KeyCorp’s 18.2% return over the past six months has outpaced the S&P 500 by 12.3%, and its stock price has climbed to $21.50 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy KeyCorp, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is KeyCorp Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about KeyCorp. Here are three reasons you should be careful with KEY and a stock we'd rather own.

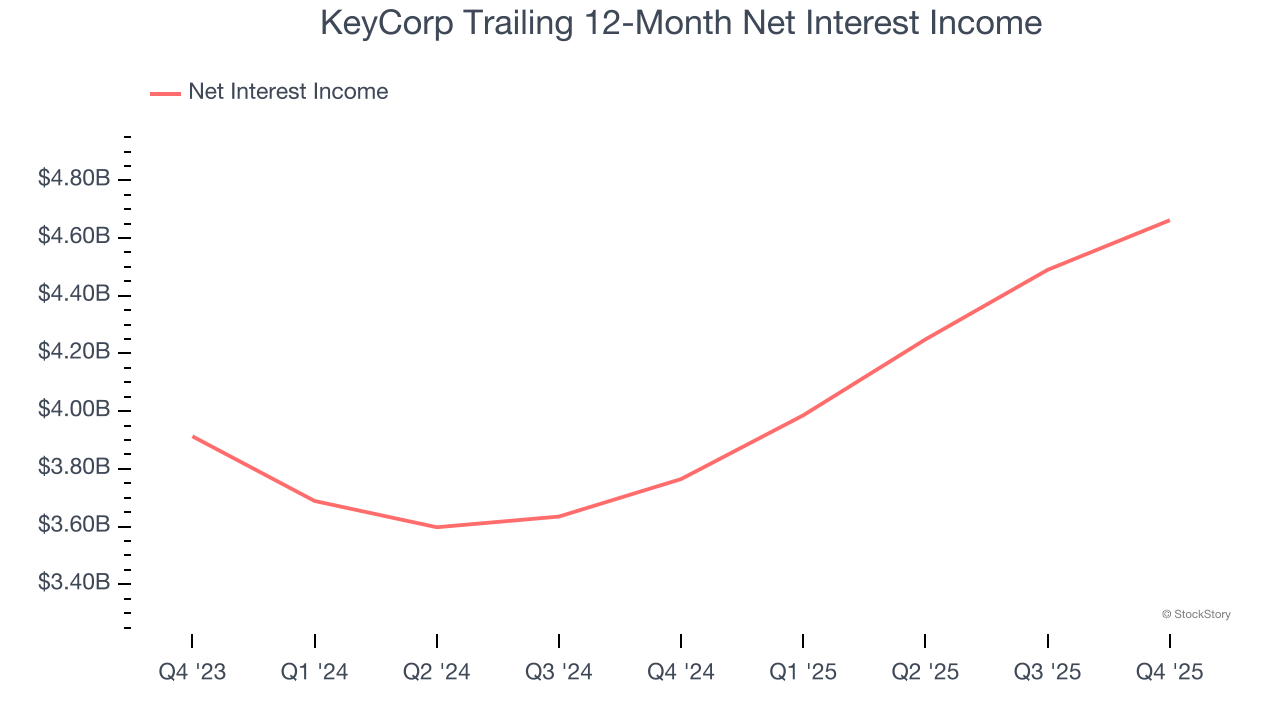

1. Net Interest Income Points to Soft Demand

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

KeyCorp’s net interest income has grown at a 2.9% annualized rate over the last five years, much worse than the broader banking industry and in line with its total revenue.

