Lazard trades at $56.81 per share and has stayed right on track with the overall market, gaining 10.2% over the last six months. At the same time, the S&P 500 has returned 6.6%.

Is LAZ a buy right now? Find out in our full research report, it’s free.

Why Does Lazard Spark Debate?

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE:LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

One Thing to Like:

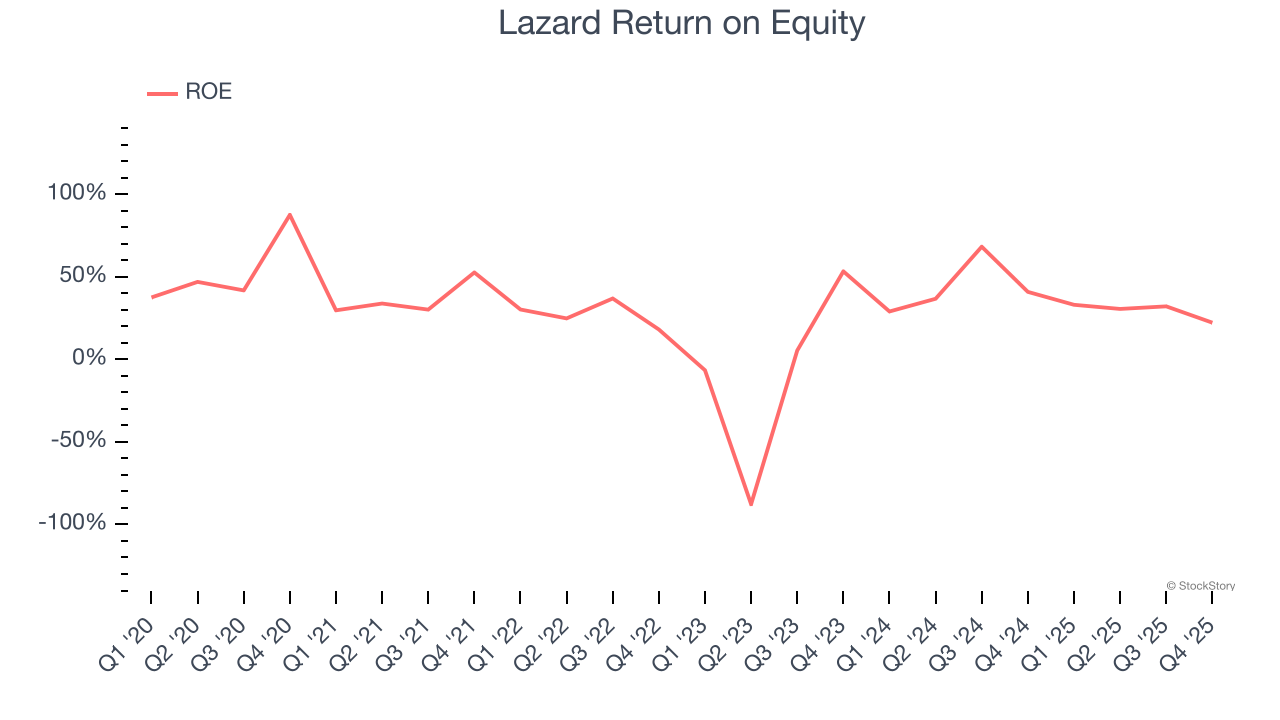

1. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Lazard has averaged an ROE of 25.7%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Lazard has a strong competitive moat.

One Reason to be Careful:

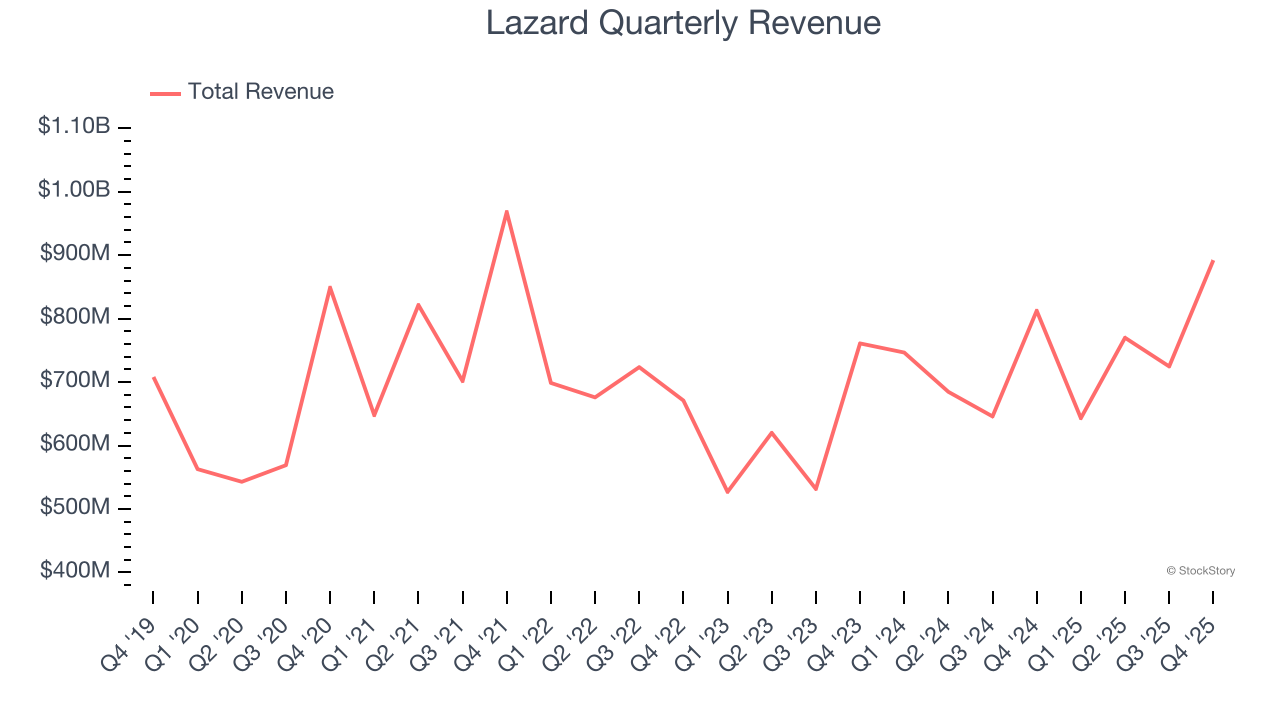

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

Over the last five years, Lazard grew its revenue at a sluggish 3.7% compounded annual growth rate. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Lazard.

Final Judgment

Lazard has huge potential even though it has some open questions, but at $56.81 per share (or 14.8× forward P/E), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Lazard

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.