Over the past six months, Samsara’s stock price fell to $36.52. Shareholders have lost 8.2% of their capital, which is disappointing considering the S&P 500 has climbed by 11.7%. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy IOT? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Samsara?

From sensors on vehicles to AI-powered cameras that help prevent accidents, Samsara (NYSE:IOT) is a cloud-based Internet of Things platform that helps businesses improve the safety, efficiency, and sustainability of their physical operations.

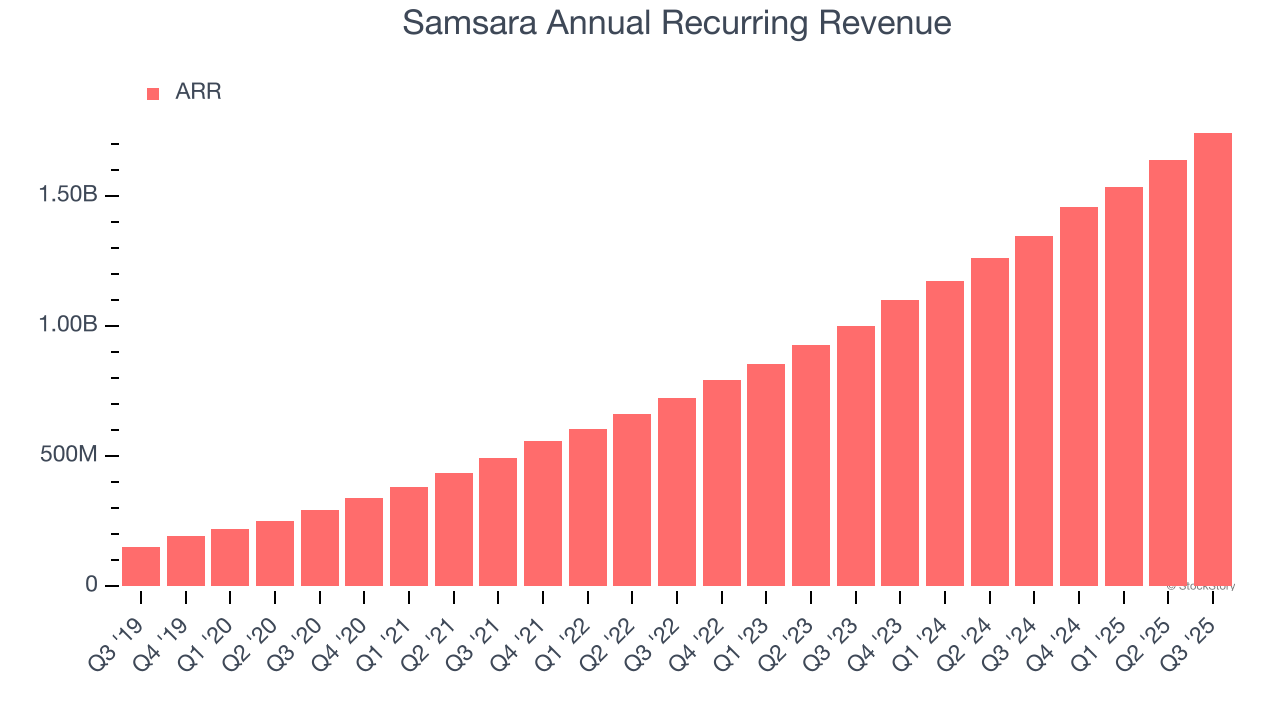

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Samsara’s ARR punched in at $1.75 billion in Q3, and over the last four quarters, its year-on-year growth averaged 30.5%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Samsara a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

