3M has been treading water for the past six months, recording a small return of 4.1% while holding steady at $160.28. The stock also fell short of the S&P 500’s 9.9% gain during that period.

Is there a buying opportunity in 3M, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think 3M Will Underperform?

We're cautious about 3M. Here are three reasons there are better opportunities than MMM and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

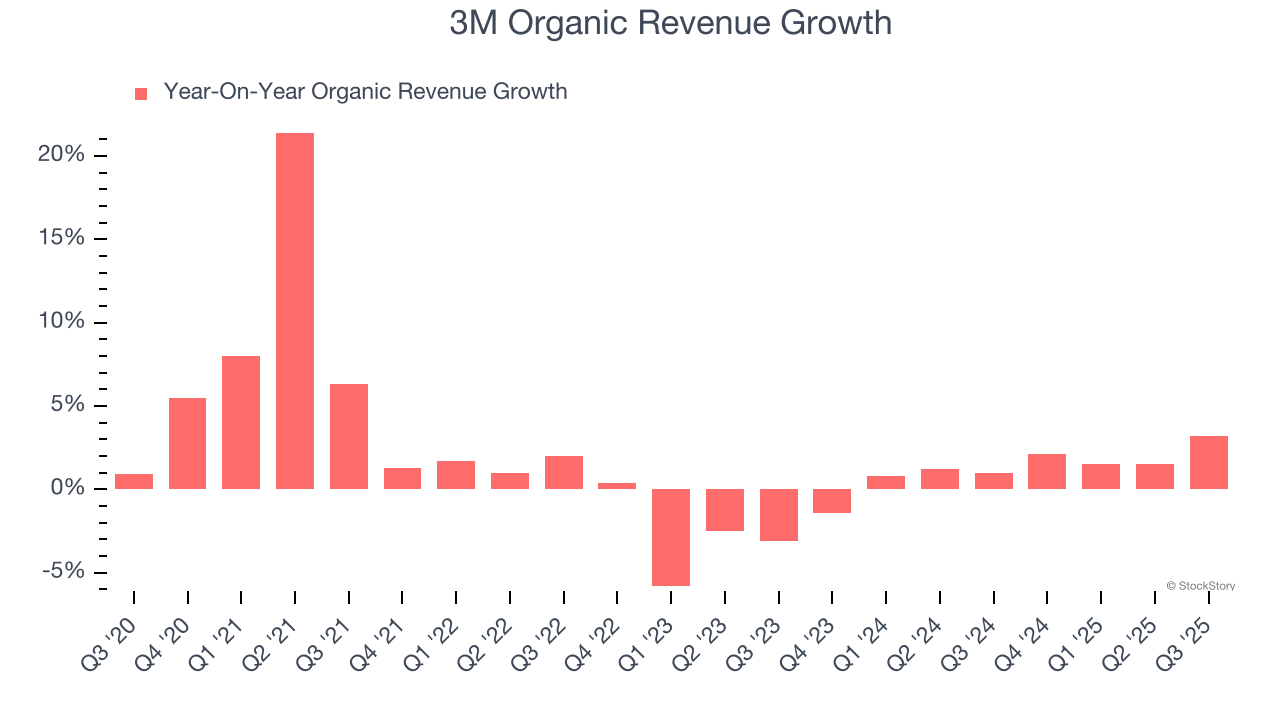

We can better understand General Industrial Machinery companies by analyzing their organic revenue. This metric gives visibility into 3M’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, 3M’s organic revenue averaged 1.2% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect 3M’s revenue to rise by 2.9%. Although this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

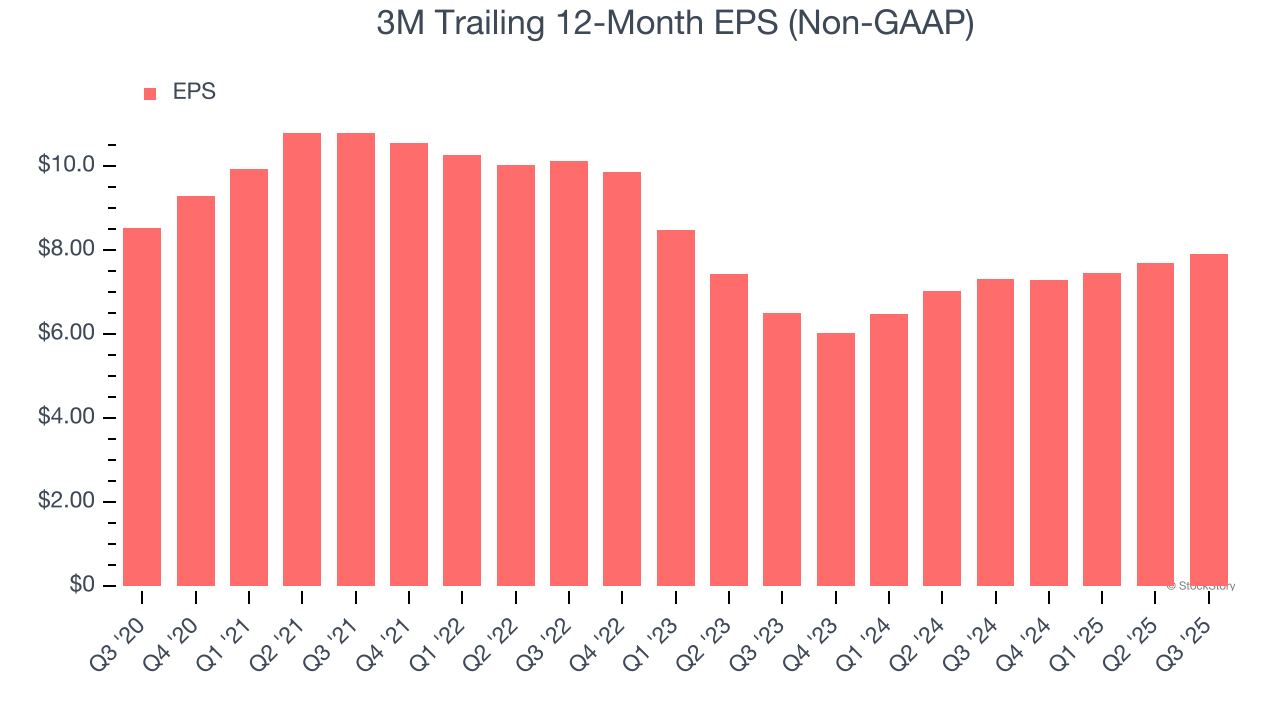

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for 3M, its EPS and revenue declined by 1.5% and 5.4% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, 3M’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of 3M, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 19× forward P/E (or $160.28 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.