Over the last six months, Lamb Weston’s shares have sunk to $48.00, producing a disappointing 11.6% loss - a stark contrast to the S&P 500’s 6% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Lamb Weston, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Lamb Weston Not Exciting?

Even with the cheaper entry price, we're cautious about Lamb Weston. Here are three reasons there are better opportunities than LW and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

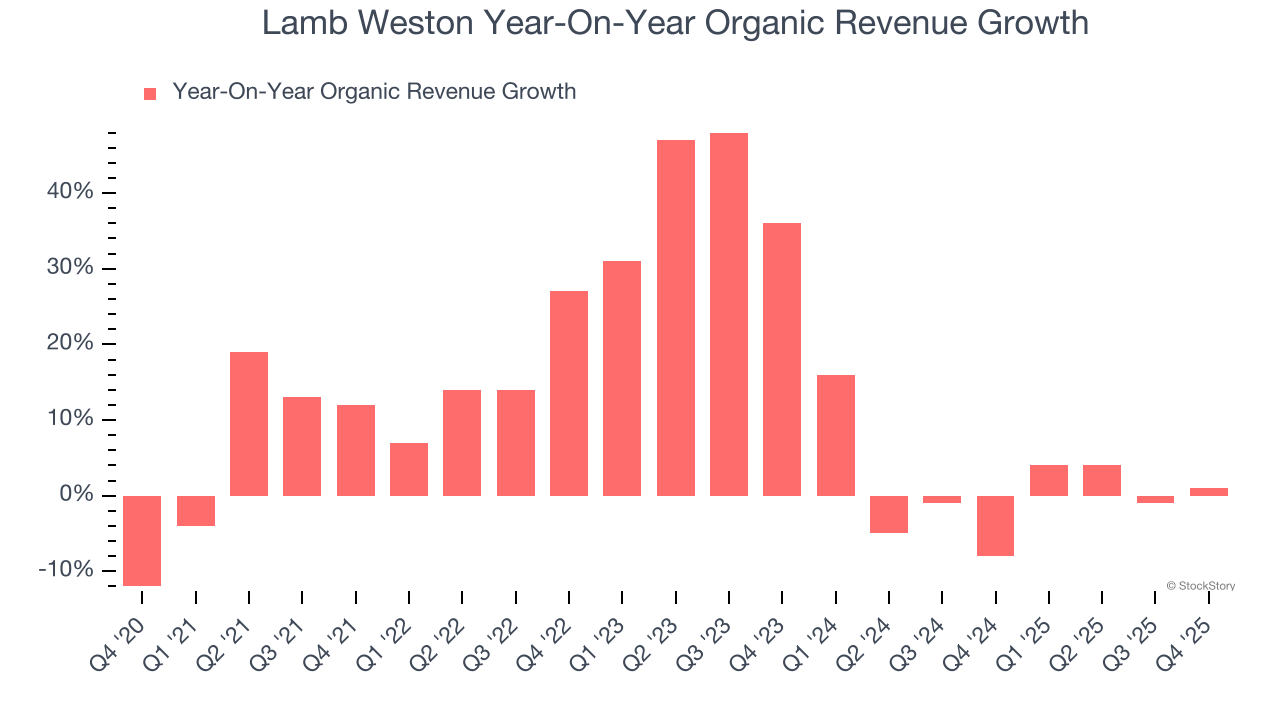

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Lamb Weston’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 1.3%.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Lamb Weston’s revenue to stall, a deceleration versus This projection is underwhelming and indicates its products will see some demand headwinds.

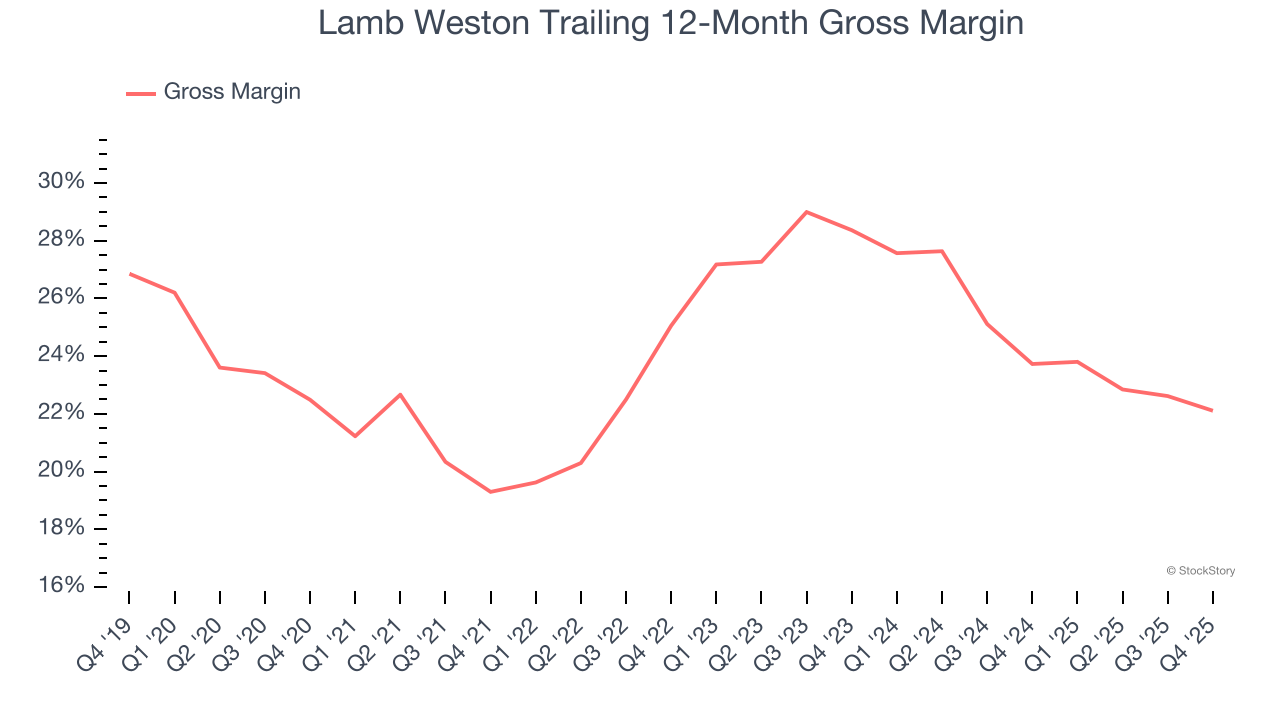

3. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Lamb Weston has bad unit economics for a consumer staples company, giving it less room to reinvest and develop new products. As you can see below, it averaged a 22.9% gross margin over the last two years. That means Lamb Weston paid its suppliers a lot of money ($77.09 for every $100 in revenue) to run its business.

Final Judgment

Lamb Weston isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 18.6× forward P/E (or $48.00 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks We Would Buy Instead of Lamb Weston

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.