Magnachip currently trades at $3.04 per share and has shown little upside over the past six months, posting a middling return of 3.8%.

Is now the time to buy Magnachip, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Magnachip Will Underperform?

We're cautious about Magnachip. Here are three reasons we avoid MX and a stock we'd rather own.

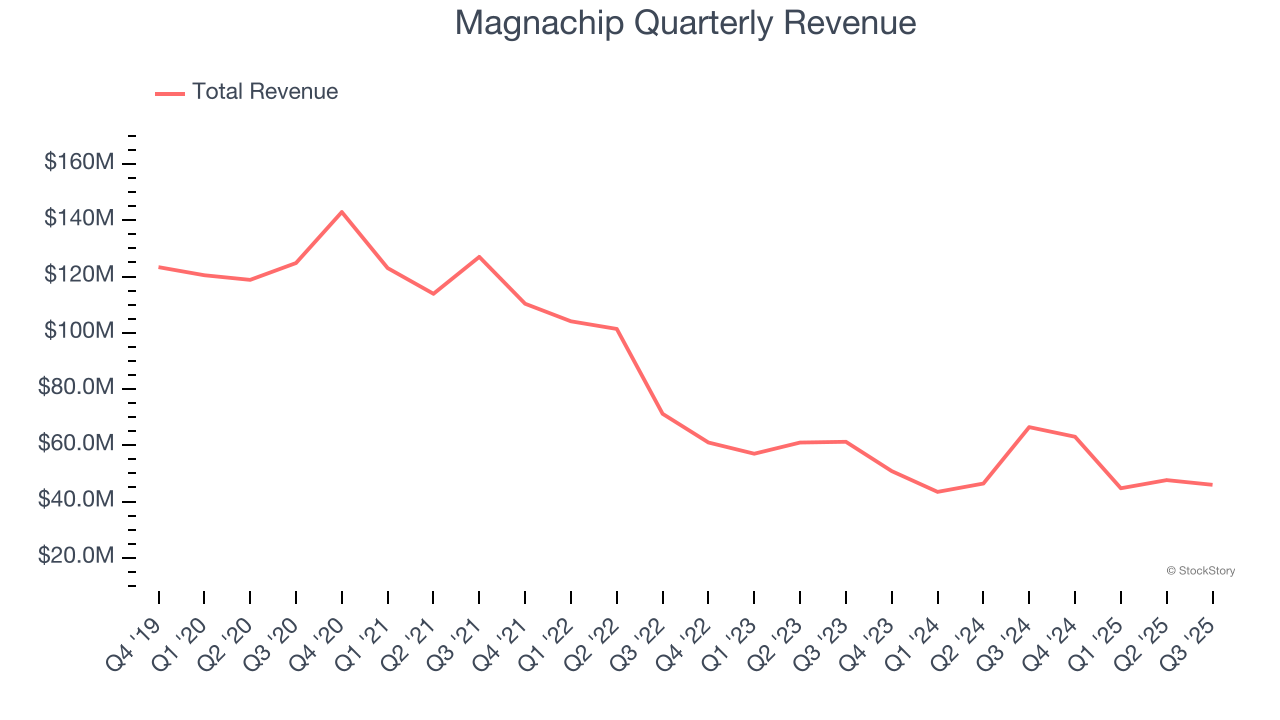

1. Revenue Spiraling Downwards

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Magnachip’s demand was weak over the last five years as its sales fell at a 16.2% annual rate. This wasn’t a great result and signals it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

