LendingClub has been on fire lately. In the past six months alone, the company’s stock price has rocketed 86.5%, setting a new 52-week high of $20.50 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy LC? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On LC?

Pioneering peer-to-peer lending in the US before evolving into a digital bank, LendingClub (NYSE:LC) operates a marketplace that connects borrowers with lenders, offering personal loans, auto refinancing, and banking services.

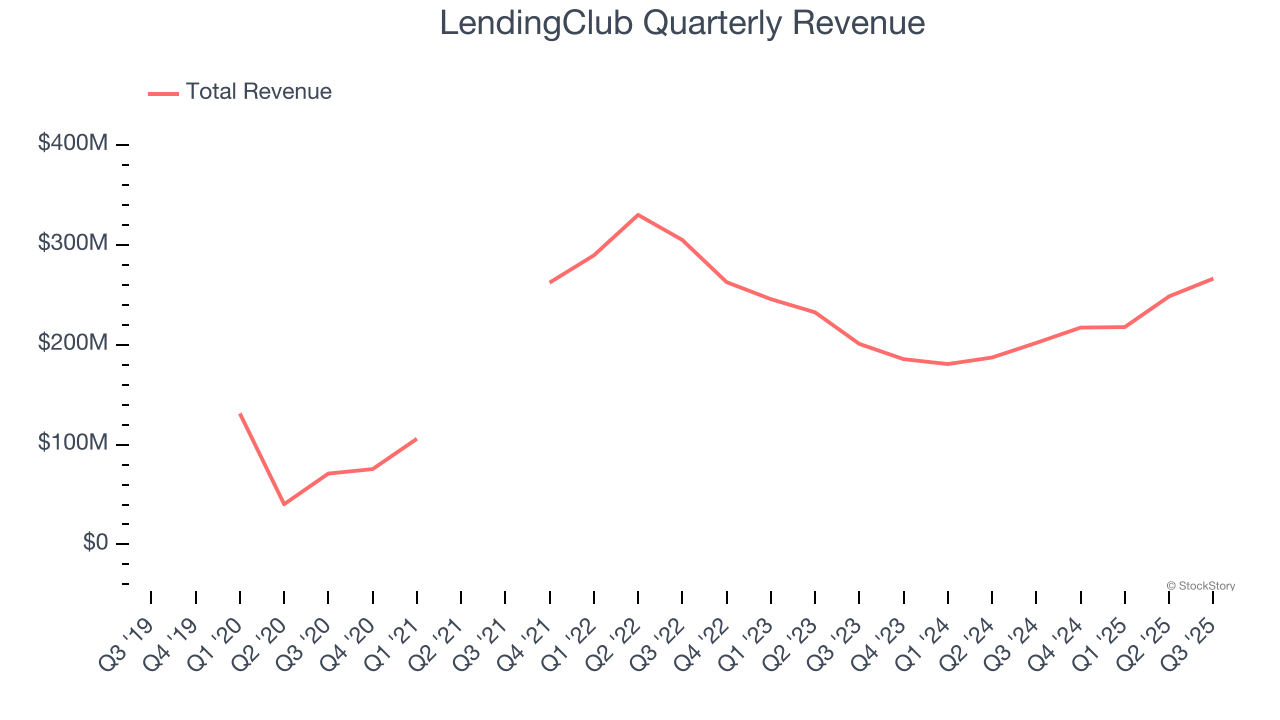

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Over the last five years, LendingClub grew its revenue at an exceptional 24.7% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

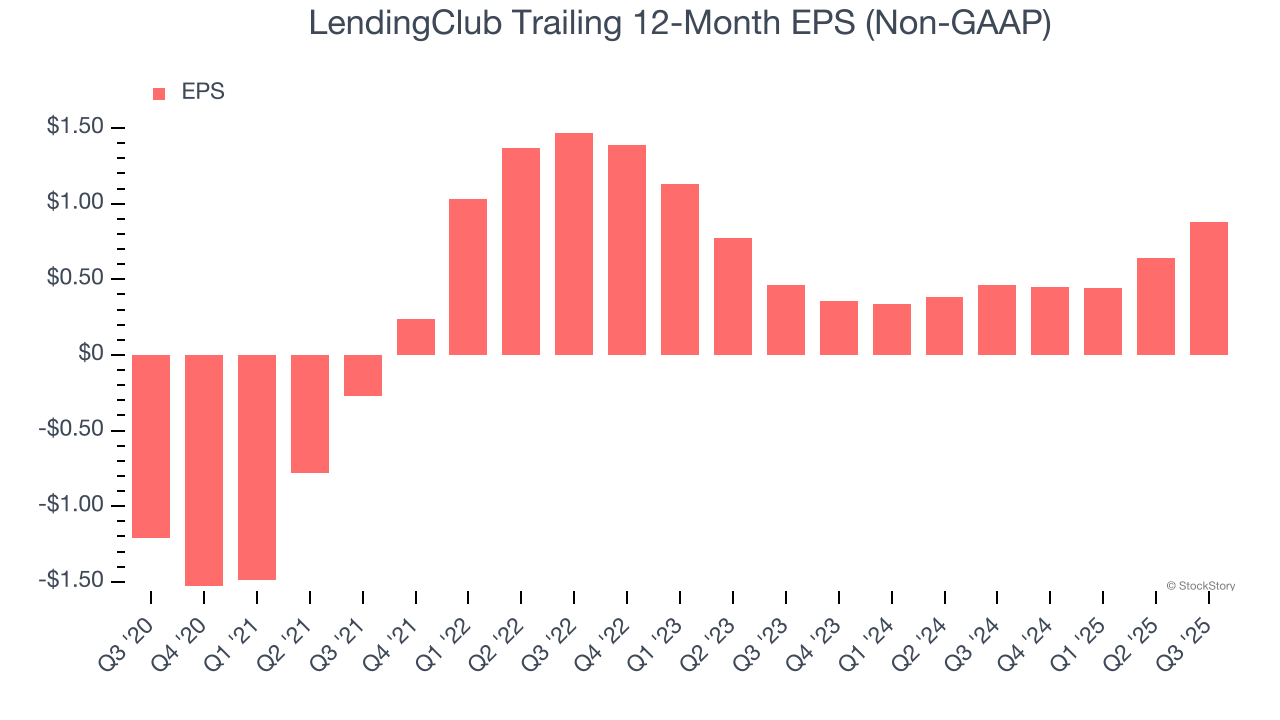

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

LendingClub’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons LendingClub is a rock-solid business worth owning, and after the recent rally, the stock trades at 13.5× forward P/E (or $20.50 per share). Is now the time to buy despite the apparent froth? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.