Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Mastercard (NYSE:MA) and its peers.

Credit card companies facilitate electronic payments and extend revolving credit to consumers. Growth comes from increasing digital payment adoption, cross-border transaction growth, and value-added services for cardholders and merchants. Challenges include regulatory scrutiny of fees and practices, competition from alternative payment methods, and potential credit losses during economic downturns.

The 6 credit card stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 0.5%.

In light of this news, share prices of the companies have held steady as they are up 1.2% on average since the latest earnings results.

Mastercard (NYSE:MA)

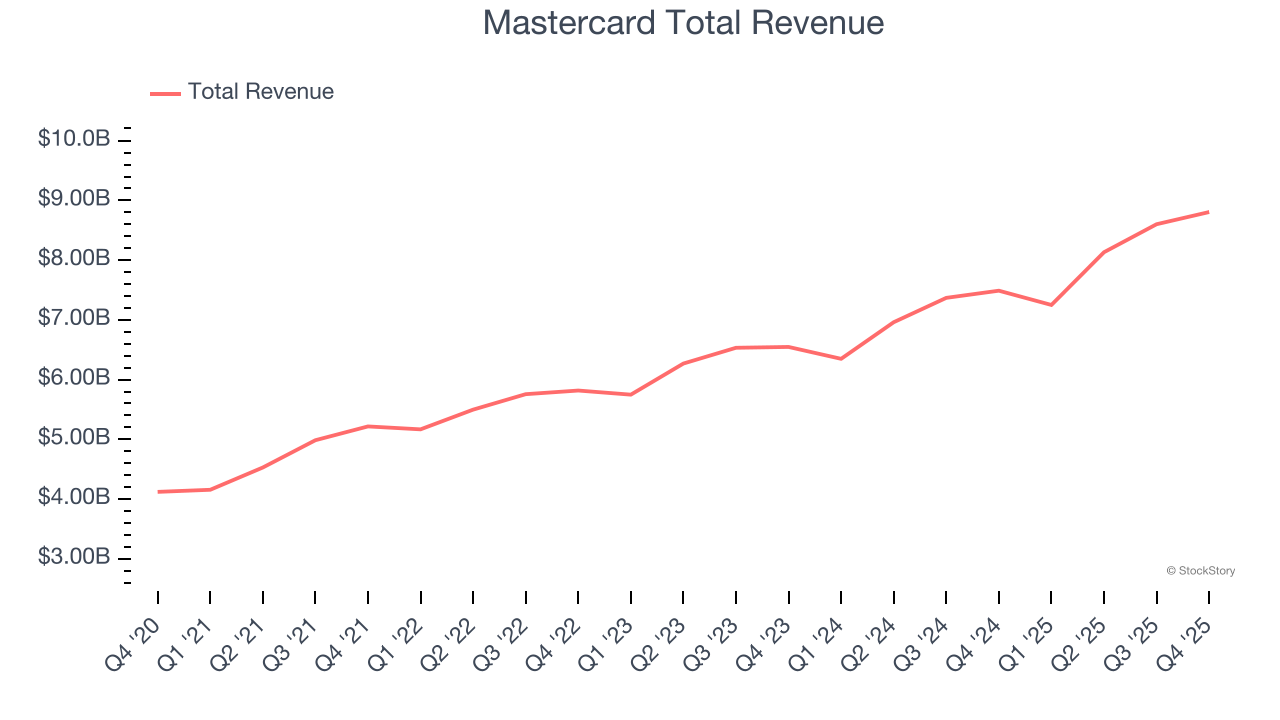

Recognizable by its iconic "Priceless" advertising campaign that has run in over 120 countries, Mastercard (NYSE:MA) operates a global payments network that connects consumers, financial institutions, merchants, and businesses, enabling electronic transactions and providing payment solutions.

Mastercard reported revenues of $8.81 billion, up 17.6% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ transaction volumes estimates and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 3.7% since reporting and currently trades at $540.47.

Read why we think that Mastercard is one of the best credit card stocks, our full report is free.

