Over the past six months, Lowe's has been a great trade, beating the S&P 500 by 7.3%. Its stock price has climbed to $268.65, representing a healthy 16.8% increase. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Lowe's, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Lowe's Not Exciting?

Despite the momentum, we don't have much confidence in Lowe's. Here are three reasons there are better opportunities than LOW and a stock we'd rather own.

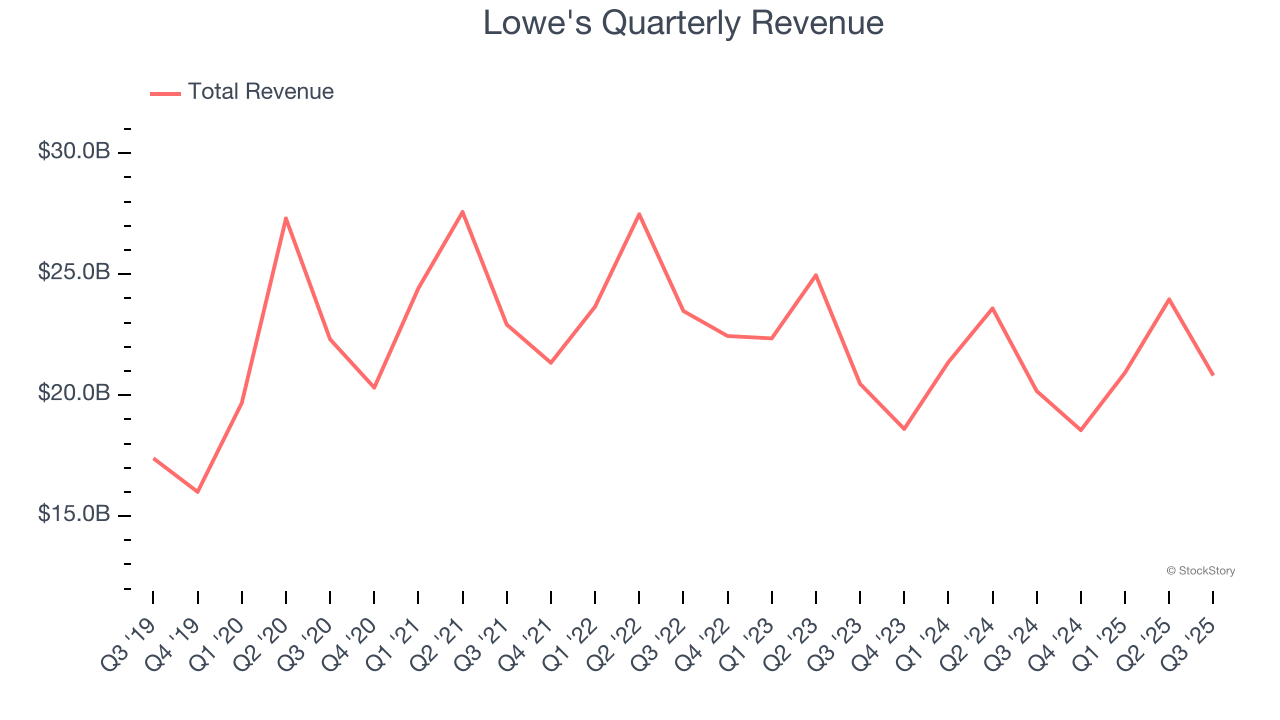

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Lowe's struggled to consistently generate demand over the last three years as its sales dropped at a 4.2% annual rate. This wasn’t a great result and signals it’s a lower quality business.

