As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the home furnishing and improvement retail industry, including Floor And Decor (NYSE:FND) and its peers.

Home furnishing and improvement retailers understand that ‘home is where the heart is’ but that a home is only right when it’s in livable condition and furnished just right. These stores therefore focus on providing what is needed for both the upkeep of a house as well as what is desired for the aesthetics of a home. Decades ago, it was thought that furniture and home improvement would resist e-commerce because of the logistical challenges of shipping a sofa or lawn mower, but now you can buy both online; so just like other retailers, these stores need to adapt to new realities and consumer behaviors.

The 7 home furnishing and improvement retail stocks we track reported a slower Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, home furnishing and improvement retail stocks have performed well with share prices up 24.5% on average since the latest earnings results.

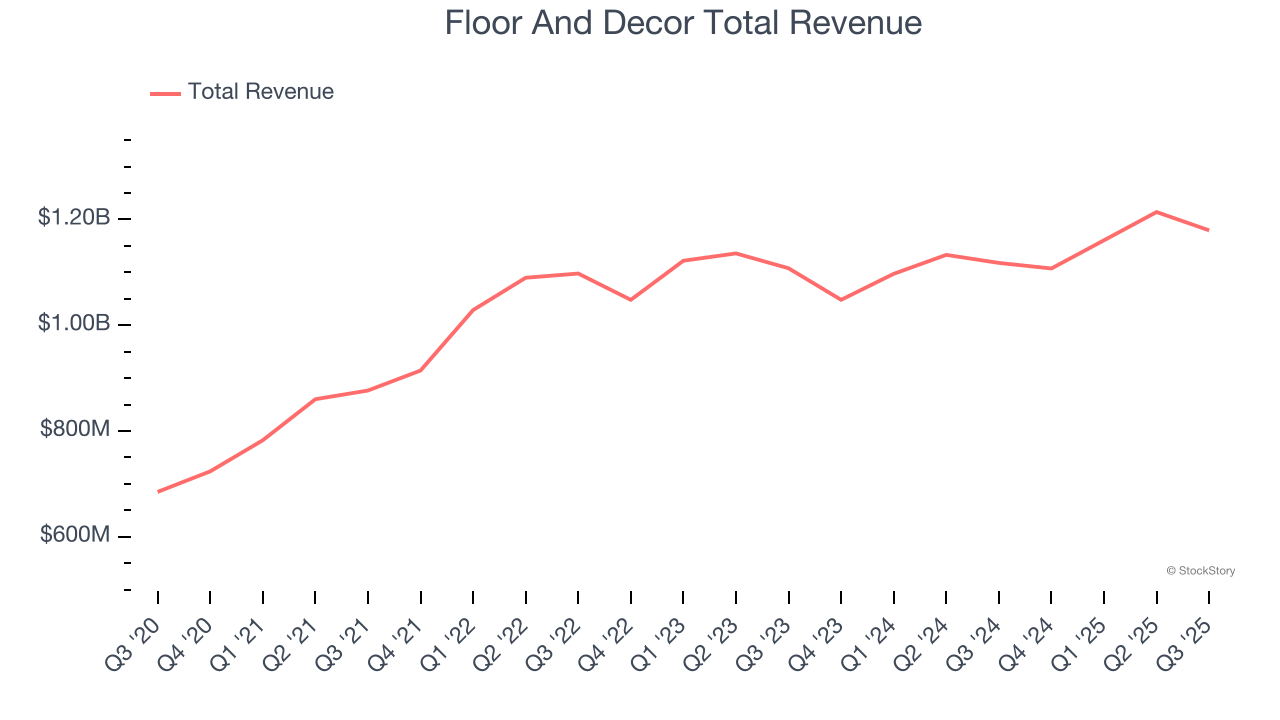

Floor And Decor (NYSE:FND)

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

Floor And Decor reported revenues of $1.18 billion, up 5.5% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ gross margin estimates but full-year revenue guidance meeting analysts’ expectations.

Tom Taylor, Chief Executive Officer, stated, “We are pleased to report third quarter diluted earnings per share of $0.53, a 10.4% increase from $0.48 in the same period last year. This result exceeded the high end of our guidance and marks our second consecutive quarter of double-digit EPS growth, a testament to our operational discipline amid persistently soft demand in the hard surface flooring industry.”

Interestingly, the stock is up 8% since reporting and currently trades at $70.20.

Is now the time to buy Floor And Decor? Access our full analysis of the earnings results here, it’s free.