Best Q4: Bread Financial (NYSE:BFH)

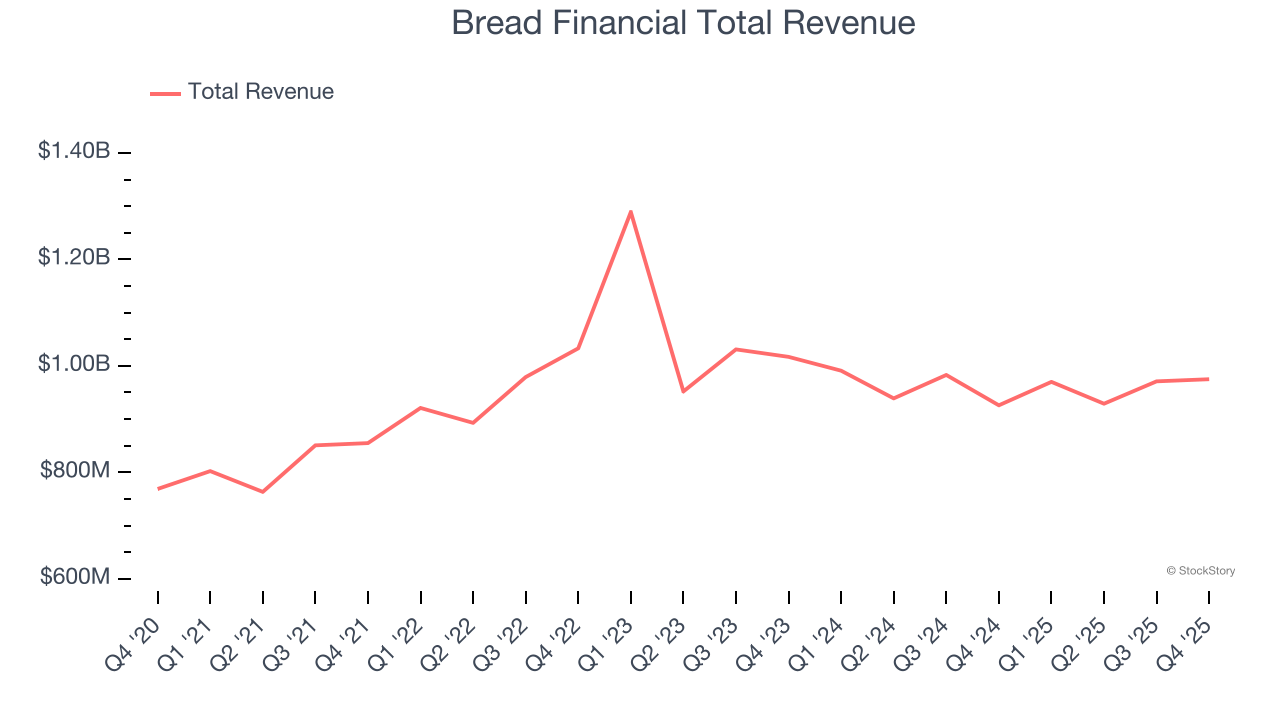

Formerly known as Alliance Data Systems until its 2022 rebranding, Bread Financial (NYSE:BFH) provides credit cards, installment loans, and savings products to consumers while powering branded payment solutions for retailers and merchants.

Bread Financial reported revenues of $975 million, up 5.3% year on year, outperforming analysts’ expectations by 2.2%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ net interest margin estimates.

Bread Financial pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 13.1% since reporting. It currently trades at $77.11.

Is now the time to buy Bread Financial? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: American Express (NYSE:AXP)

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE:AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

American Express reported revenues of $17.57 billion, up 10.6% year on year, falling short of analysts’ expectations by 7.2%. It was a softer quarter as it posted a significant miss of analysts’ revenue estimates and a miss of analysts’ EPS estimates.

American Express delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 1.6% since the results and currently trades at $364.10.

Read our full analysis of American Express’s results here.

Capital One (NYSE:COF)

Starting as a credit card company in 1988 before expanding into a full-service bank, Capital One (NYSE:COF) is a financial services company that offers credit cards, auto loans, banking services, and commercial lending to consumers and businesses.

Capital One reported revenues of $15.62 billion, up 53.3% year on year. This result topped analysts’ expectations by 0.9%. However, it was a slower quarter as it produced a significant miss of analysts’ efficiency ratio estimates and a significant miss of analysts’ EPS estimates.

Capital One delivered the fastest revenue growth among its peers. The stock is down 6.3% since reporting and currently trades at $220.19.

Read our full, actionable report on Capital One here, it’s free.

Visa (NYSE:V)

Processing over 829 million transactions daily and connecting billions of cards to 150 million merchant locations worldwide, Visa (NYSE:V) operates one of the world's largest electronic payments networks, facilitating secure money movement across more than 200 countries through its VisaNet processing platform.

Visa reported revenues of $10.9 billion, up 14.6% year on year. This print beat analysts’ expectations by 2%. Aside from that, it was a satisfactory quarter as it also produced a decent beat of analysts’ revenue estimates but a significant miss of analysts’ transaction volumes estimates.

The stock is down 1.1% since reporting and currently trades at $328.25.

Read our full, actionable report on Visa here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.