Athletic apparel brand Nike (NYSE:NKE) announced better-than-expected revenue in Q4 CY2025, but sales were flat year on year at $12.43 billion. Its GAAP profit of $0.53 per share was 41.9% above analysts’ consensus estimates.

Is now the time to buy Nike? Find out by accessing our full research report, it’s free for active Edge members.

Nike (NKE) Q4 CY2025 Highlights:

- Revenue: $12.43 billion vs analyst estimates of $12.22 billion (flat year on year, 1.7% beat)

- North America revenue rose 9% year-on-year (beat) while Greater China revenue dropped 17% (miss)

- EPS (GAAP): $0.53 vs analyst estimates of $0.37 (41.9% beat)

- Operating Margin: 8%, down from 11.2% in the same quarter last year

- Constant Currency Revenue was flat year on year (-9% in the same quarter last year)

- Market Capitalization: $97.1 billion

Company Overview

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE:NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Nike grew its sales at a weak 4% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

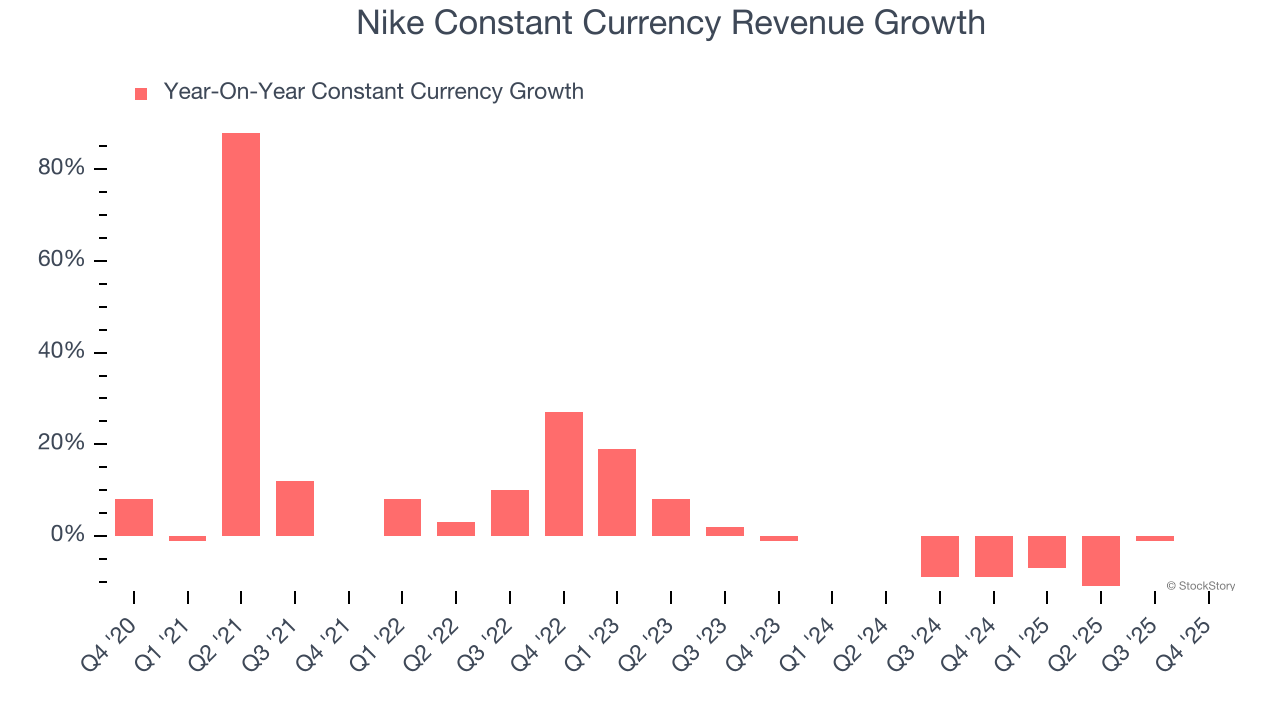

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Nike’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5% annually.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 4.6% year-on-year declines. Because this number aligns with its normal revenue growth, we can see that Nike has properly hedged its foreign currency exposure.

This quarter, Nike’s $12.43 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

