Over the past six months, Lennox’s shares (currently trading at $508.60) have posted a disappointing 15.3% loss, well below the S&P 500’s 10.2% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Following the drawdown, is this a buying opportunity for LII? Find out in our full research report, it’s free.

Why Does Lennox Spark Debate?

Based in Texas and founded over a century ago, Lennox (NYSE:LII) is a climate control solutions company offering heating, ventilation, air conditioning, and refrigeration (HVACR) goods.

Two Things to Like:

1. Operating Margin Rising, Profits Up

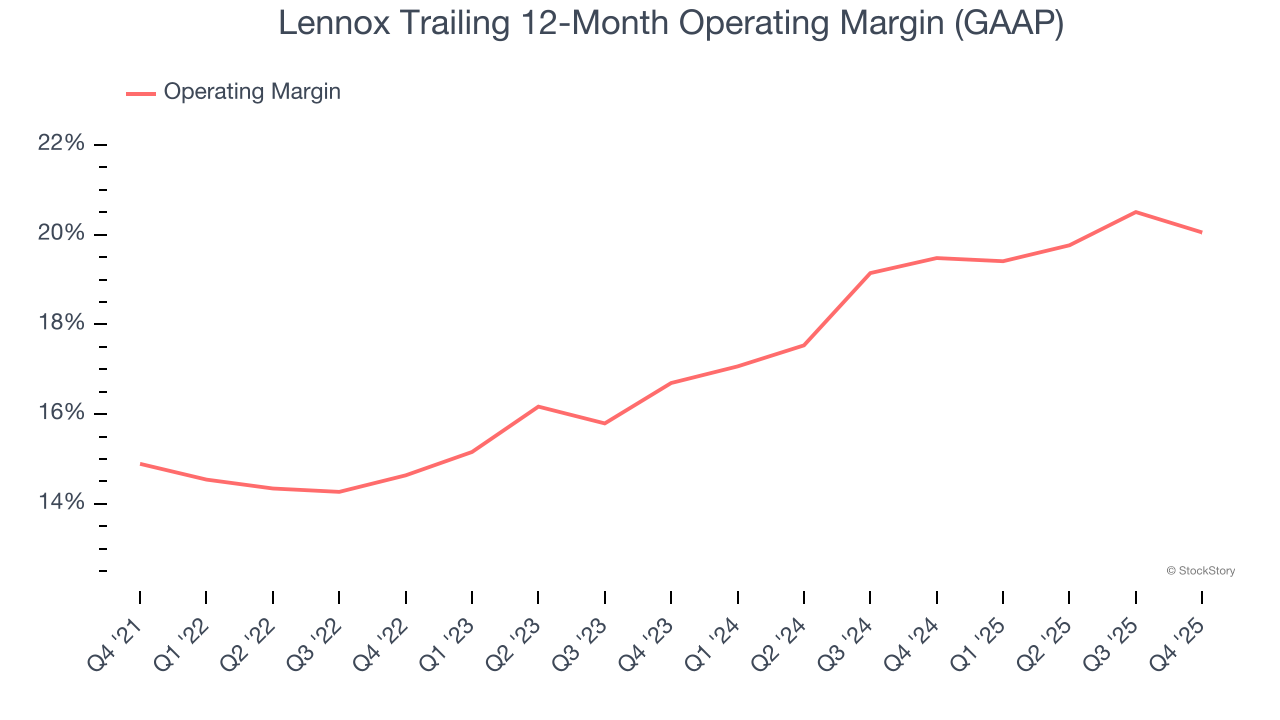

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, Lennox’s operating margin rose by 5.2 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 20%.

