Since July 2025, Ladder Capital has been in a holding pattern, posting a small return of 1.2% while floating around $10.99. The stock also fell short of the S&P 500’s 11.2% gain during that period.

Is there a buying opportunity in Ladder Capital, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Ladder Capital Will Underperform?

We're swiping left on Ladder Capital for now. Here are three reasons why LADR doesn't excite us and a stock we'd rather own.

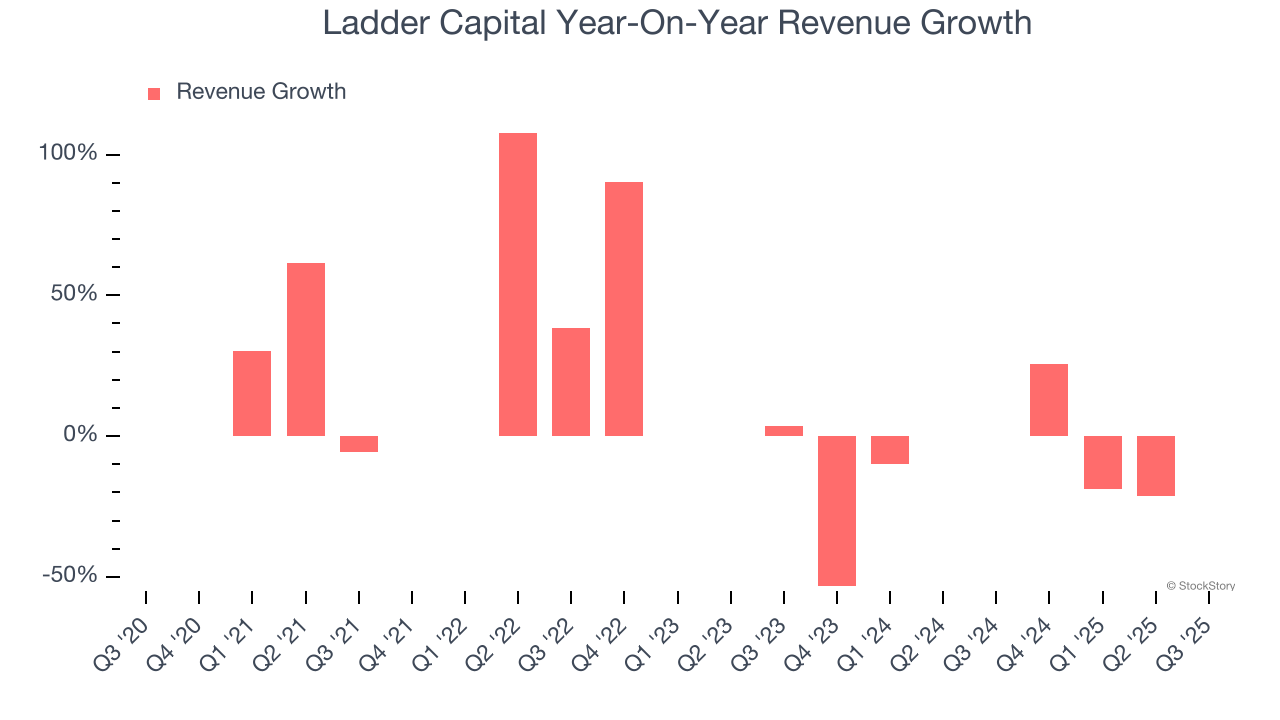

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Ladder Capital’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 15.4% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

