Methode Electronics’s 39.4% return over the past six months has outpaced the S&P 500 by 31%, and its stock price has climbed to $8.83 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Methode Electronics, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Methode Electronics Will Underperform?

We’re glad investors have benefited from the price increase, but we're cautious about Methode Electronics. Here are three reasons why MEI doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

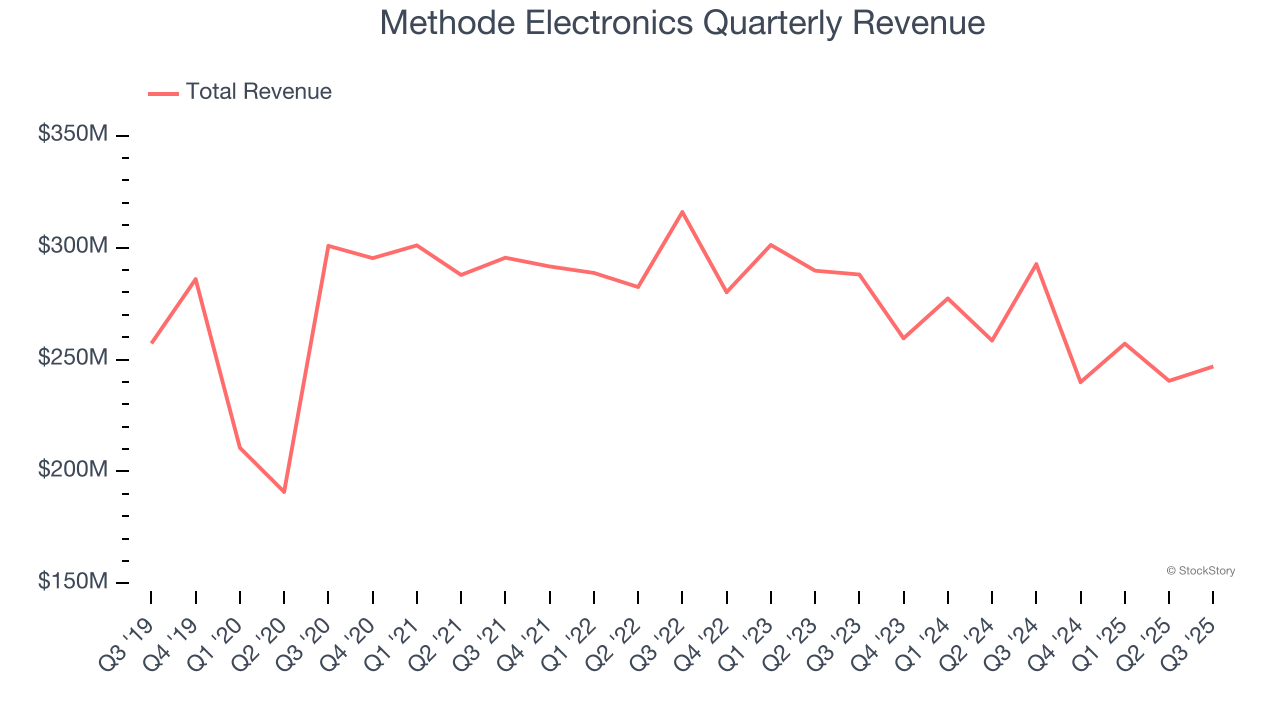

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Methode Electronics struggled to consistently increase demand as its $984.4 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

