M&T Bank trades at $214.01 per share and has stayed right on track with the overall market, gaining 10.2% over the last six months. At the same time, the S&P 500 has returned 8.2%.

Is now the time to buy M&T Bank, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is M&T Bank Not Exciting?

We're cautious about M&T Bank. Here are three reasons you should be careful with MTB and a stock we'd rather own.

1. Lackluster Revenue Growth

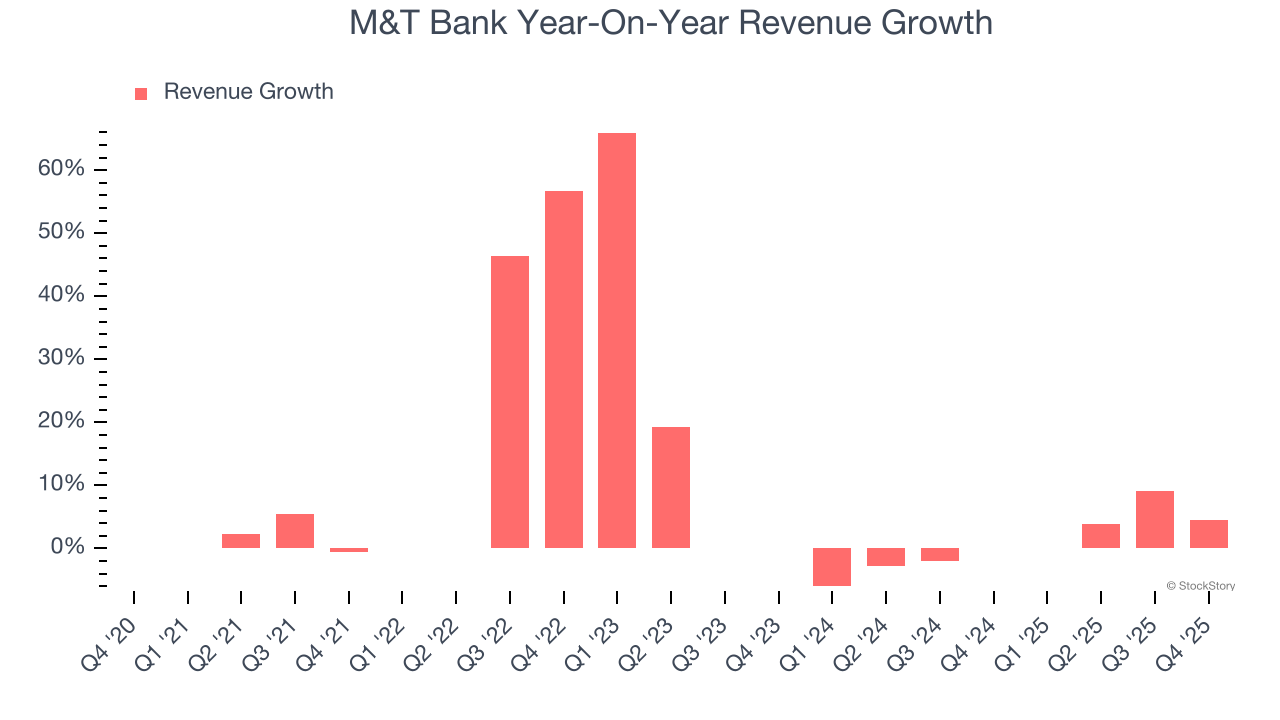

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. M&T Bank’s recent performance shows its demand has slowed as its annualized revenue growth of 1.4% over the last two years was below its five-year trend.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. Recent EPS Growth Below Our Standards

