Over the past six months, OPENLANE has been a great trade, beating the S&P 500 by 7%. Its stock price has climbed to $29.25, representing a healthy 16.8% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy OPENLANE, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is OPENLANE Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in OPENLANE. Here are three reasons we avoid OPLN and a stock we'd rather own.

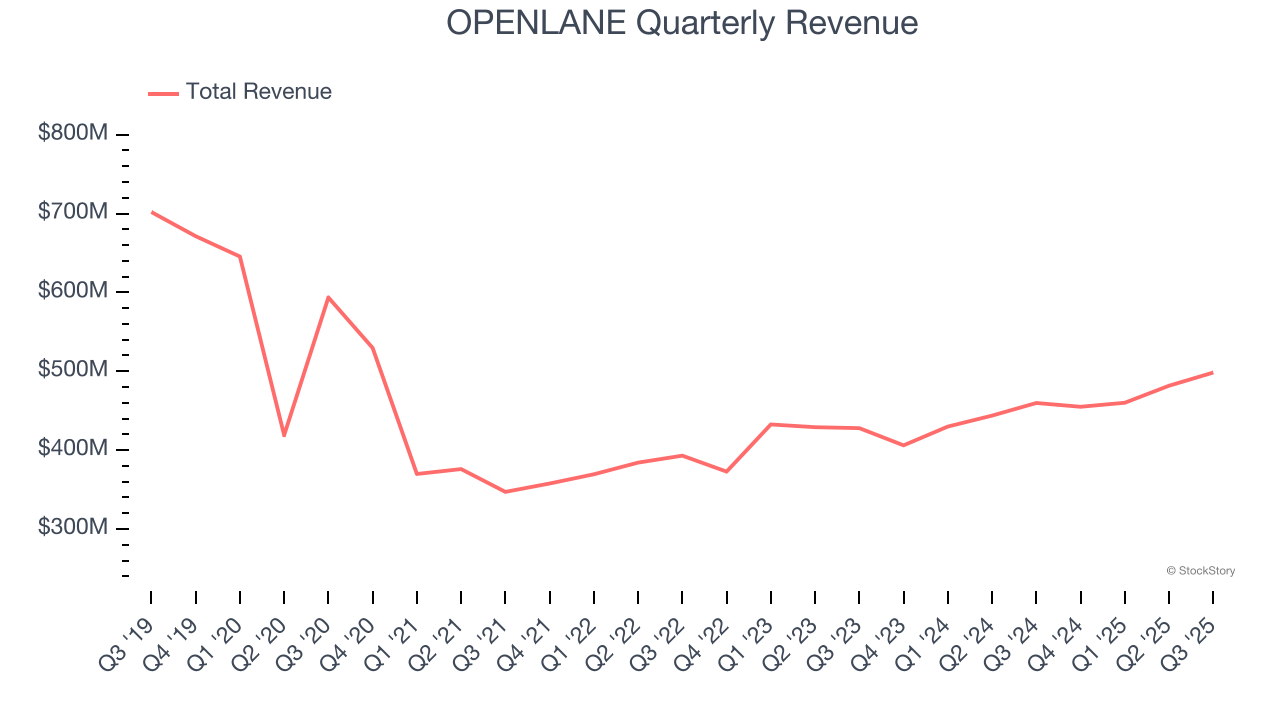

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. OPENLANE’s demand was weak over the last five years as its sales fell at a 4% annual rate. This wasn’t a great result and signals it’s a lower quality business.

