National Bank Holdings trades at $39.90 and has moved in lockstep with the market. Its shares have returned 10.7% over the last six months while the S&P 500 has gained 14.4%.

Is there a buying opportunity in National Bank Holdings, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think National Bank Holdings Will Underperform?

We're sitting this one out for now. Here are three reasons we avoid NBHC and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

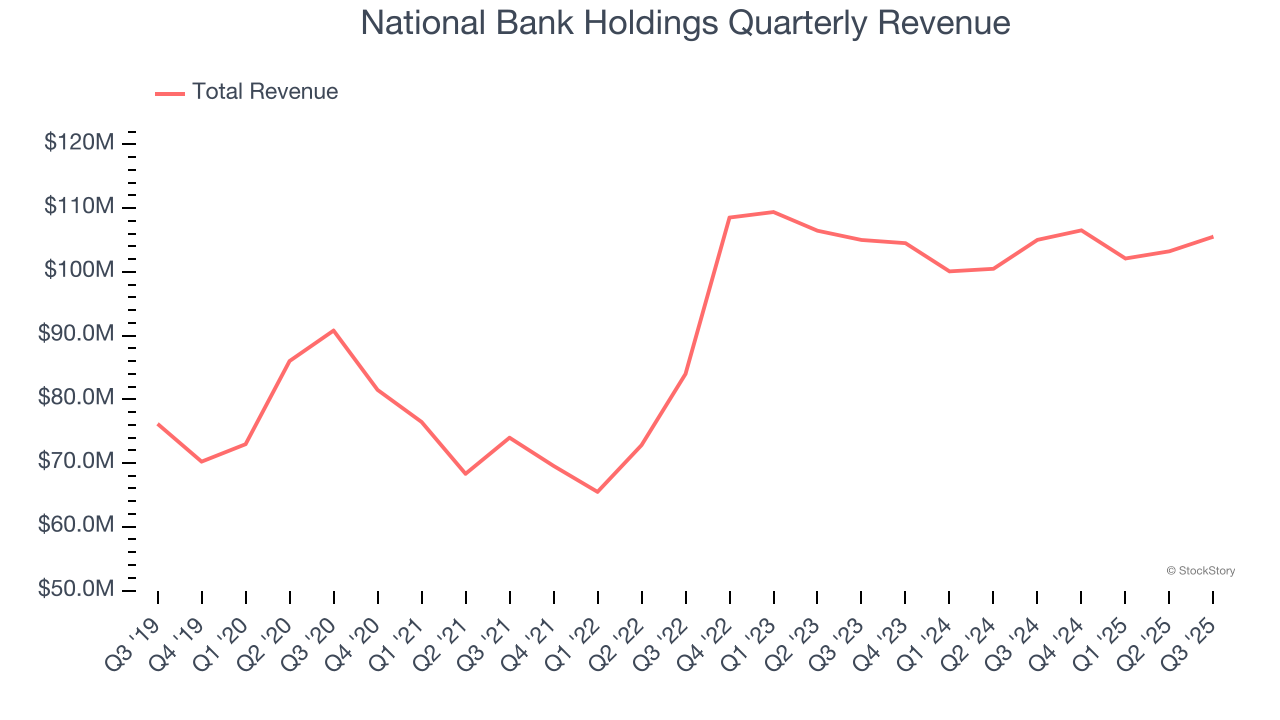

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Regrettably, National Bank Holdings’s revenue grew at a sluggish 5.5% compounded annual growth rate over the last five years. This was below our standard for the banking sector.

