International Flavors & Fragrances has been treading water for the past six months, recording a small loss of 3% while holding steady at $69.59. The stock also fell short of the S&P 500’s 9.6% gain during that period.

Is there a buying opportunity in International Flavors & Fragrances, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think International Flavors & Fragrances Will Underperform?

We're cautious about International Flavors & Fragrances. Here are three reasons you should be careful with IFF and a stock we'd rather own.

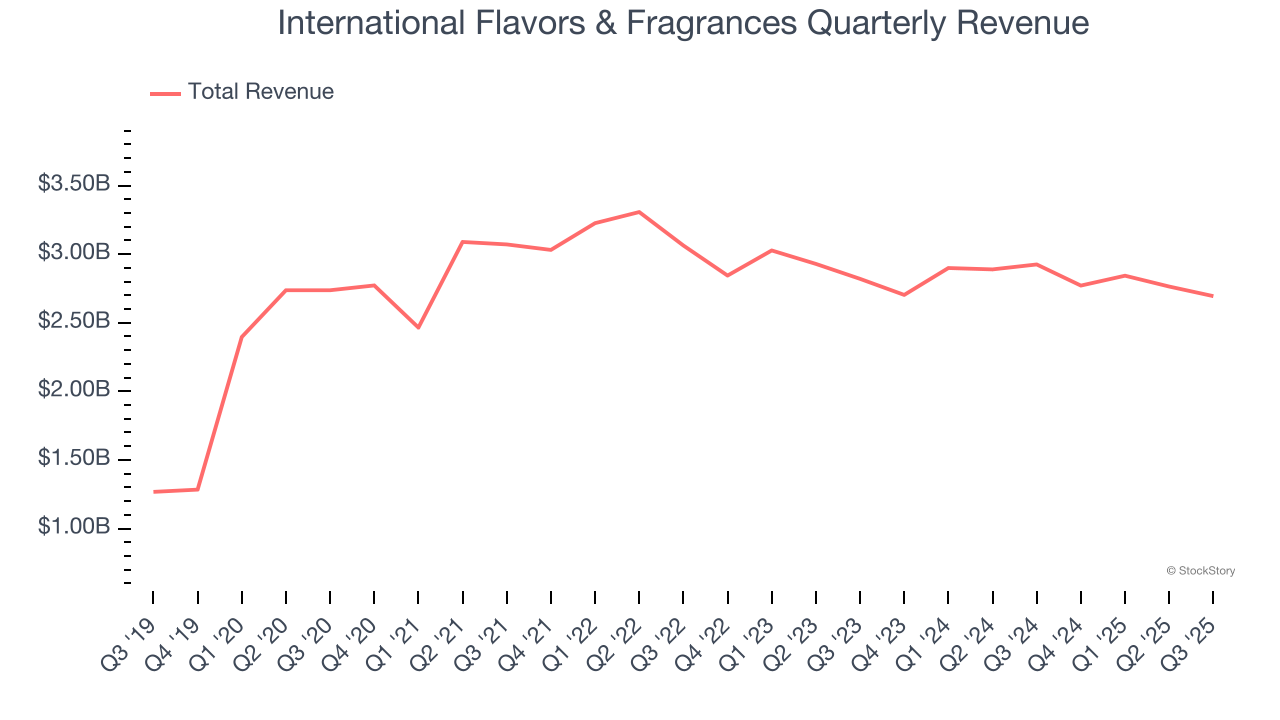

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. International Flavors & Fragrances’s demand was weak over the last three years as its sales fell at a 4.3% annual rate. This wasn’t a great result and signals it’s a low quality business.