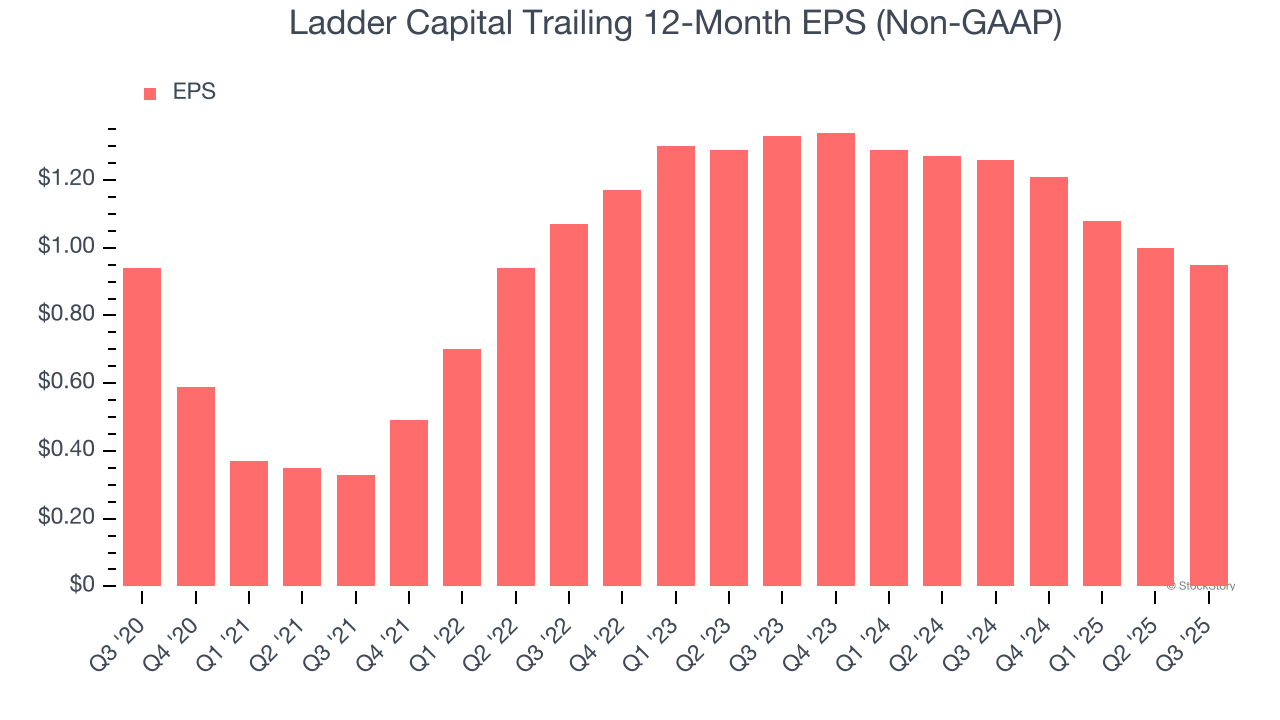

2. EPS Growth Has Stalled

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ladder Capital’s flat EPS over the last five years was below its 10% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

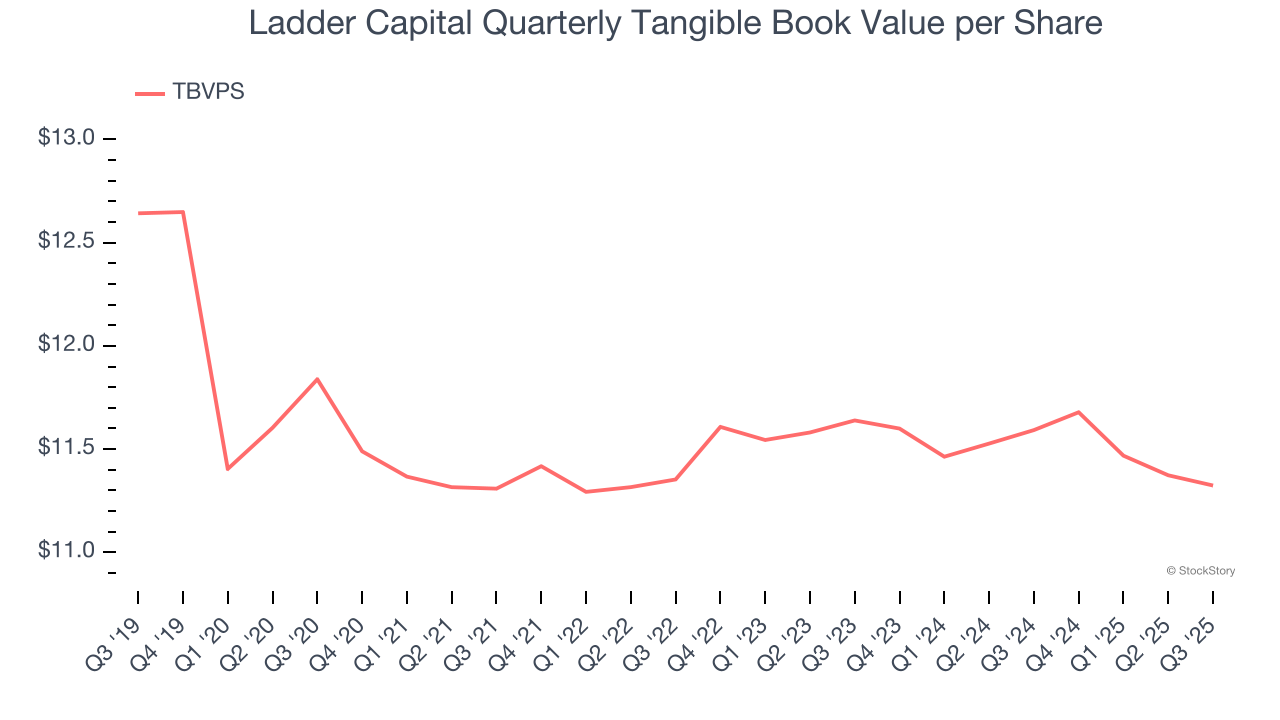

3. Declining TBVPS Reflects Erosion of Asset Value

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

To the detriment of investors, Ladder Capital’s TBVPS declined at a 1.4% annual clip over the last two years.

Final Judgment

Ladder Capital doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 1× forward P/B (or $10.99 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.