2. EPS Barely Growing

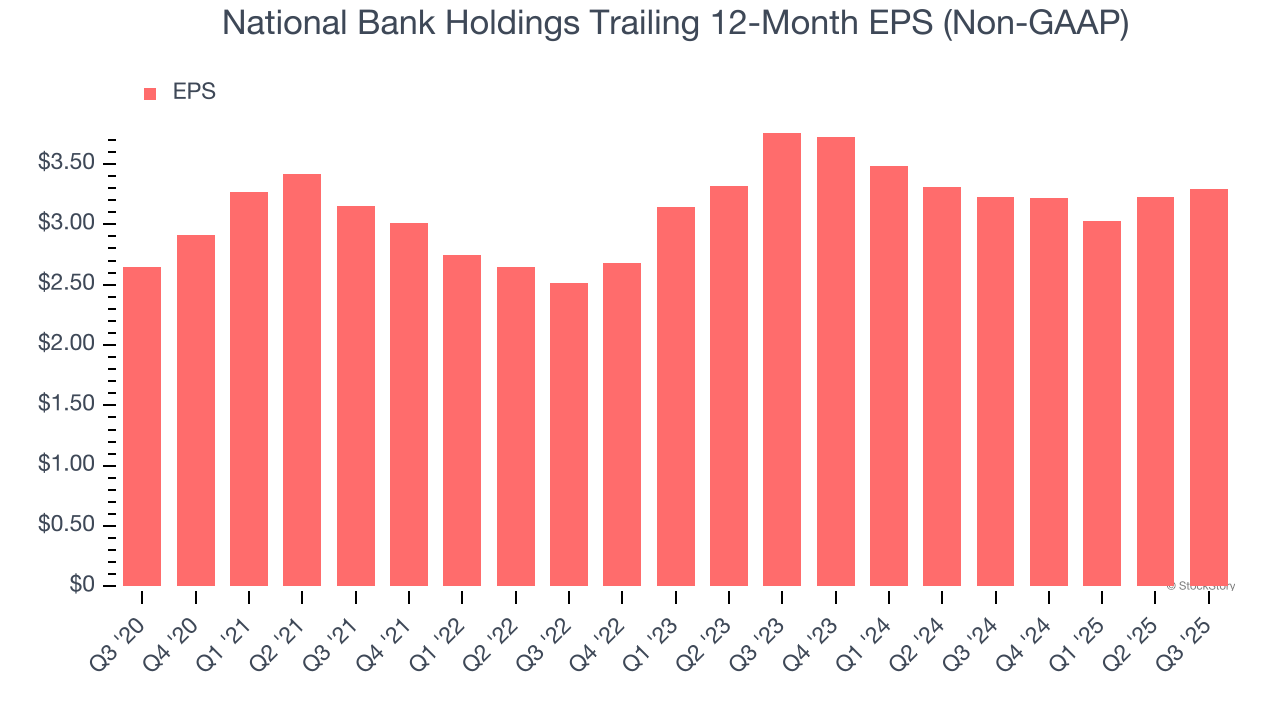

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

National Bank Holdings’s weak 4.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

3. Projected TBVPS Growth Is Slim

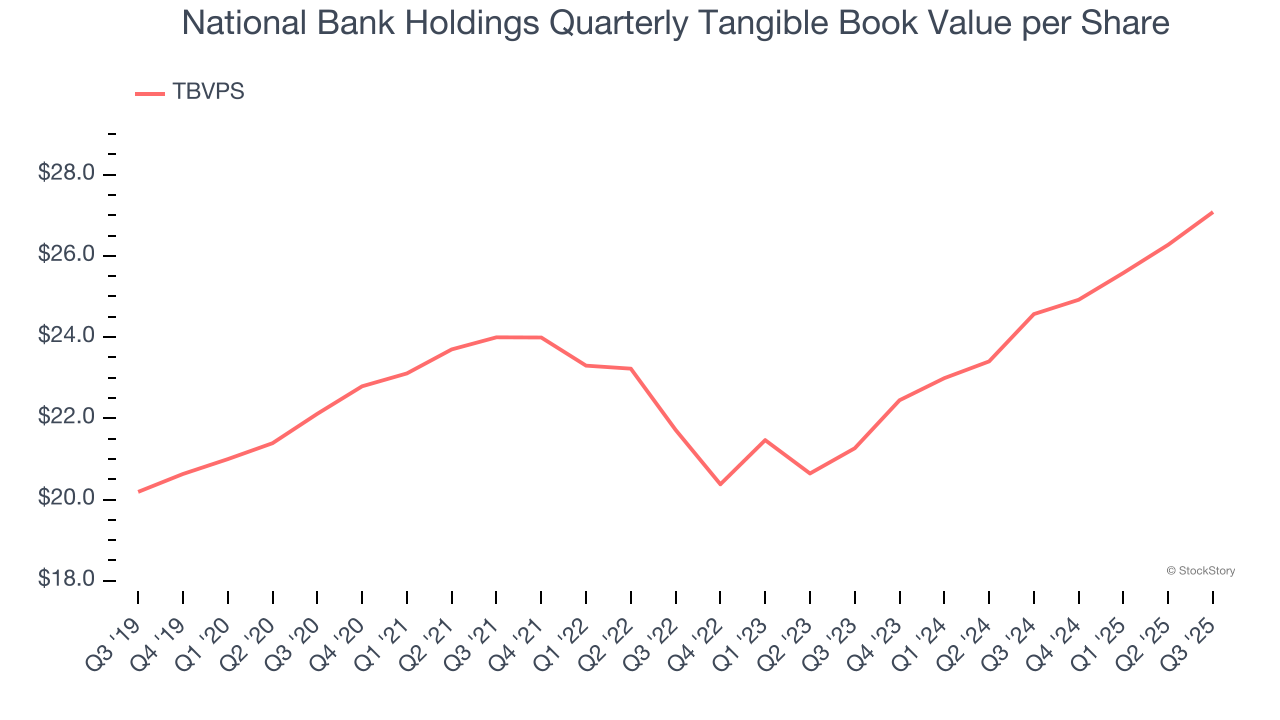

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for National Bank Holdings’s TBVPS to grow by 4.7% to $28.34, lousy growth rate.

Final Judgment

We see the value of companies driving economic growth, but in the case of National Bank Holdings, we’re out. That said, the stock currently trades at 1.1× forward P/B (or $39.90 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than National Bank Holdings

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.