2. New Investments Fail to Bear Fruit as ROIC Declines

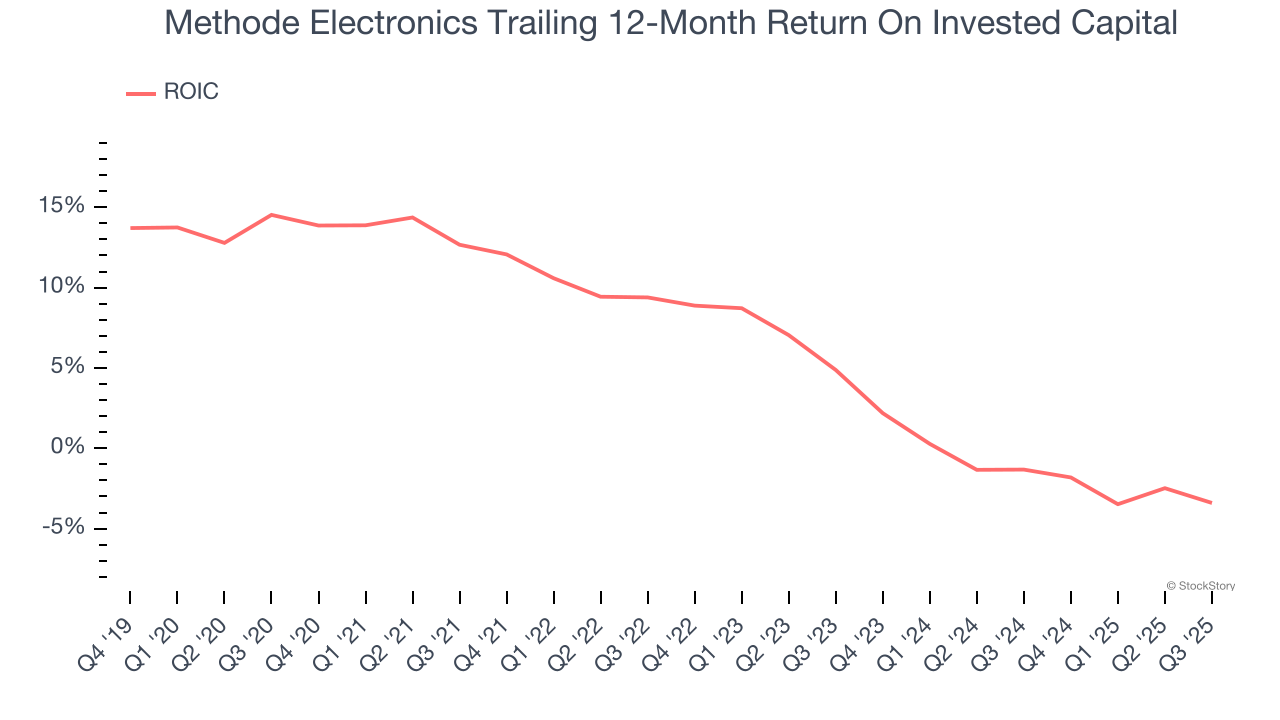

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Methode Electronics’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

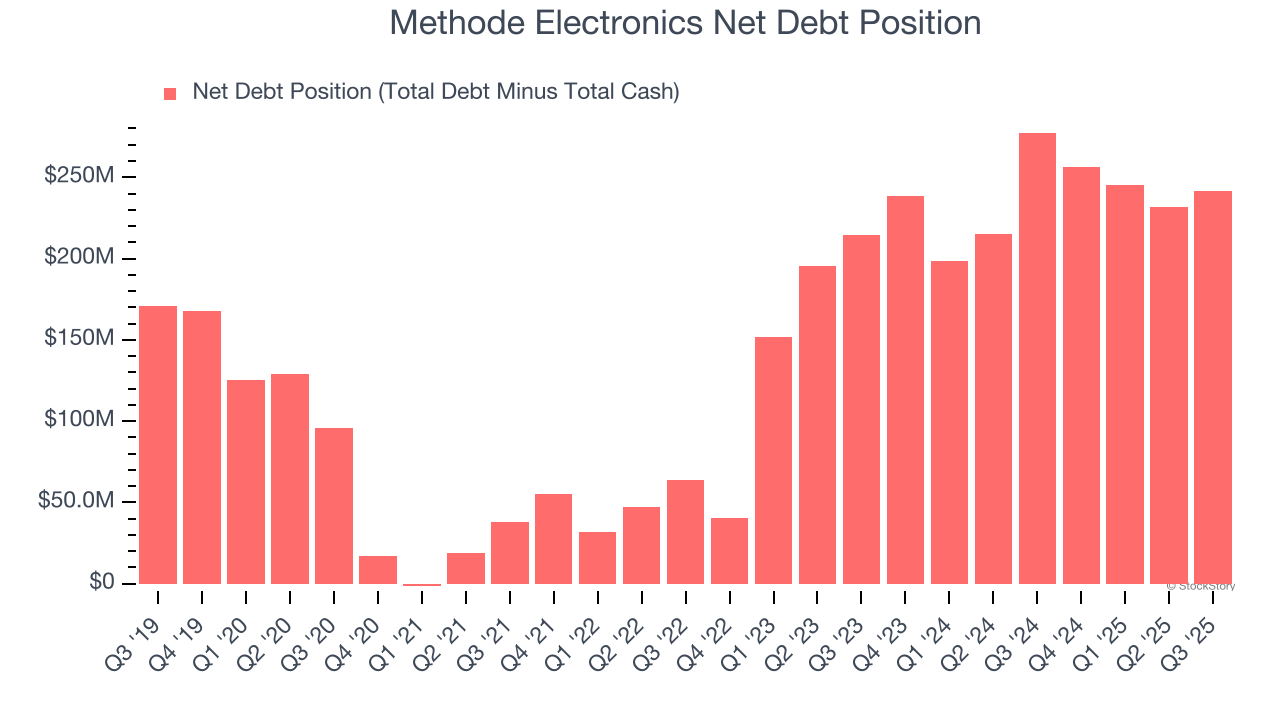

Methode Electronics’s $359.8 million of debt exceeds the $118.5 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $38.5 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Methode Electronics could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Methode Electronics can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Methode Electronics, we’ll be cheering from the sidelines. With its shares topping the market in recent months, the stock trades at 144× forward P/E (or $8.83 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at the most dominant software business in the world.

Stocks We Would Buy Instead of Methode Electronics

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.