The past six months have been a windfall for Gap’s shareholders. The company’s stock price has jumped 40.4%, hitting $27.67 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Gap, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Gap Not Exciting?

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons you should be careful with GAP and a stock we'd rather own.

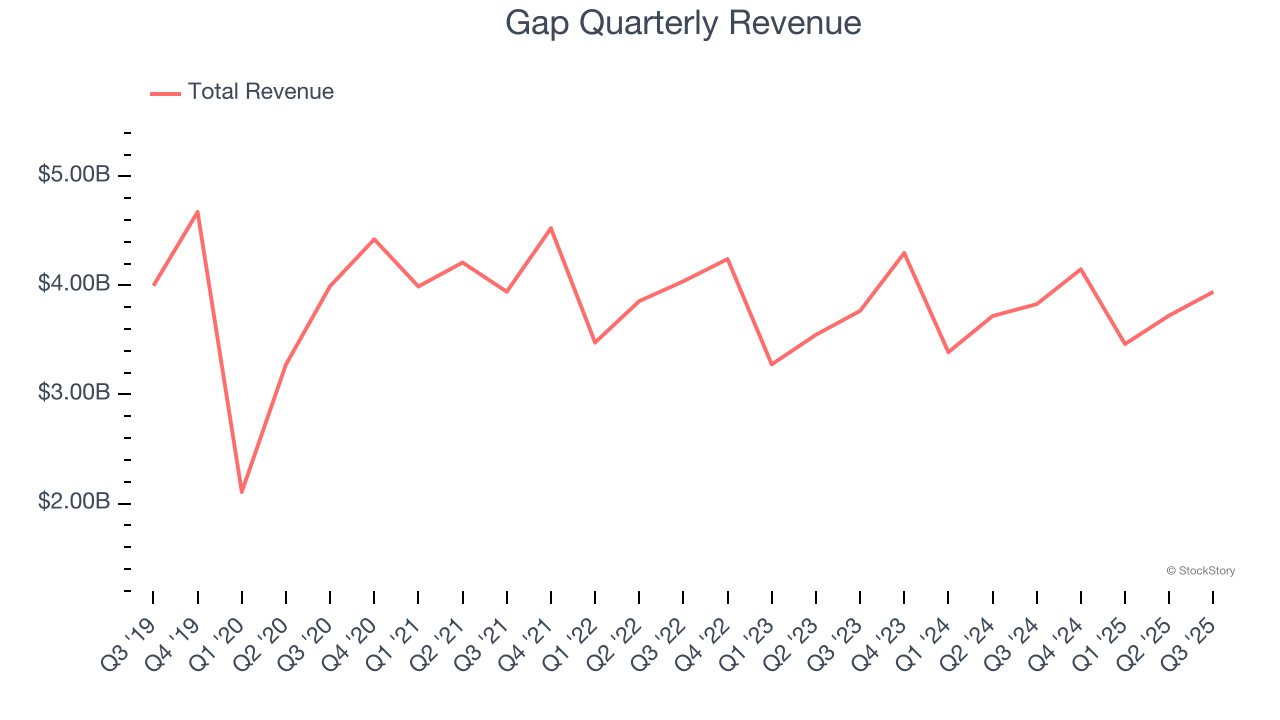

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Gap struggled to consistently generate demand over the last three years as its sales dropped at a 1.3% annual rate. This wasn’t a great result and is a sign of lacking business quality.

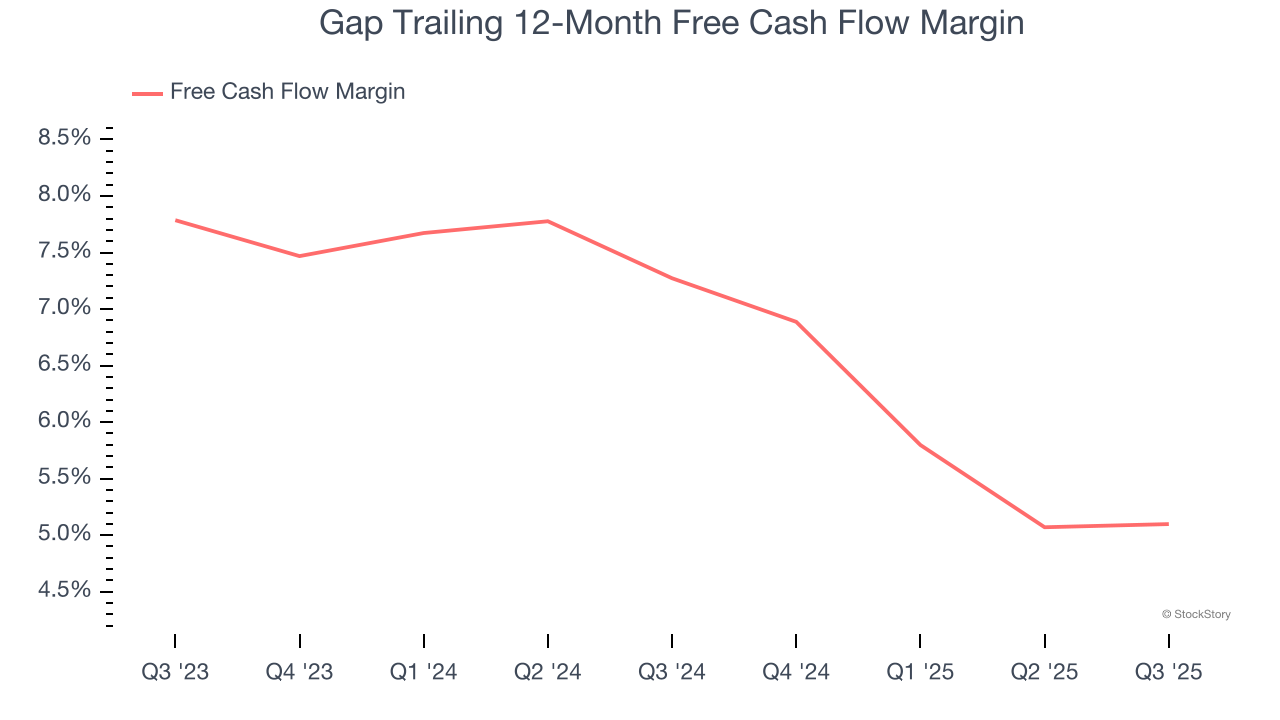

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Gap’s margin dropped by 2.2 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Gap historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.7%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

Final Judgment

Gap’s business quality ultimately falls short of our standards. Following the recent rally, the stock trades at 13× forward P/E (or $27.67 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.