Nelnet currently trades at $130.98 per share and has shown little upside over the past six months, posting a middling return of 3%.

Is now the time to buy NNI? Find out in our full research report, it’s free.

Why Are We Positive On NNI?

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE:NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

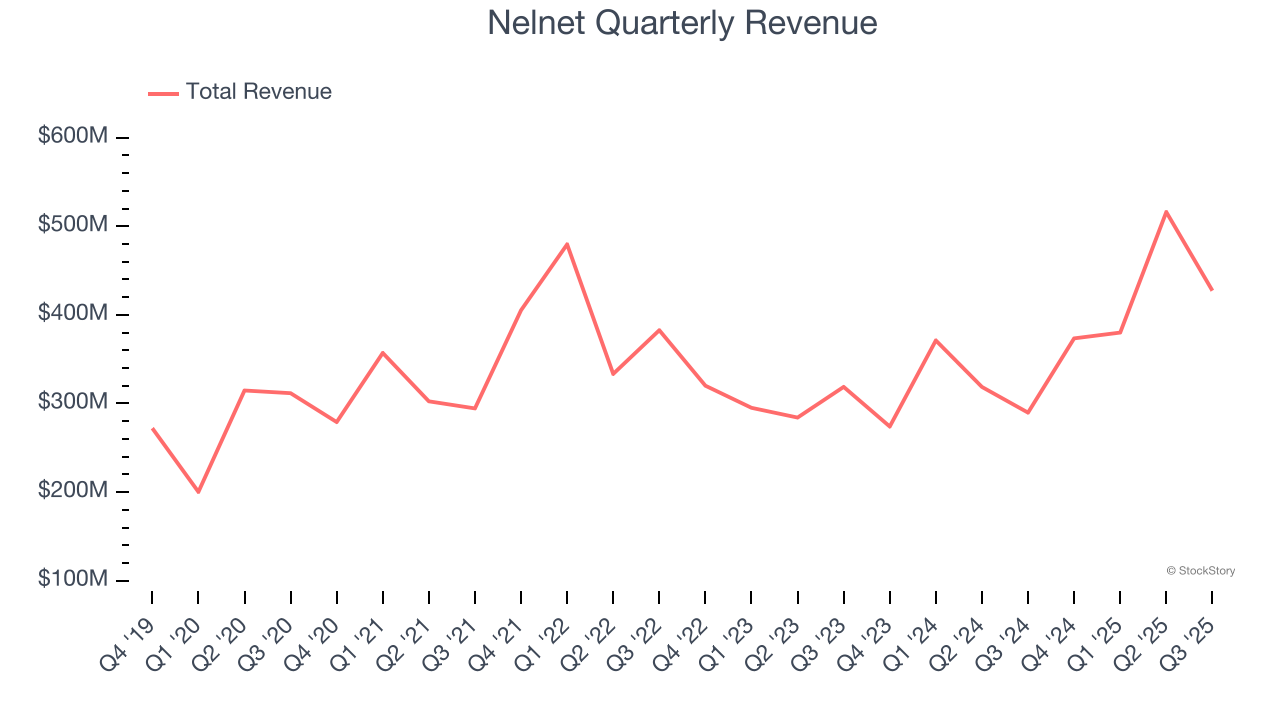

1. Long-Term Revenue Growth Shows Momentum

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Over the last five years, Nelnet grew its revenue at a decent 9.1% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