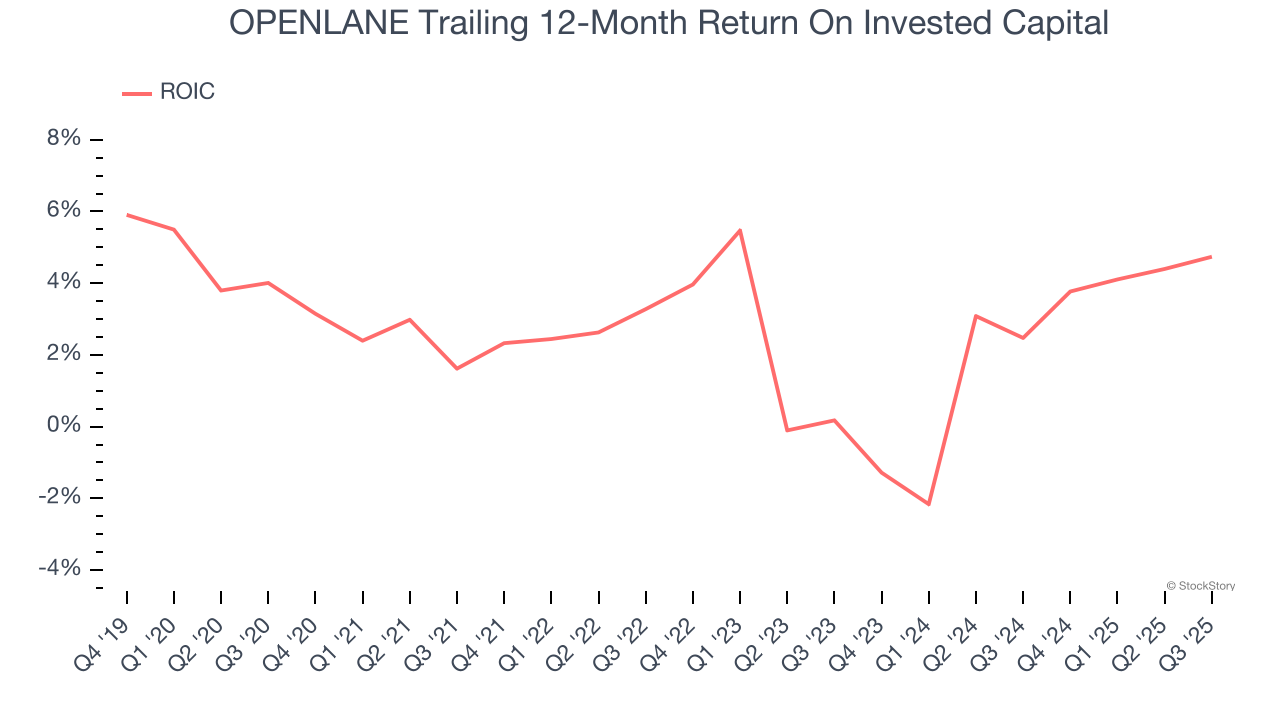

2. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

OPENLANE historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.5%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

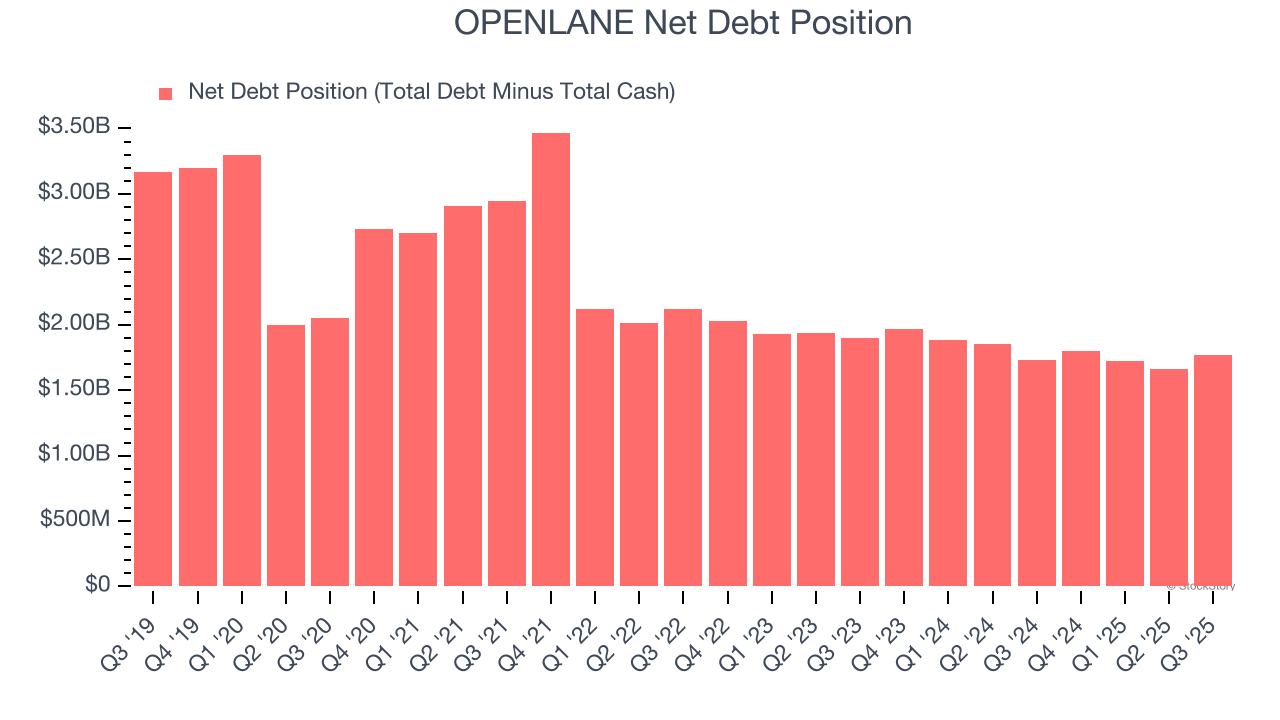

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

OPENLANE’s $1.89 billion of debt exceeds the $119.3 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $329.3 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. OPENLANE could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope OPENLANE can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

OPENLANE’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 22× forward P/E (or $29.25 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

Stocks We Would Buy Instead of OPENLANE

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.