Griffon currently trades at $75.02 per share and has shown little upside over the past six months, posting a small loss of 1.3%. The stock also fell short of the S&P 500’s 9.9% gain during that period.

Is now the time to buy Griffon, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Griffon Not Exciting?

We're cautious about Griffon. Here are two reasons we avoid GFF and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

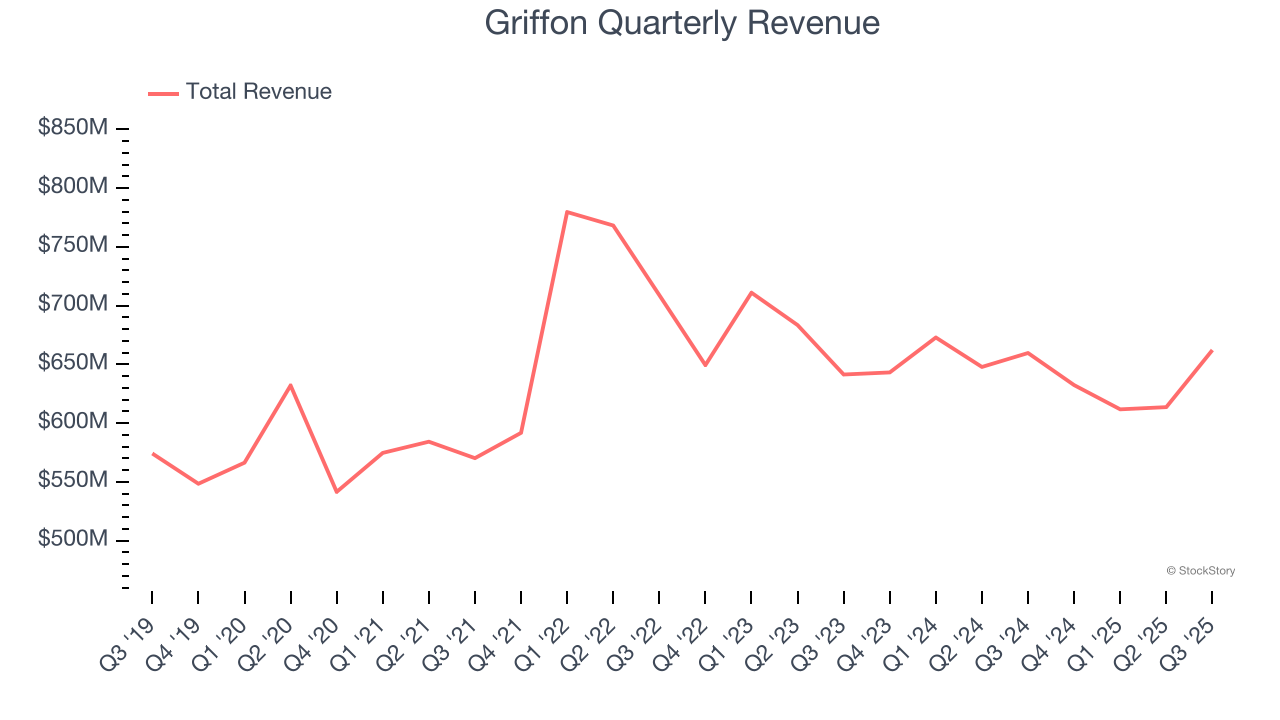

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Griffon grew its sales at a weak 1.2% compounded annual growth rate. This was below our standards.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Griffon’s revenue to stall. While this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Final Judgment

Griffon isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 12.3× forward P/E (or $75.02 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Griffon

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.