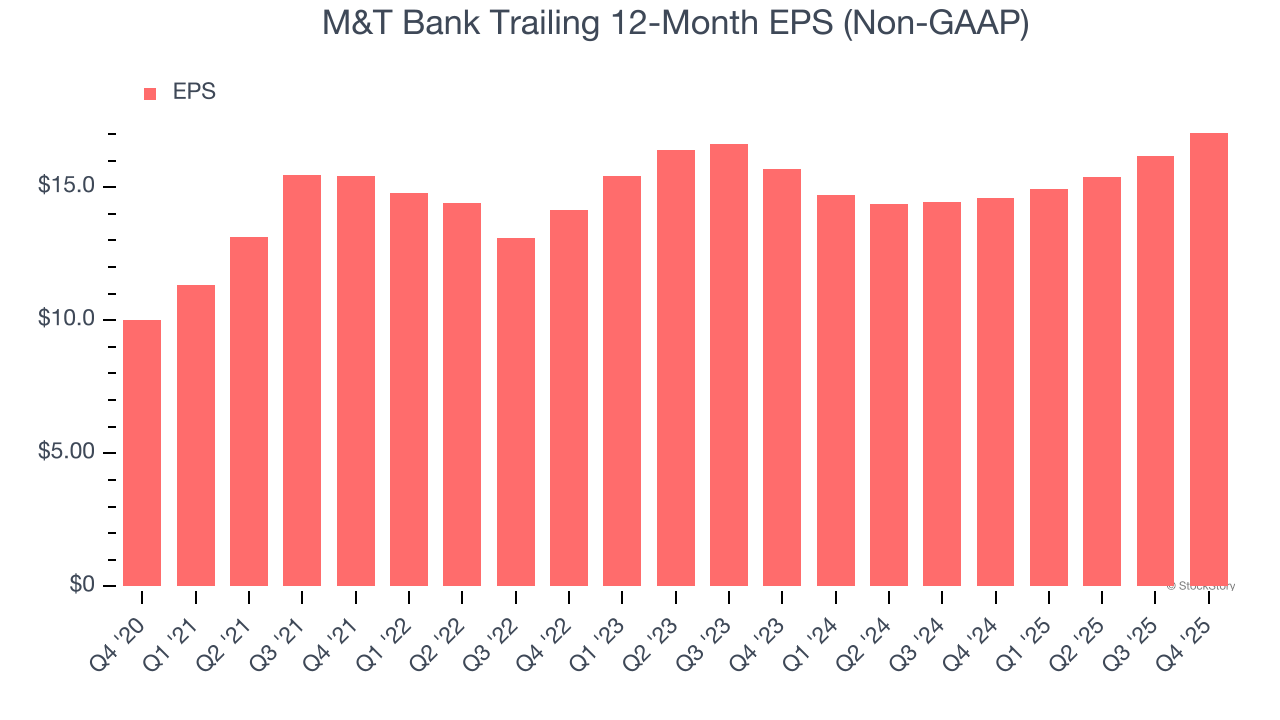

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

M&T Bank’s EPS grew at a weak 4.2% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 1.4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

3. Projected TBVPS Growth Is Slim

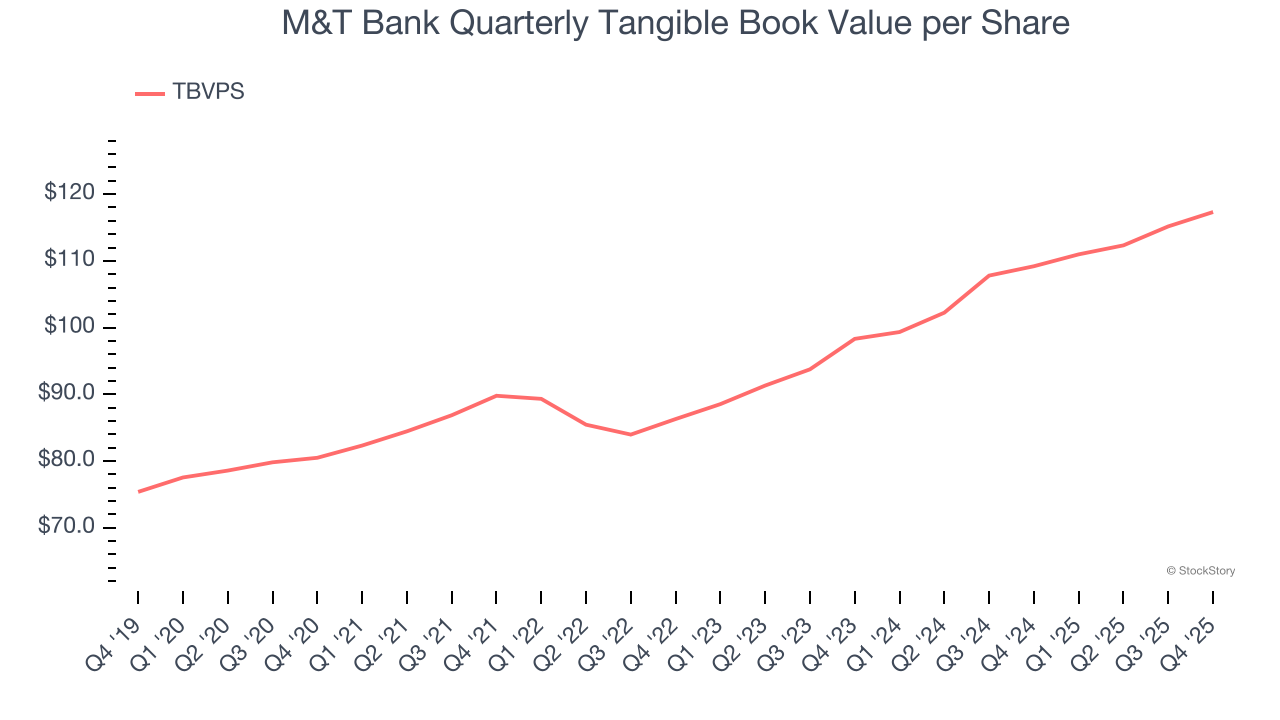

Tangible book value per share (TBVPS) growth is driven by a bank’s ability to earn more than its cost of capital through lending activities while maintaining a strong balance sheet.

Over the next 12 months, Consensus estimates call for M&T Bank’s TBVPS to grow by 4.2% to $122.21, lousy growth rate.

Final Judgment

M&T Bank isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 1.2× forward P/B (or $214.01 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of M&T Bank

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.