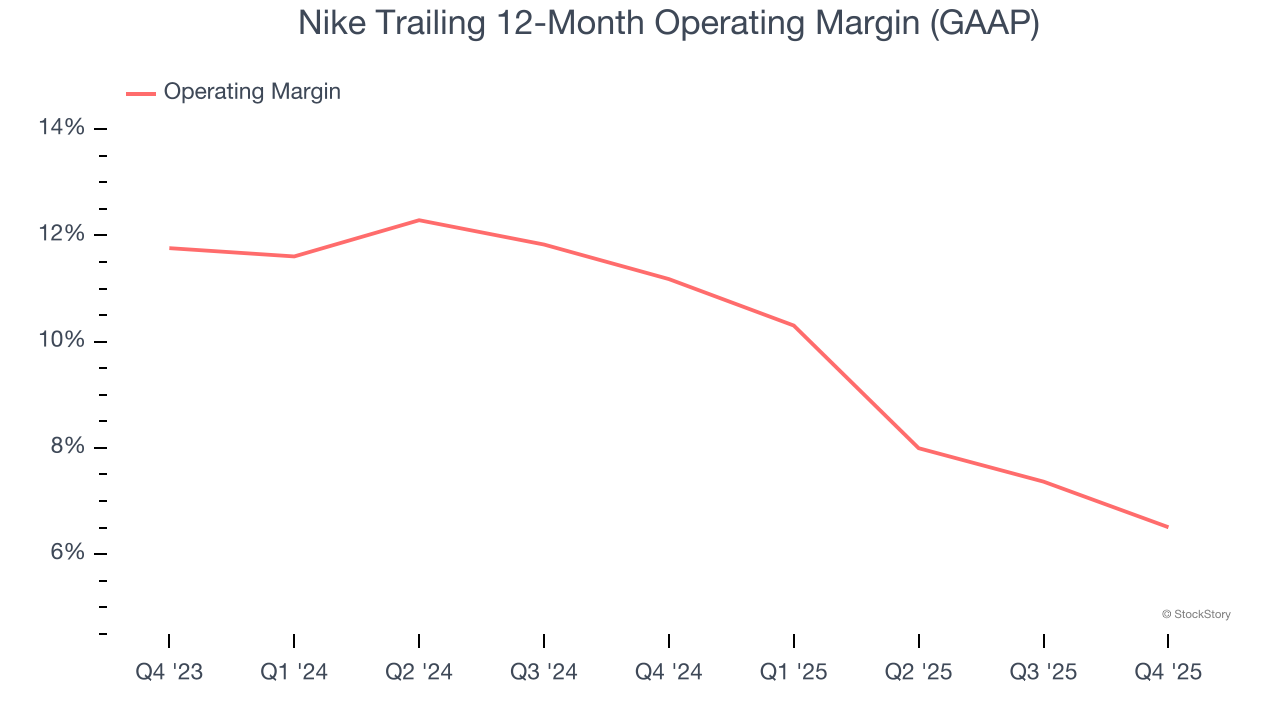

Nike’s operating margin has shrunk over the last 12 months and averaged 8.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Nike generated an operating margin profit margin of 8%, down 3.2 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

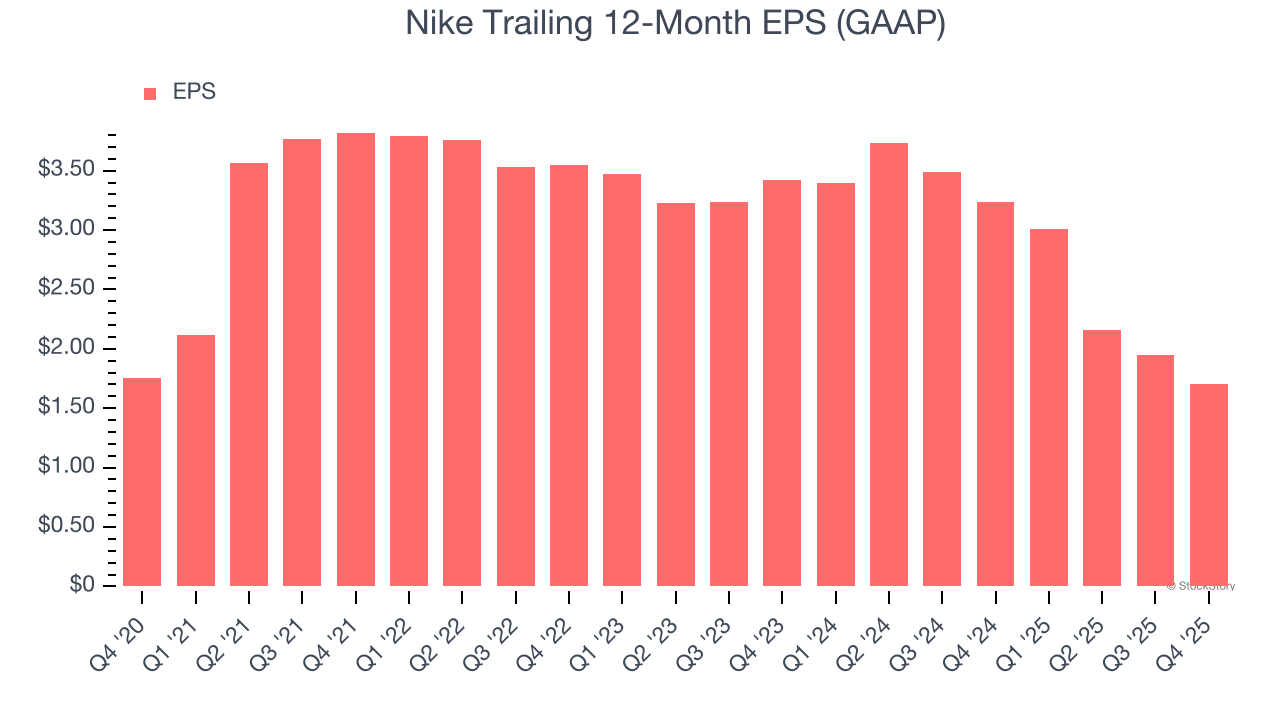

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Nike’s flat EPS over the last five years was below its 4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, Nike reported EPS of $0.53, down from $0.78 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Nike’s full-year EPS of $1.70 to grow 27.6%.

Key Takeaways from Nike’s Q4 Results

It was good to see Nike beat analysts’ constant currency revenue and EPS expectations this quarter. On the other hand, China revenue declined meaningfully. Zooming out, we think this was a mixed print. The market seemed to be hoping for more, and the stock traded down 2.3% to $64.35 immediately after reporting.

Is Nike an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.