Hayward trades at $16.50 per share and has stayed right on track with the overall market, gaining 10.2% over the last six months. At the same time, the S&P 500 has returned 8.2%.

Is there a buying opportunity in Hayward, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Hayward Not Exciting?

We're sitting this one out for now. Here are three reasons why HAYW doesn't excite us and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

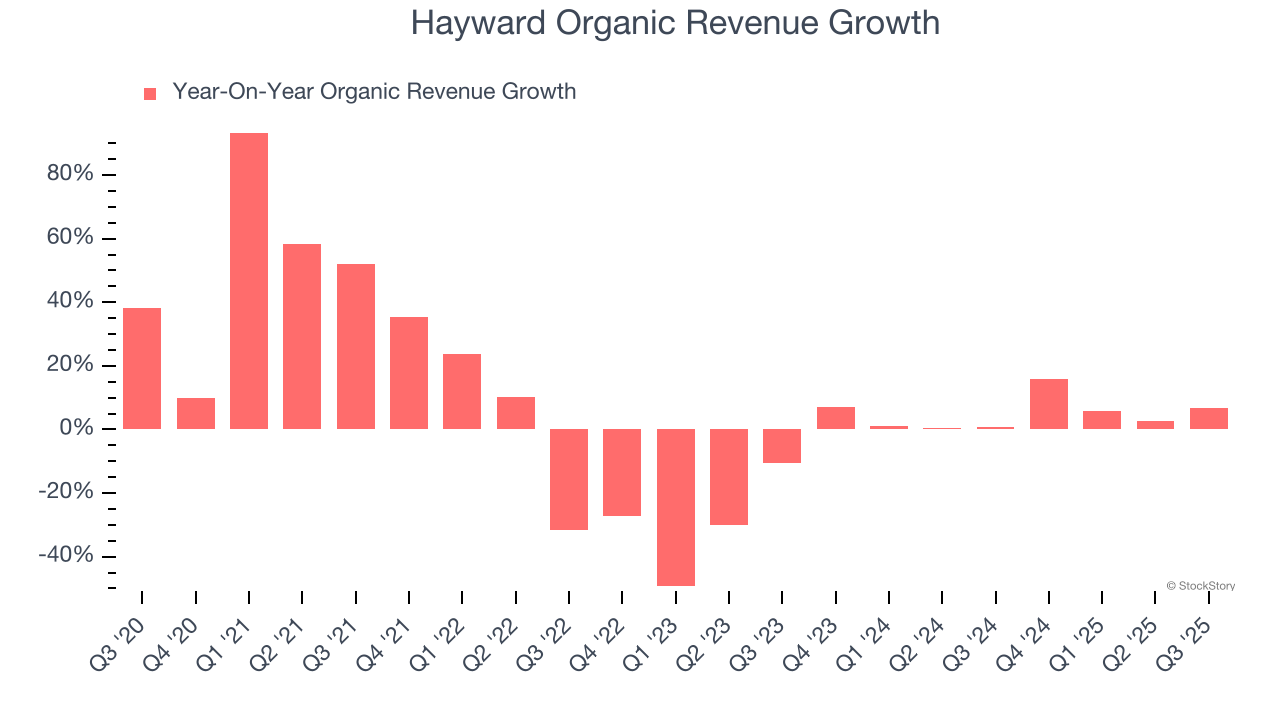

Investors interested in Home Construction Materials companies should track organic revenue in addition to reported revenue. This metric gives visibility into Hayward’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Hayward’s organic revenue averaged 5.1% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. EPS Trending Down

