Since February 2021, the S&P 500 has delivered a total return of 76.4%. But one standout stock has more than doubled the market - over the past five years, Installed Building Products has surged 172% to $335.00 per share. Its momentum hasn’t stopped as it’s also gained 22.9% in the last six months thanks to its solid quarterly results, beating the S&P by 15.6%.

Is now still a good time to buy IBP? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does IBP Stock Spark Debate?

Founded in 1977, Installed Building Products (NYSE:IBP) is a company specializing in the installation of insulation, waterproofing, and other complementary building products for residential and commercial construction.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

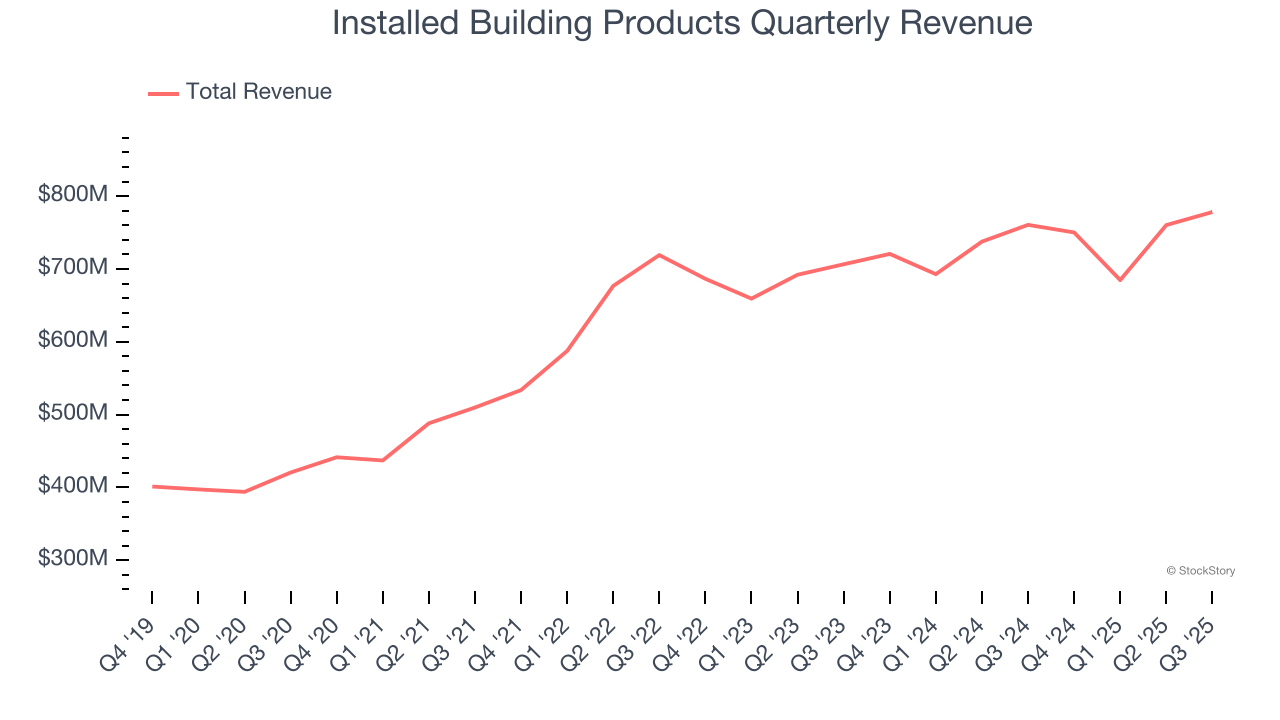

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Installed Building Products grew its sales at an excellent 13% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

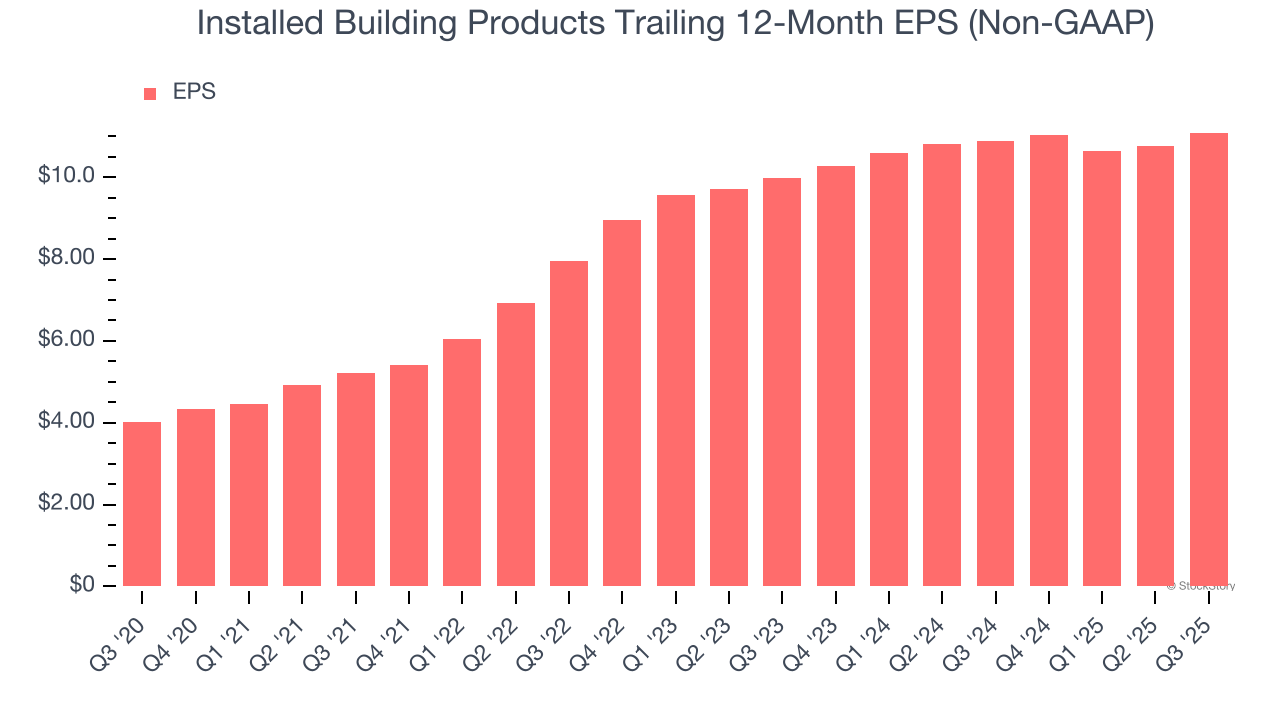

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Installed Building Products’s EPS grew at an astounding 22.4% compounded annual growth rate over the last five years, higher than its 13% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Installed Building Products’s revenue to stall, a deceleration versus its 13% annualized growth for the past five years. This projection doesn't excite us and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Final Judgment

Installed Building Products’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at 31× forward P/E (or $335.00 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.