The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Gap (NYSE:GAP) and the rest of the apparel retailer stocks fared in Q3.

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 9 apparel retailer stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.4% on average since the latest earnings results.

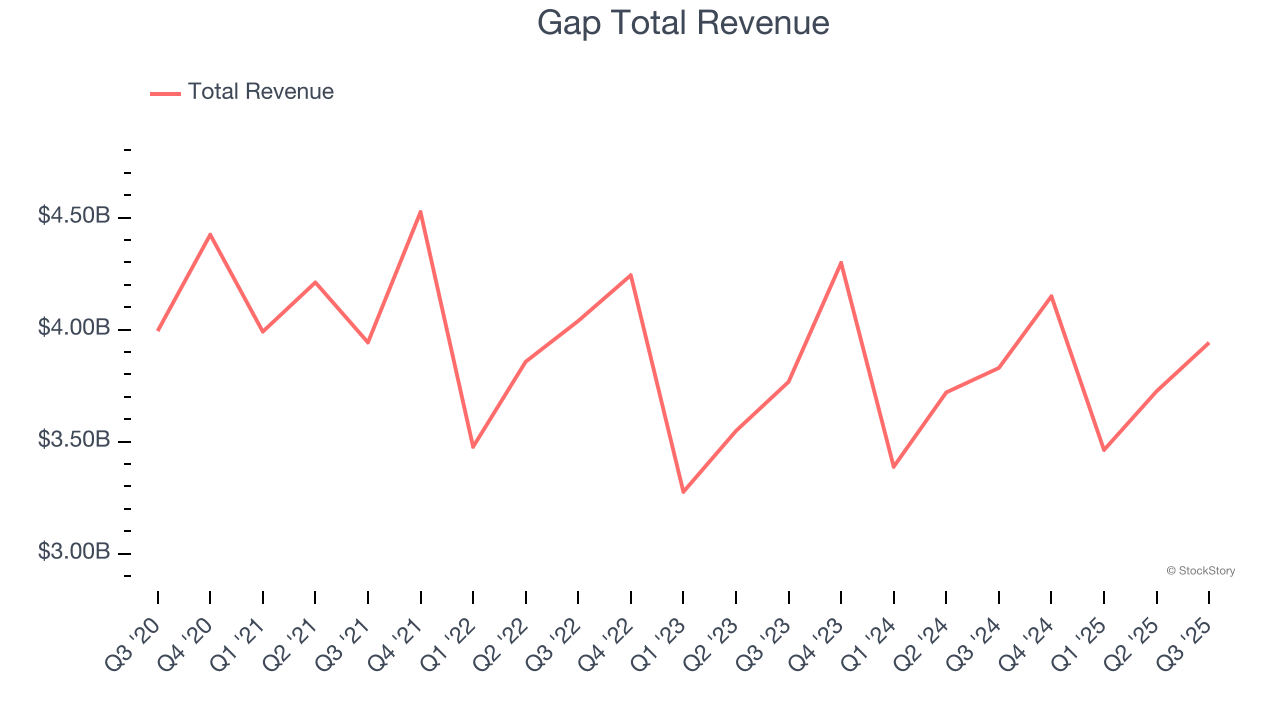

Gap (NYSE:GAP)

Operating under the Gap, Old Navy, Banana Republic, and Athleta brands, Gap (NYSE:GAP) is an apparel and accessories retailer selling casual clothing to men, women, and children.

Gap reported revenues of $3.94 billion, up 3% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

"We are proud to report that Gap Inc.'s third quarter results exceeded our net sales and margin expectations and delivered the seventh consecutive quarter of positive comparable sales," said President and Chief Executive Officer, Richard Dickson.

Interestingly, the stock is up 16.5% since reporting and currently trades at $26.88.

Is now the time to buy Gap? Access our full analysis of the earnings results here, it’s free.