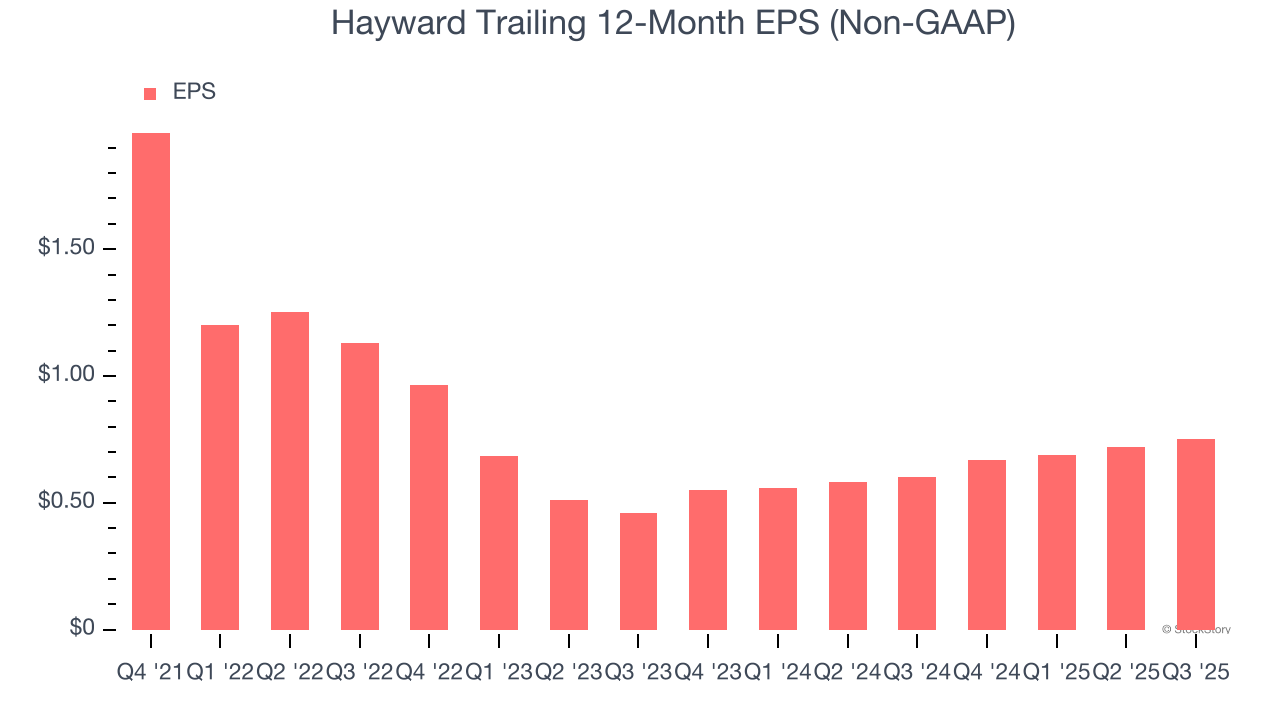

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Hayward’s full-year EPS dropped 159%, or 26.9% annually, over the last four years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

3. New Investments Fail to Bear Fruit as ROIC Declines

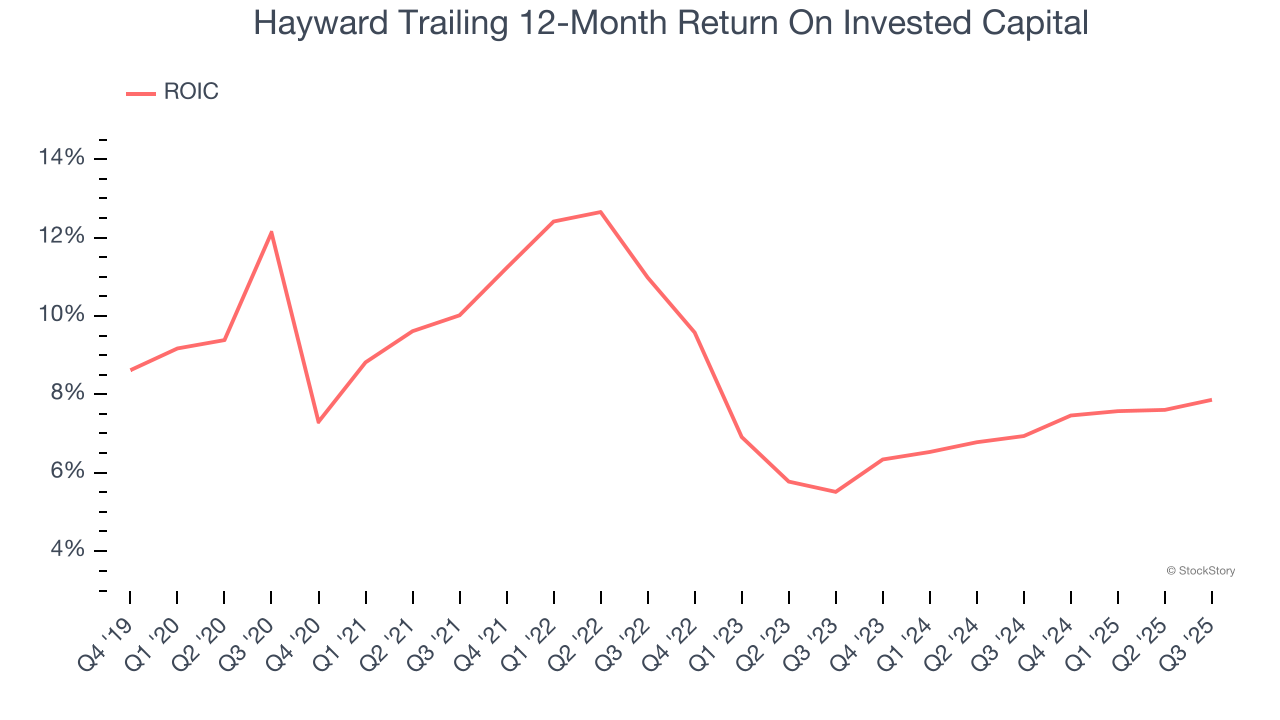

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Hayward’s ROIC averaged 3.1 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Hayward’s business quality ultimately falls short of our standards. That said, the stock currently trades at 20.3× forward P/E (or $16.50 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than Hayward

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.