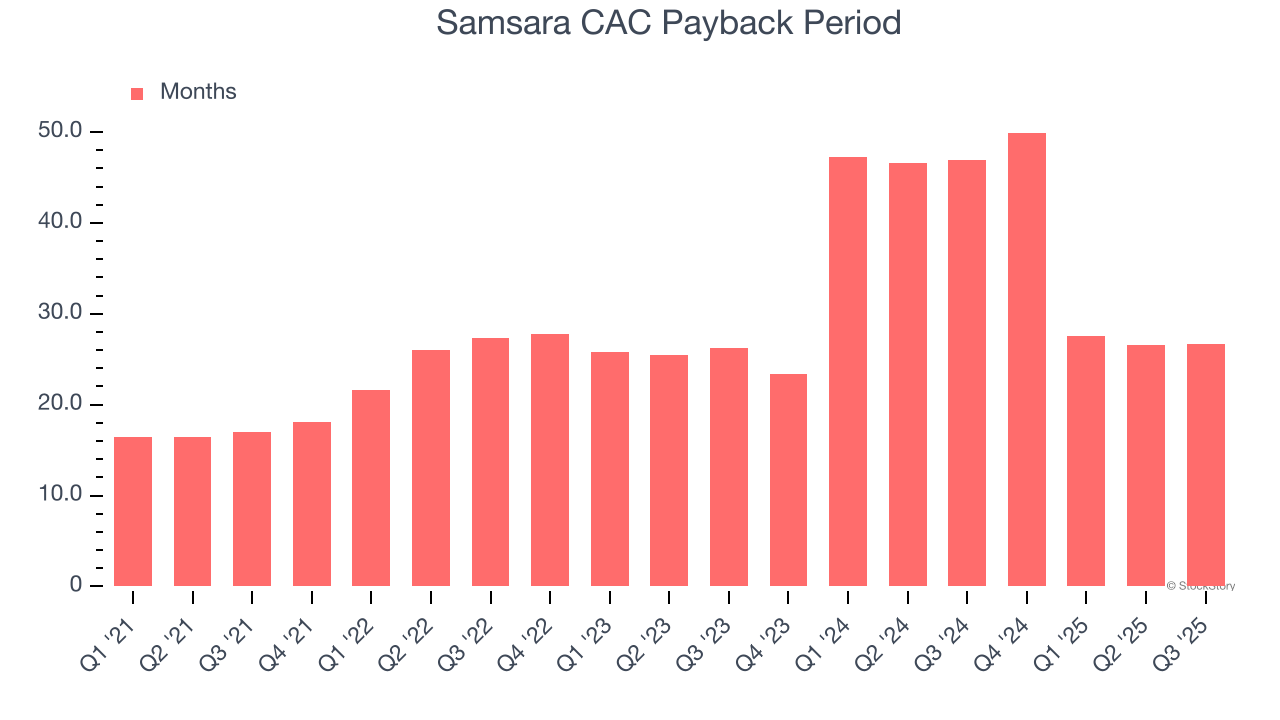

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Samsara is very efficient at acquiring new customers, and its CAC payback period checked in at 26.7 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Samsara more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

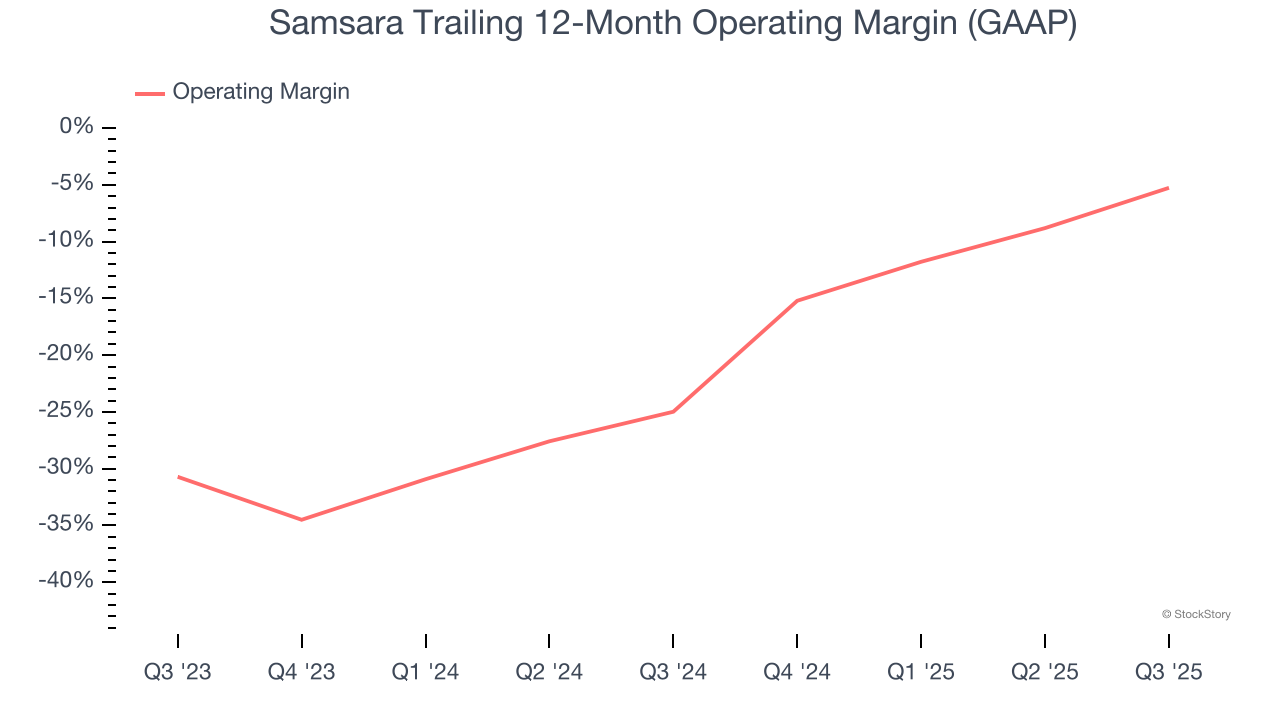

3. Operating Margin Rising, Profits Up

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Over the last two years, Samsara’s expanding sales gave it operating leverage as its margin rose by 19.7 percentage points. Although its operating margin for the trailing 12 months was negative 5.3%, we’re confident it can one day reach sustainable profitability.

Final Judgment

These are just a few reasons why Samsara is one of the best software companies out there. After the recent drawdown, the stock trades at 11.7× forward price-to-sales (or $36.52 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Samsara

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.