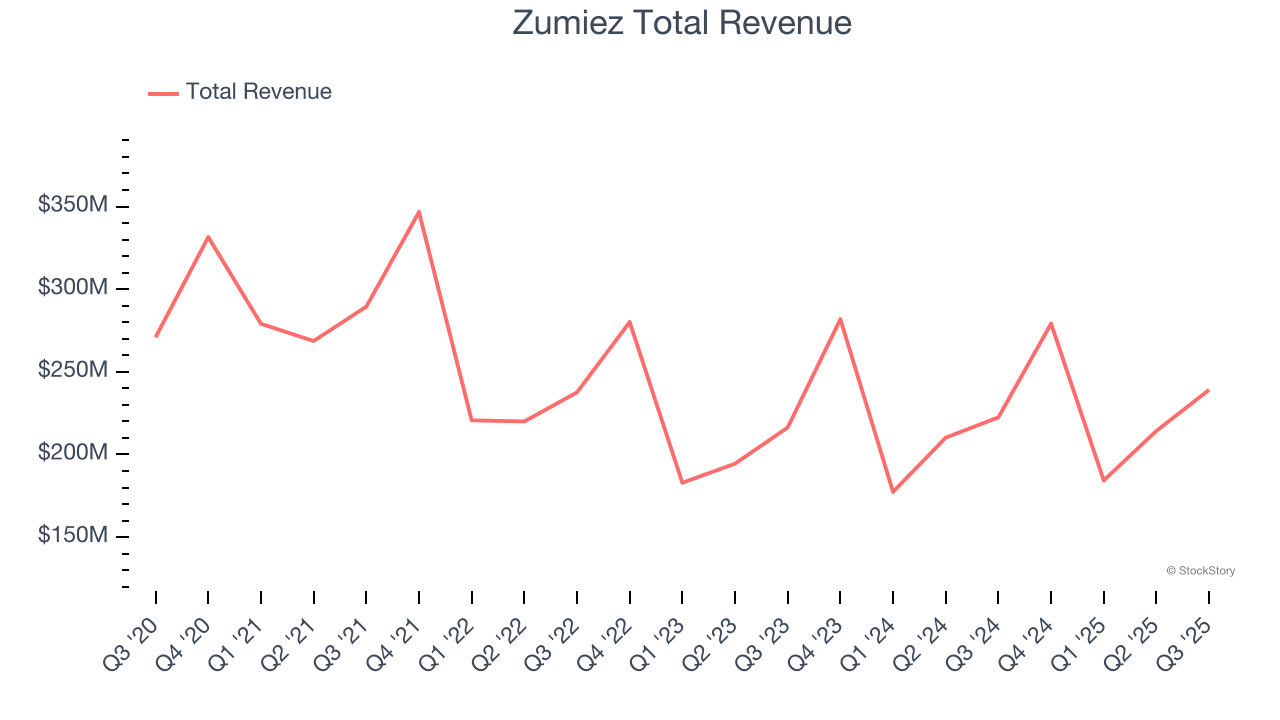

Best Q3: Zumiez (NASDAQ:ZUMZ)

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ:ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Zumiez reported revenues of $239.1 million, up 7.5% year on year, outperforming analysts’ expectations by 2%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 9.5% since reporting. It currently trades at $24.67.

Is now the time to buy Zumiez? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Torrid (NYSE:CURV)

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

Torrid reported revenues of $235.2 million, down 10.8% year on year, falling short of analysts’ expectations by 2%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ EBITDA estimates.

Torrid delivered the highest full-year guidance raise but had the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 7.3% since the results and currently trades at $1.22.

Read our full analysis of Torrid’s results here.

American Eagle (NYSE:AEO)

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

American Eagle reported revenues of $1.36 billion, up 5.7% year on year. This print beat analysts’ expectations by 3.1%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 10.6% since reporting and currently trades at $23.05.

Read our full, actionable report on American Eagle here, it’s free.

Urban Outfitters (NASDAQ:URBN)

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ:URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

Urban Outfitters reported revenues of $1.53 billion, up 12.3% year on year. This number topped analysts’ expectations by 2.6%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

Urban Outfitters delivered the fastest revenue growth among its peers. The stock is up 1.9% since reporting and currently trades at $69.60.

Read our full, actionable report on Urban Outfitters here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.