2. Outstanding Long-Term EPS Growth

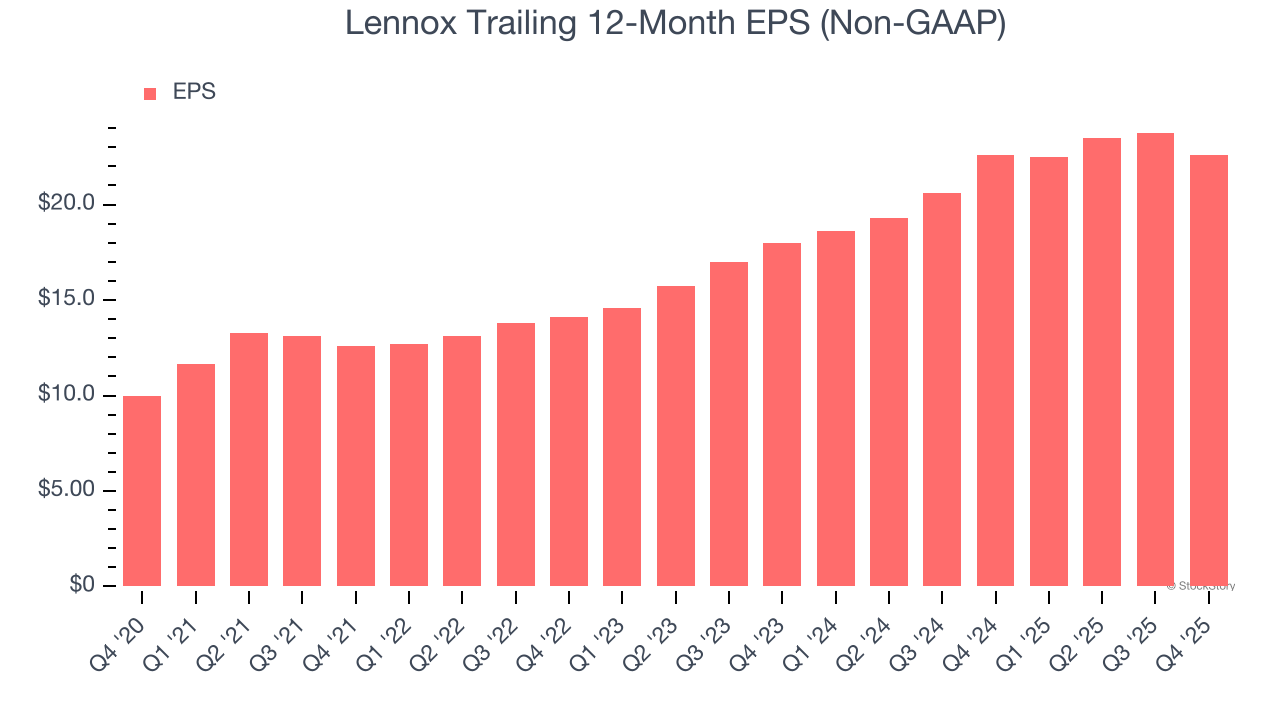

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Lennox’s EPS grew at an astounding 17.9% compounded annual growth rate over the last five years, higher than its 7.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

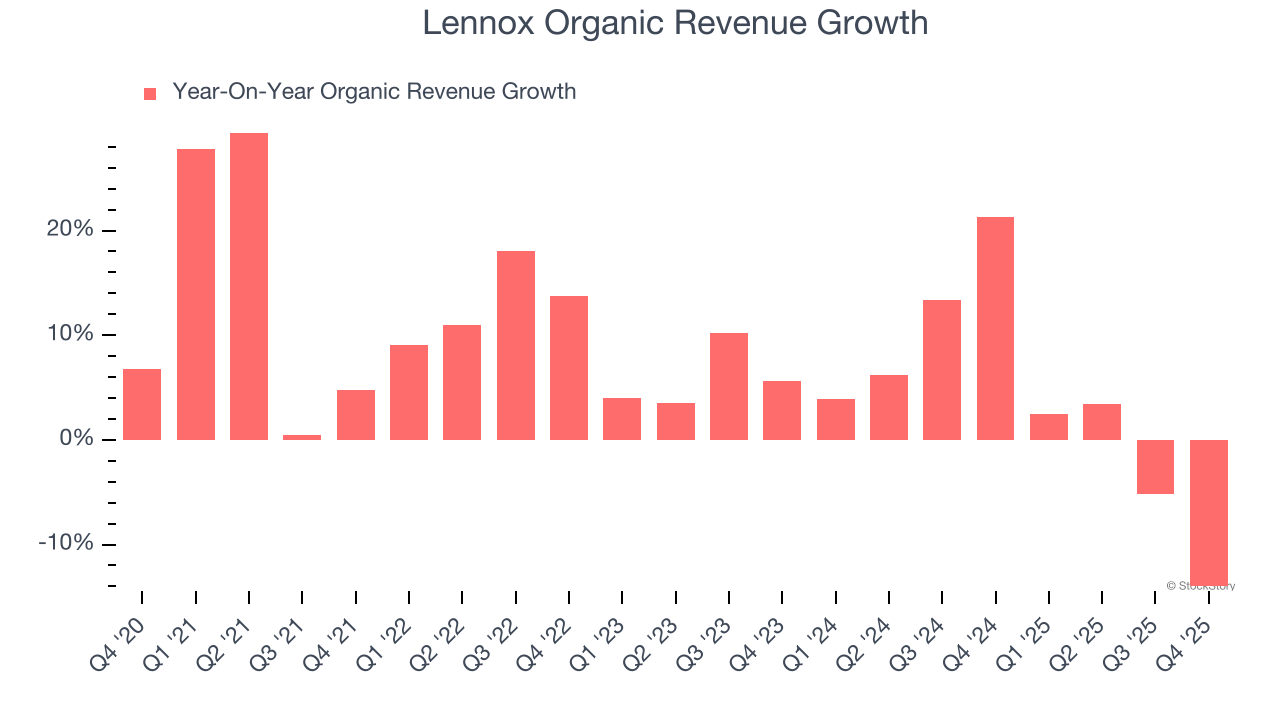

We can better understand HVAC and Water Systems companies by analyzing their organic revenue. This metric gives visibility into Lennox’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Lennox’s organic revenue averaged 3.9% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Lennox has huge potential even though it has some open questions. With the recent decline, the stock trades at 20.6× forward P/E (or $508.60 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.