Offerpad has gotten torched over the last six months - since August 2025, its stock price has dropped 25.5% to $0.92 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Offerpad, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Offerpad Will Underperform?

Despite the more favorable entry price, we're swiping left on Offerpad for now. Here are three reasons you should be careful with OPAD and a stock we'd rather own.

1. Decline in Homes Sold Points to Weak Demand

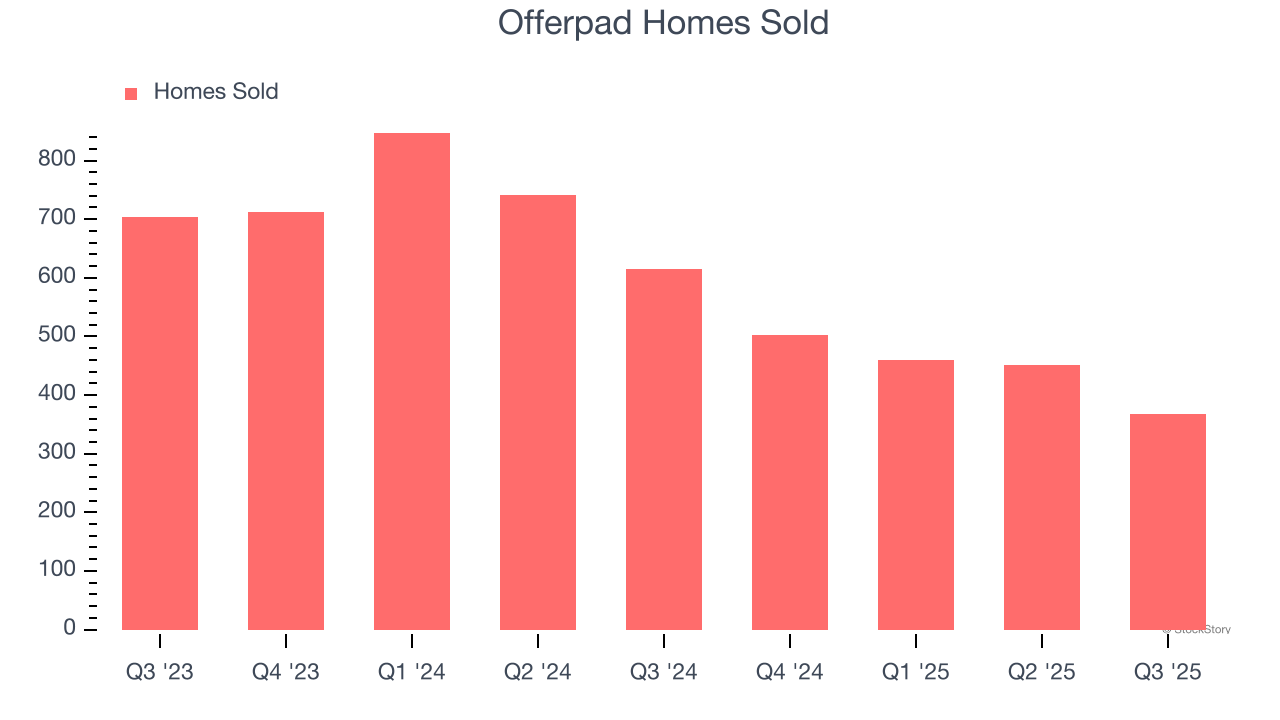

Revenue growth can be broken down into changes in price and volume (for companies like Offerpad, our preferred volume metric is homes sold). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Offerpad’s homes sold came in at 367 in the latest quarter, and over the last two years, averaged 33.4% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Offerpad might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Offerpad will flip from cash-producing to cash-burning. Their consensus estimates imply its free cash flow margin of 7.1% for the last 12 months will decrease to negative 2.1%.

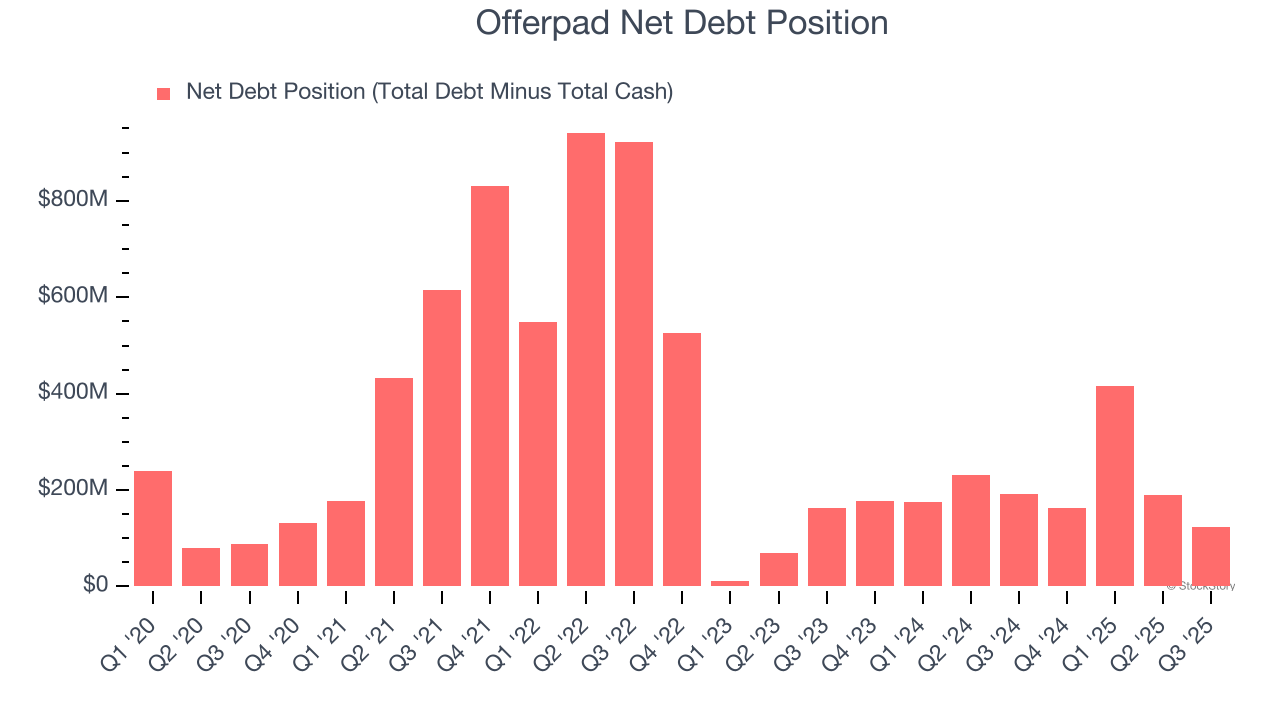

3. Restricted Access to Capital Increases Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Offerpad posted negative $28.67 million of EBITDA over the last 12 months, and its $157.9 million of debt exceeds the $33.64 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Offerpad if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Offerpad can improve its profitability and remain cautious until then.

Final Judgment

Offerpad doesn’t pass our quality test. After the recent drawdown, the stock trades at $0.92 per share (or a forward price-to-sales ratio of 0.1×). The market typically values companies like Offerpad based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Offerpad

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.