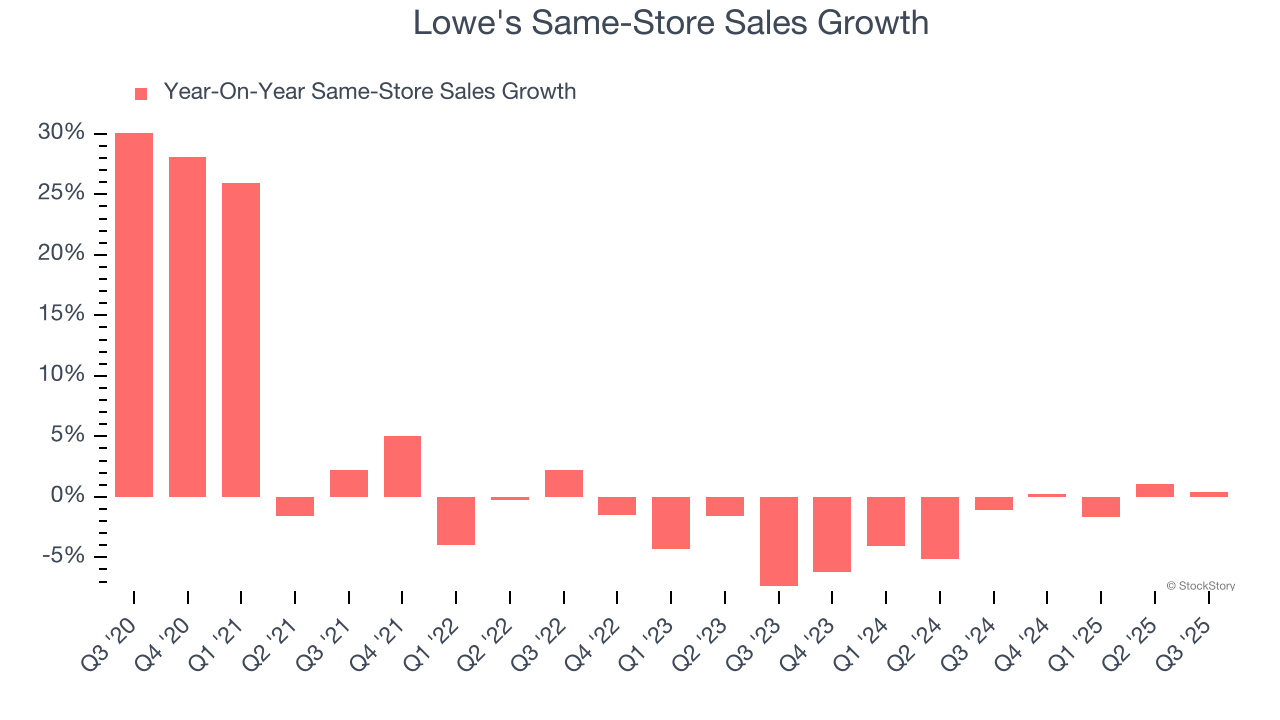

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Lowe’s demand has been shrinking over the last two years as its same-store sales have averaged 2.1% annual declines.

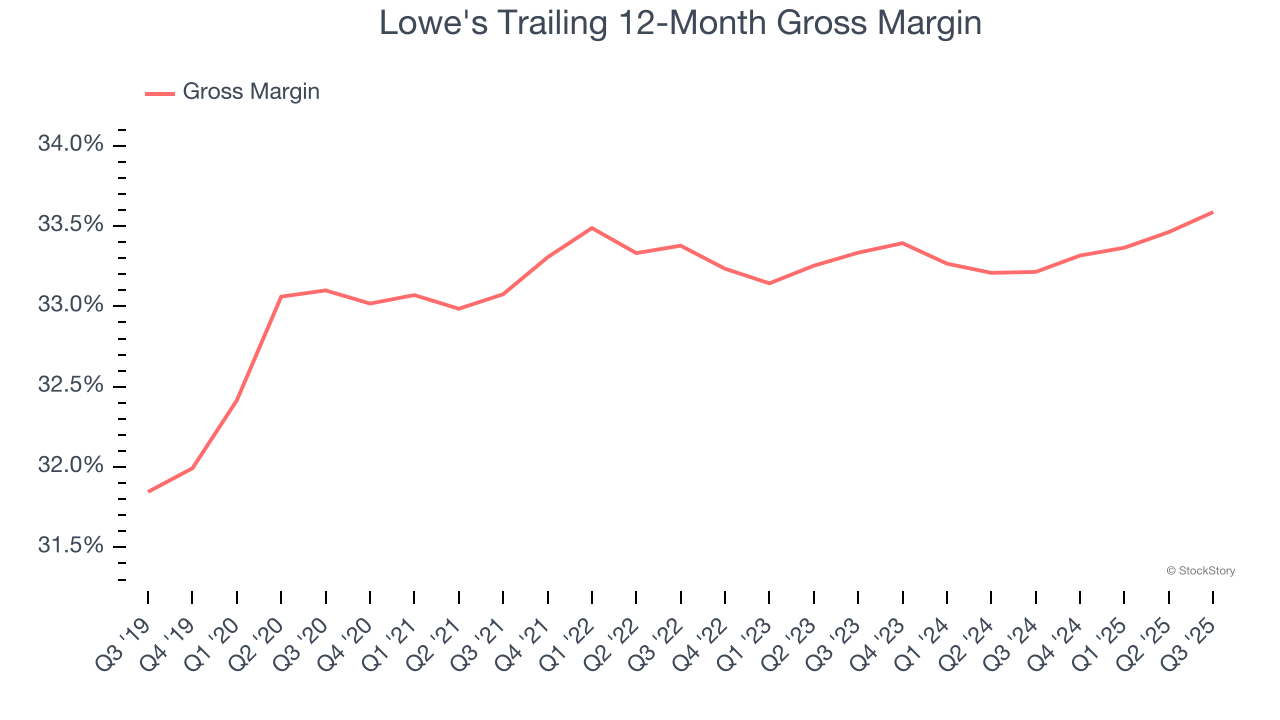

3. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Lowe's has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 33.4% gross margin over the last two years. Said differently, Lowe's had to pay a chunky $66.60 to its suppliers for every $100 in revenue.

Final Judgment

Lowe’s business quality ultimately falls short of our standards. With its shares beating the market recently, the stock trades at 21.5× forward P/E (or $268.65 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than Lowe's

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.