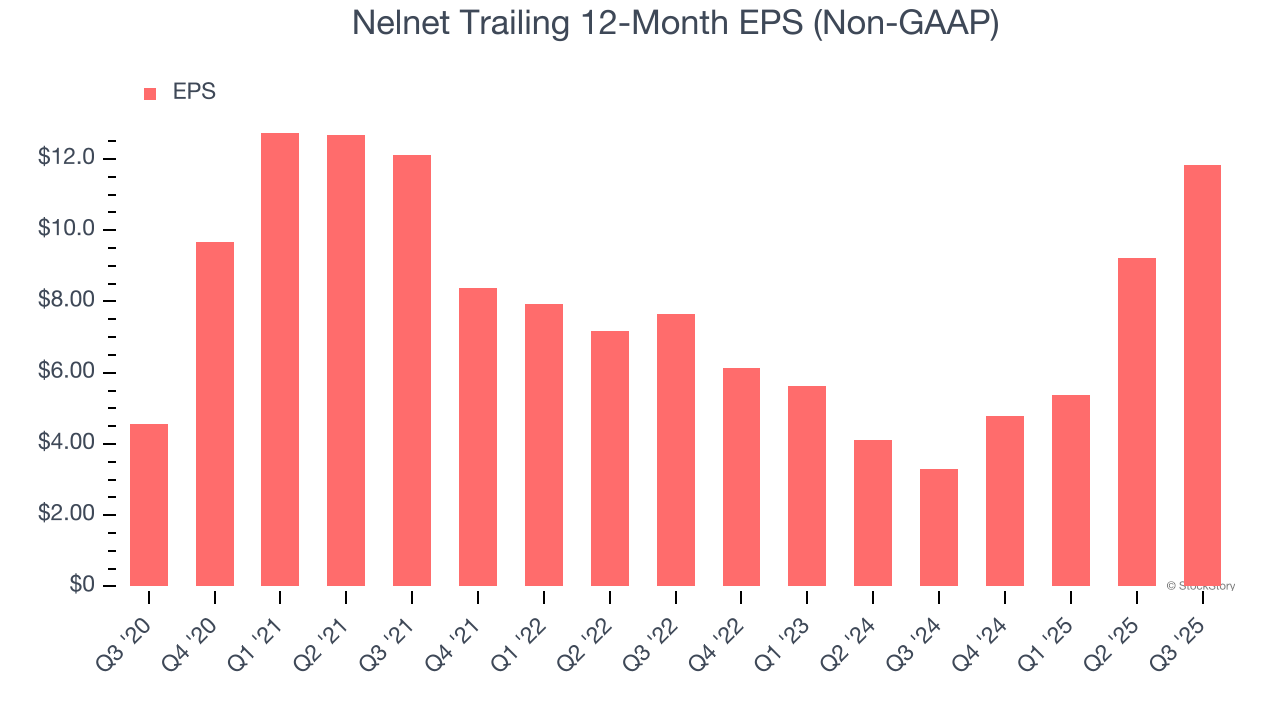

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Nelnet’s EPS grew at a spectacular 21% compounded annual growth rate over the last five years, higher than its 9.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

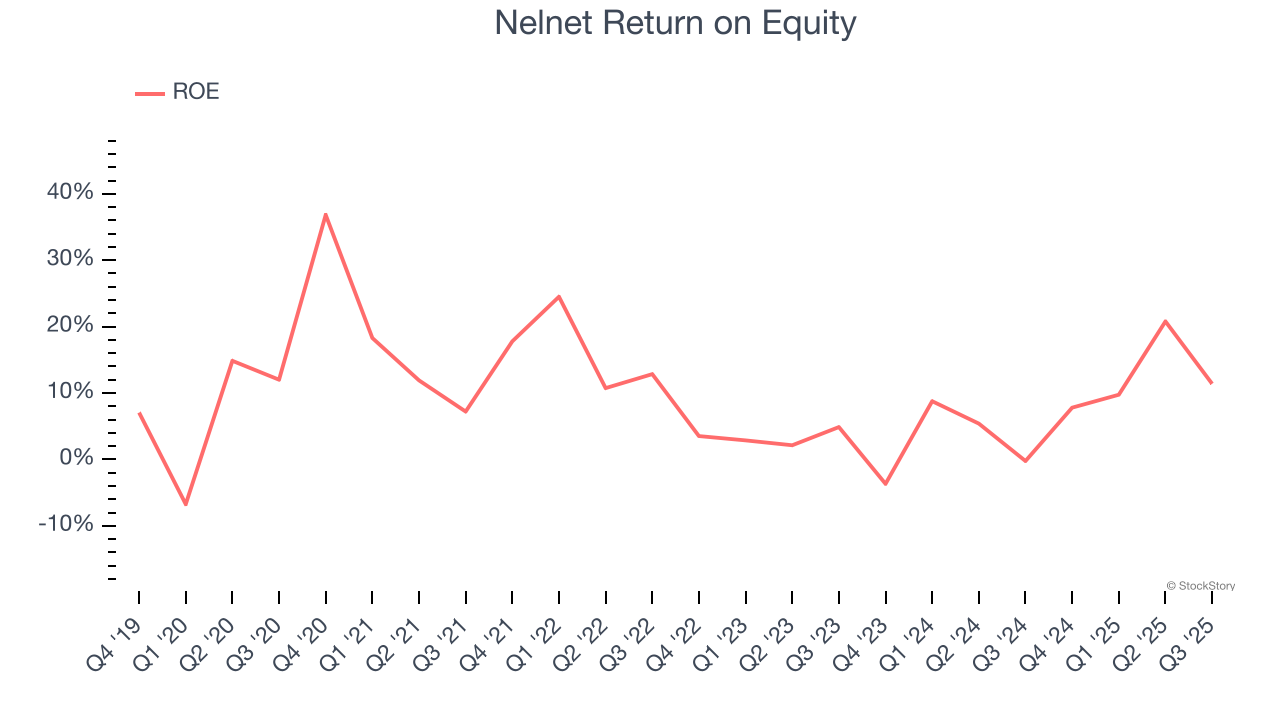

3. Previous Growth Initiatives Are Paying Off

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Nelnet has averaged an ROE of 10.7%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Nelnet has a narrow competitive moat.

Final Judgment

These are just a few reasons why we think Nelnet is a great business, but at $130.98 per share (or 15.8× forward P/E), is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.