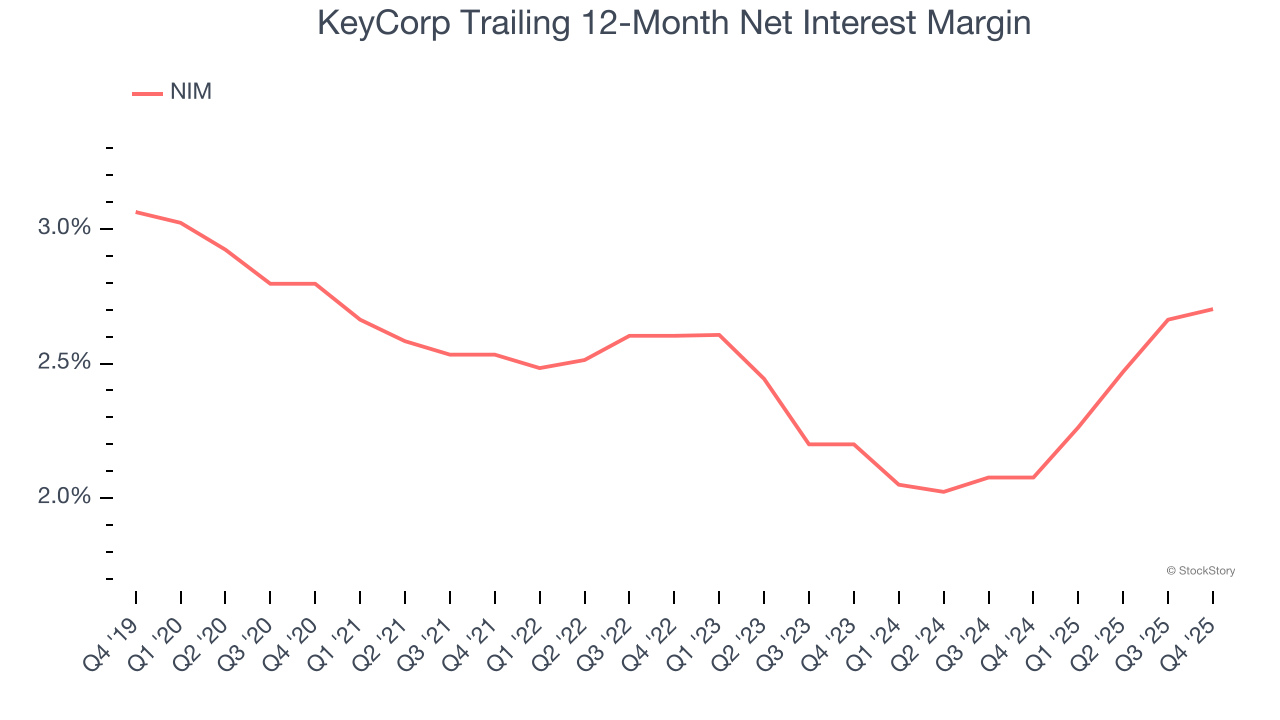

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that KeyCorp’s net interest margin averaged a poor 2.4%, meaning it must compensate for lower profitability through increased loan originations.

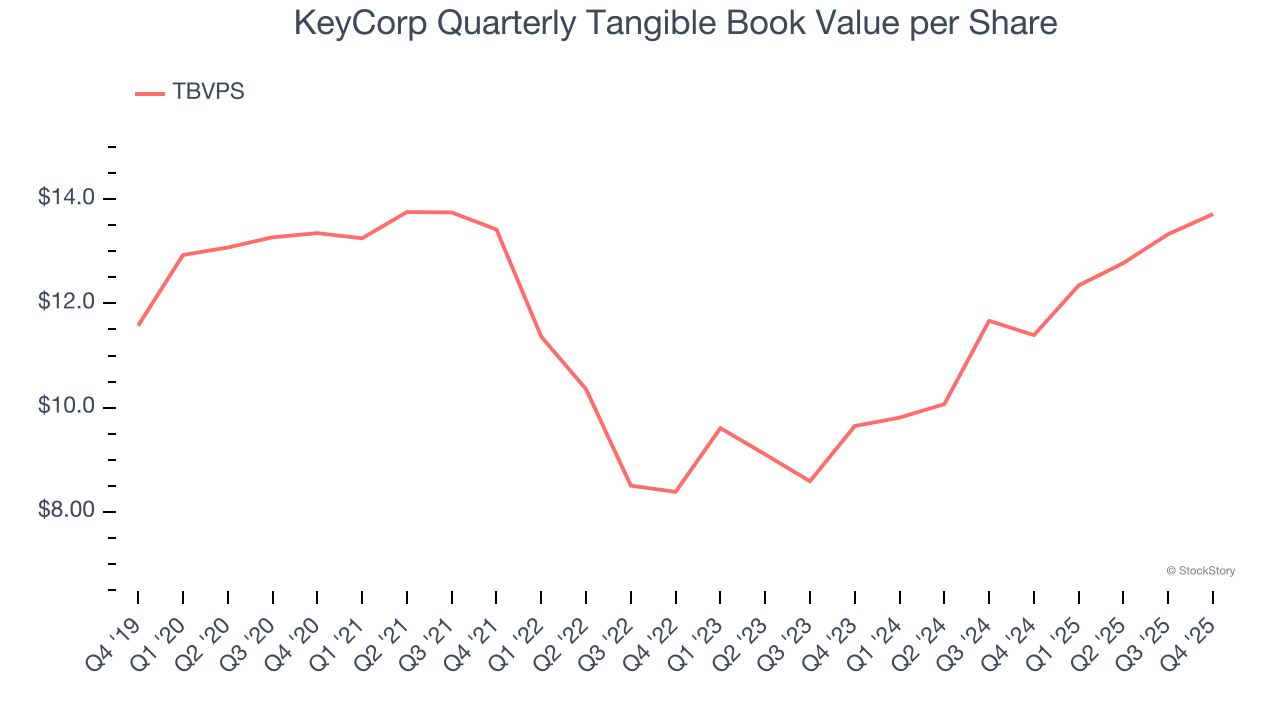

3. Growing TBVPS Reflects Strong Asset Base

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

Although KeyCorp’s TBVPS was flat over the last five years. the good news is that its growth has recently accelerated as TBVPS grew at an exceptional 19.2% annual clip over the past two years (from $9.65 to $13.72 per share).

Final Judgment

KeyCorp isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 1.3× forward P/B (or $21.50 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than KeyCorp

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.