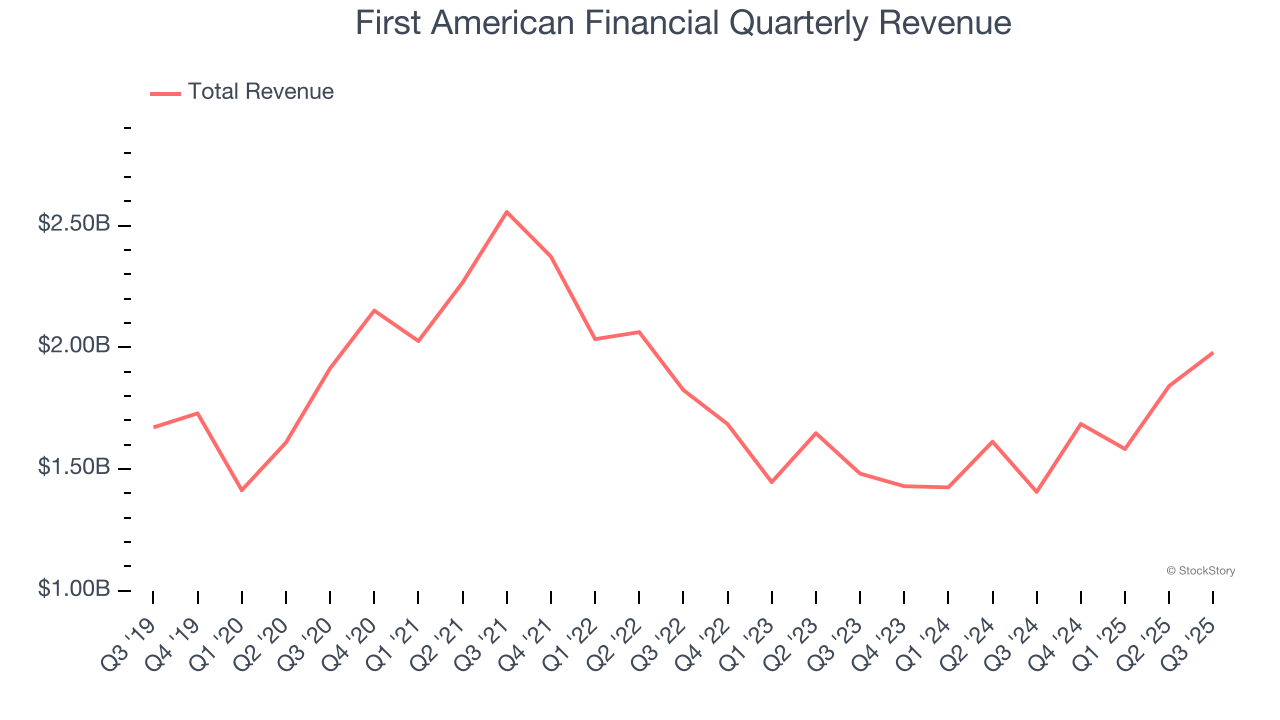

1. Long-Term Revenue Growth Disappoints

Insurers earn revenue three ways. The core insurance business itself, often called underwriting and represented in the income statement as premiums earned, is one way. Investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities is the second way. Fees from various sources such as policy administration, annuities, or other value-added services is the third.

Unfortunately, First American Financial’s 1.2% annualized revenue growth over the last five years was weak. This was below our standards.