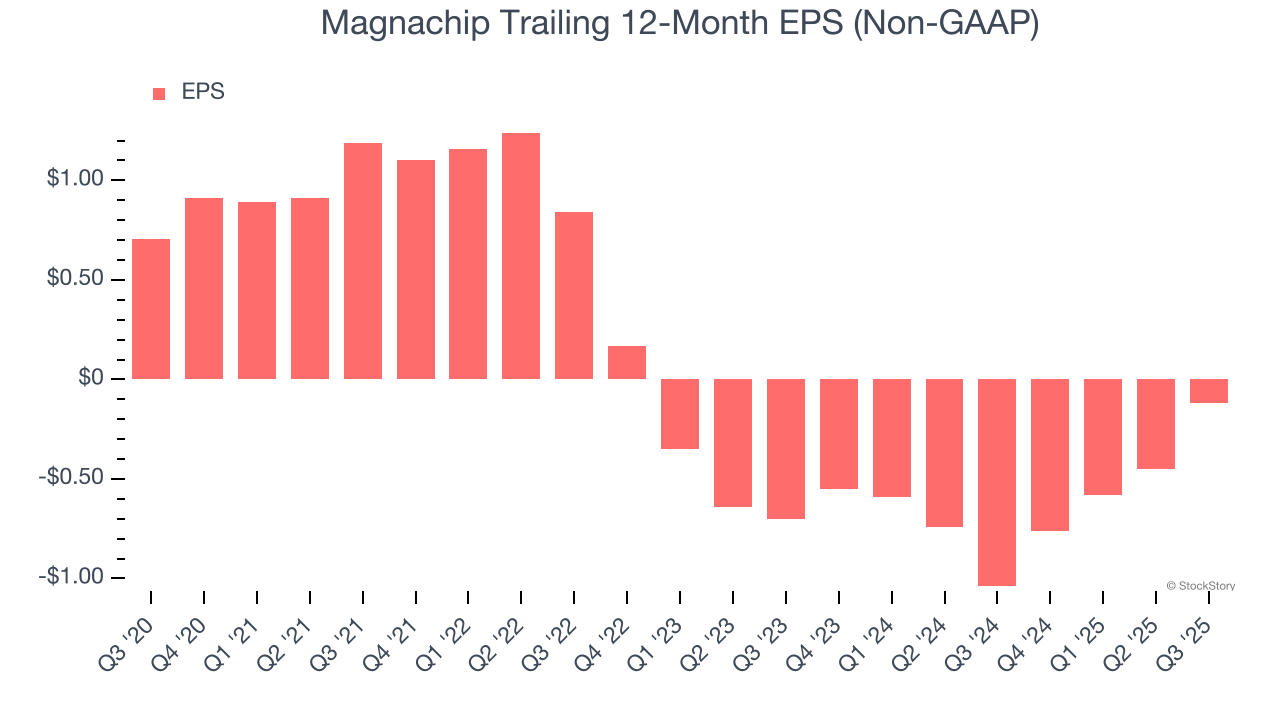

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Magnachip, its EPS and revenue declined by 16.8% and 16.2% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Magnachip’s low margin of safety could leave its stock price susceptible to large downswings.

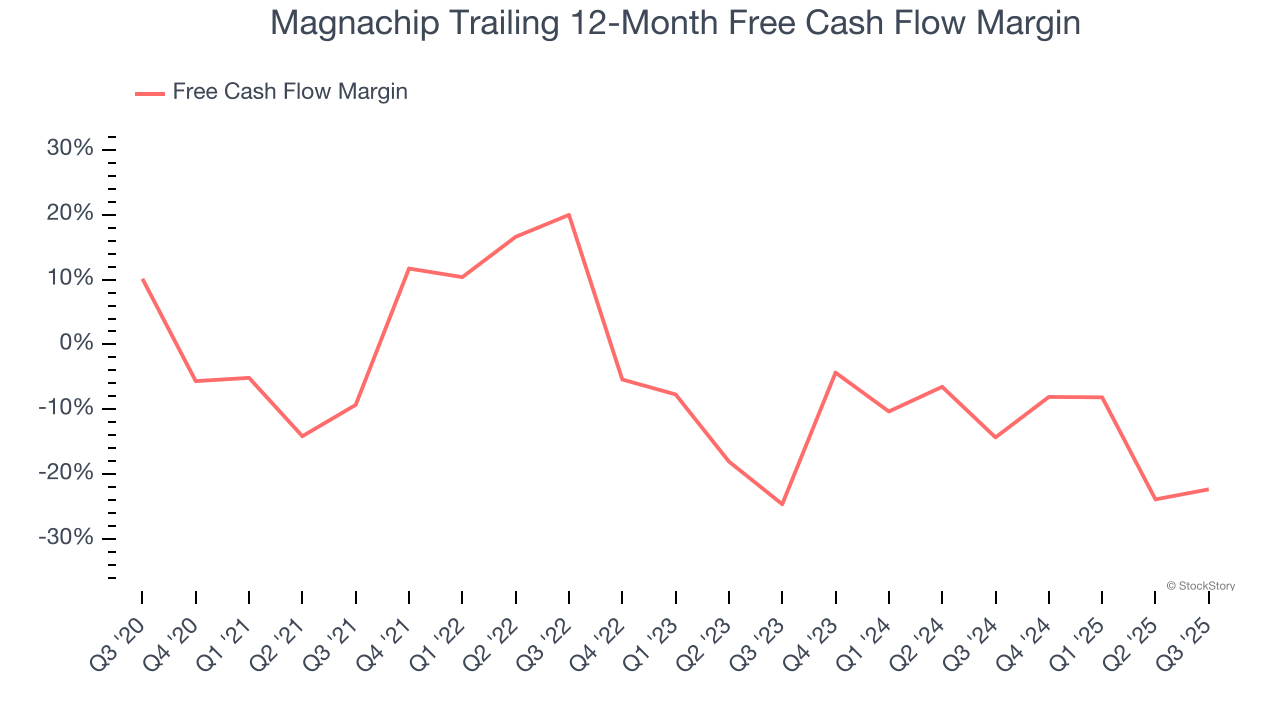

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Magnachip’s margin dropped by 13 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle. Magnachip’s free cash flow margin for the trailing 12 months was negative 22.3%.

Final Judgment

We see the value of companies furthering technological innovation, but in the case of Magnachip, we’re out. That said, the stock currently trades at $3.04 per share (or a forward price-to-sales ratio of 0.6×). The market typically values companies like Magnachip based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.