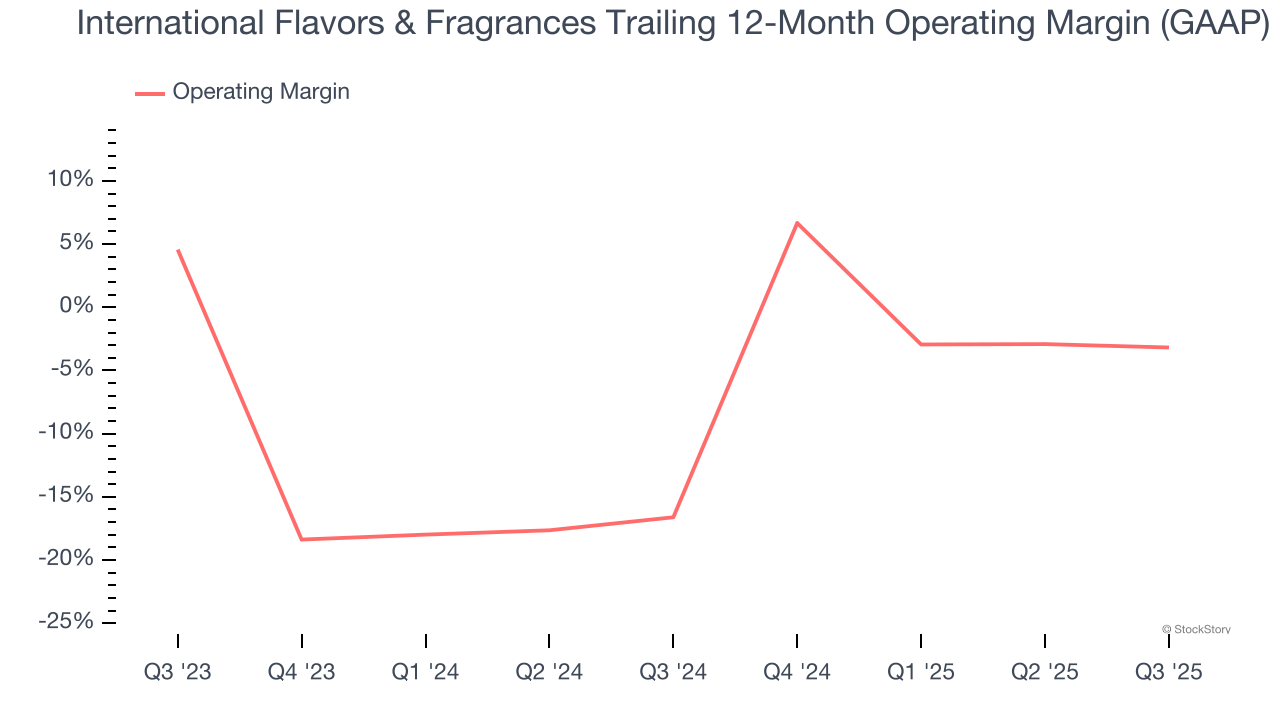

2. Operating Losses Sound the Alarms

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Although International Flavors & Fragrances was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 10% over the last two years. Unprofitable public companies are rare in the defensive consumer staples industry, so this performance certainly caught our eye.

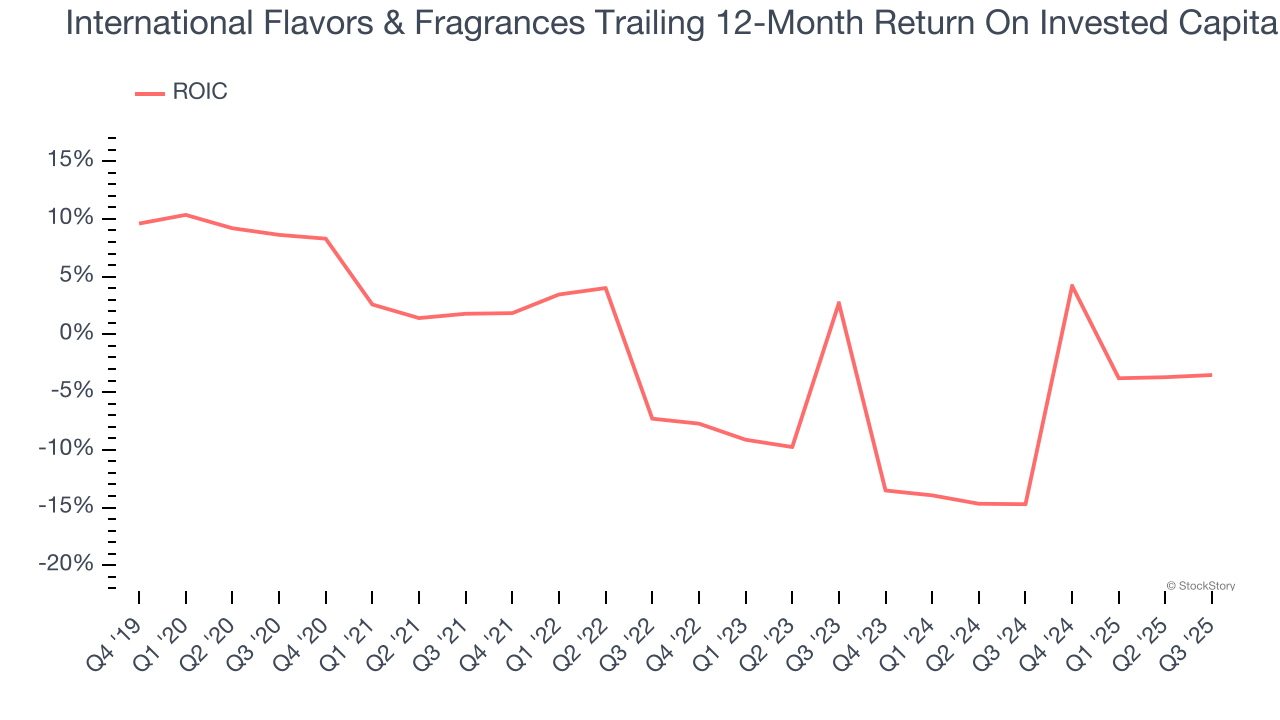

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

International Flavors & Fragrances’s five-year average ROIC was negative 4.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Final Judgment

International Flavors & Fragrances doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 16.6× forward P/E (or $69.59 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than International Flavors & Fragrances

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.