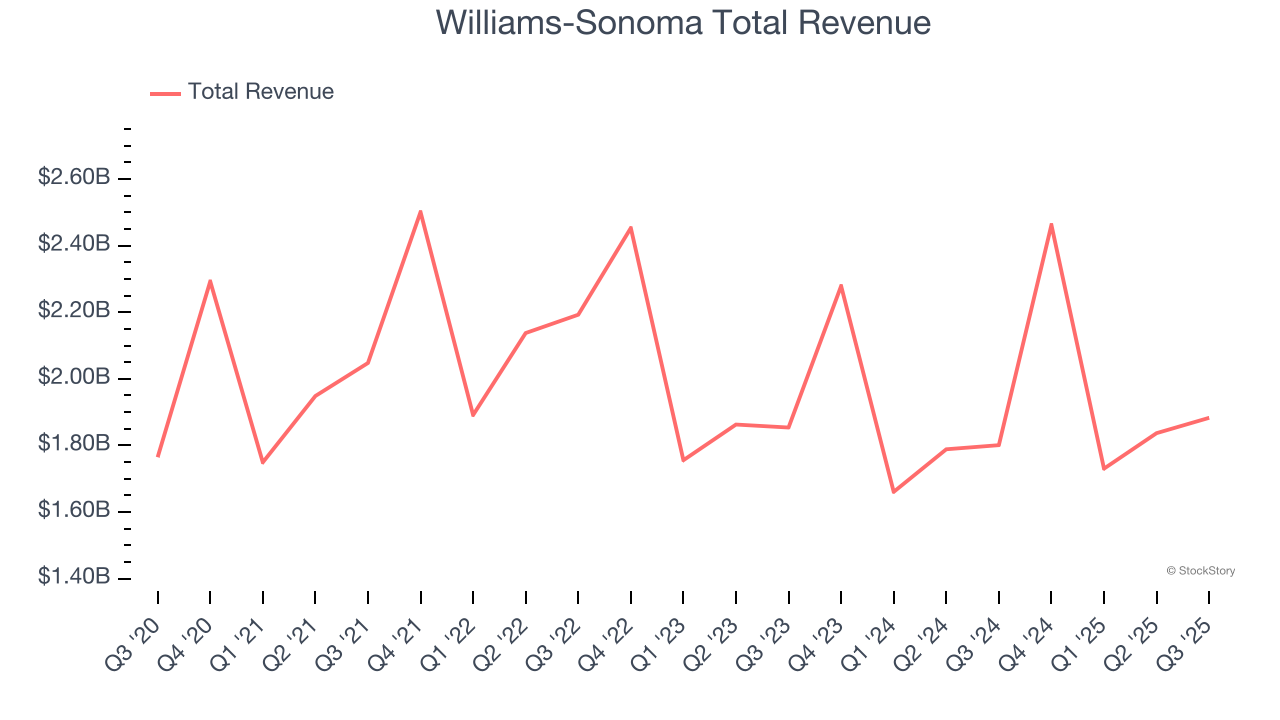

Best Q3: Williams-Sonoma (NYSE:WSM)

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Williams-Sonoma reported revenues of $1.88 billion, up 4.6% year on year, outperforming analysts’ expectations by 0.6%. The business had a strong quarter with a solid beat of analysts’ gross margin estimates and a decent beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 18.7% since reporting. It currently trades at $214.57.

Is now the time to buy Williams-Sonoma? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sleep Number (NASDAQ:SNBR)

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Sleep Number reported revenues of $342.9 million, down 19.6% year on year, falling short of analysts’ expectations by 5.4%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

Sleep Number delivered the highest full-year guidance raise but had the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 76.2% since the results and currently trades at $9.69.

Read our full analysis of Sleep Number’s results here.

Lowe's (NYSE:LOW)

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Lowe's reported revenues of $20.81 billion, up 3.2% year on year. This result was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also produced a decent beat of analysts’ gross margin estimates but revenue in line with analysts’ estimates.

Lowe's had the weakest full-year guidance update among its peers. The stock is up 31.6% since reporting and currently trades at $288.92.

Read our full, actionable report on Lowe's here, it’s free.

Home Depot (NYSE:HD)

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE:HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

Home Depot reported revenues of $41.35 billion, up 2.8% year on year. This print met analysts’ expectations. Zooming out, it was a slower quarter as it produced a miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

The stock is up 8.8% since reporting and currently trades at $389.55.

Read our full, actionable report on Home Depot here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.