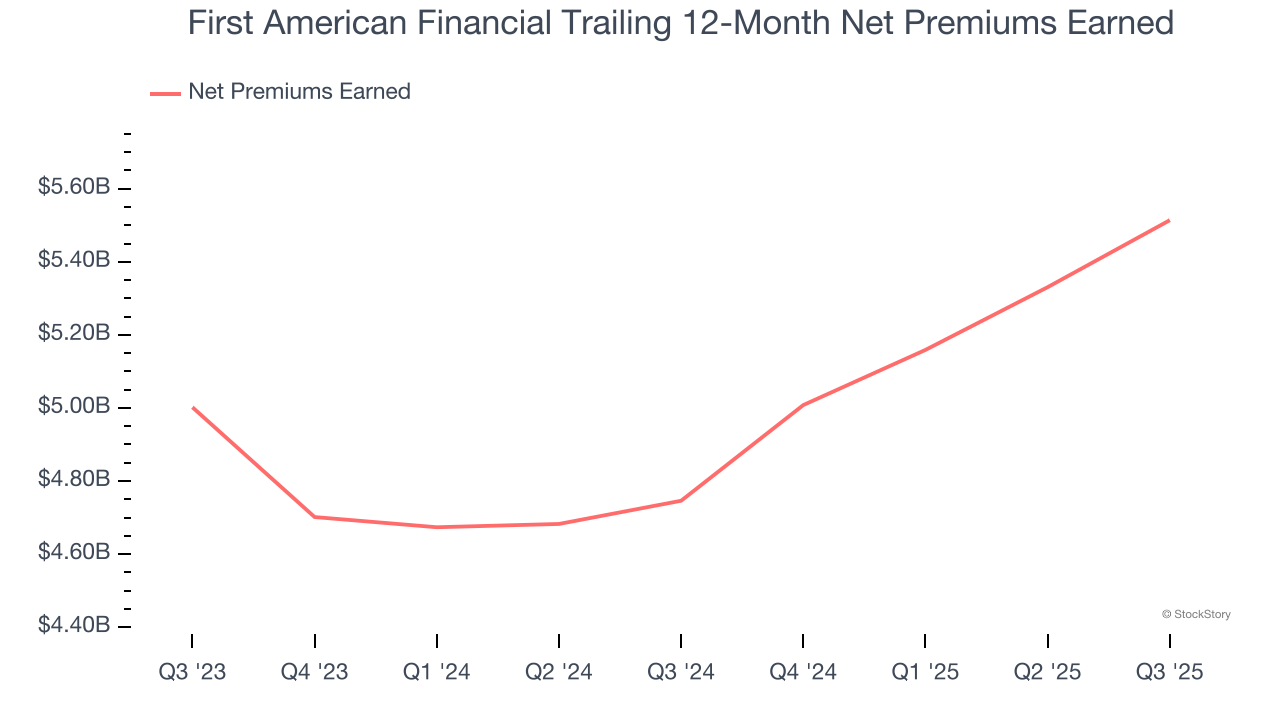

2. Net Premiums Earned Hit a Plateau

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

First American Financial’s net premiums earned was flat over the last five years, much worse than the broader insurance industry and in line with its total revenue.

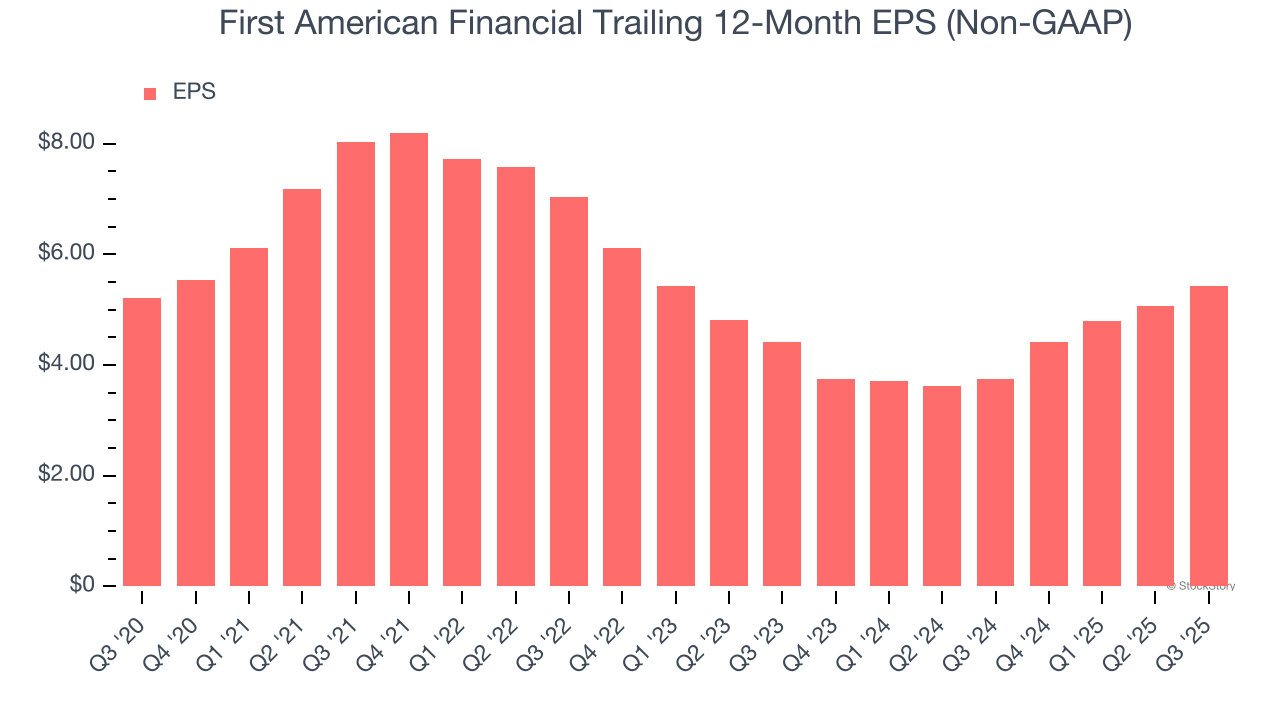

3. EPS Growth Has Stalled

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

First American Financial’s flat EPS over the last five years was below its 1.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of First American Financial, we’ll be cheering from the sidelines. With its shares trailing the market in recent months, the stock trades at 1.2× forward P/B (or $64.71 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of First American Financial

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.