Telecommunications and cable services provider Optimum Communications (NYSE:OPTU) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 2.3% year on year to $2.18 billion. Its GAAP loss of $0.15 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Optimum Communications? Find out by accessing our full research report, it’s free.

Optimum Communications (OPTU) Q4 CY2025 Highlights:

- Revenue: $2.18 billion vs analyst estimates of $2.13 billion (2.3% year-on-year decline, 2.3% beat)

- EPS (GAAP): -$0.15 vs analyst estimates of -$0.01 (significant miss)

- Adjusted EBITDA: $902.2 million vs analyst estimates of $894.7 million (41.3% margin, 0.8% beat)

- Operating Margin: 18.2%, up from 15.2% in the same quarter last year

- Free Cash Flow Margin: 9.1%, up from 2.2% in the same quarter last year

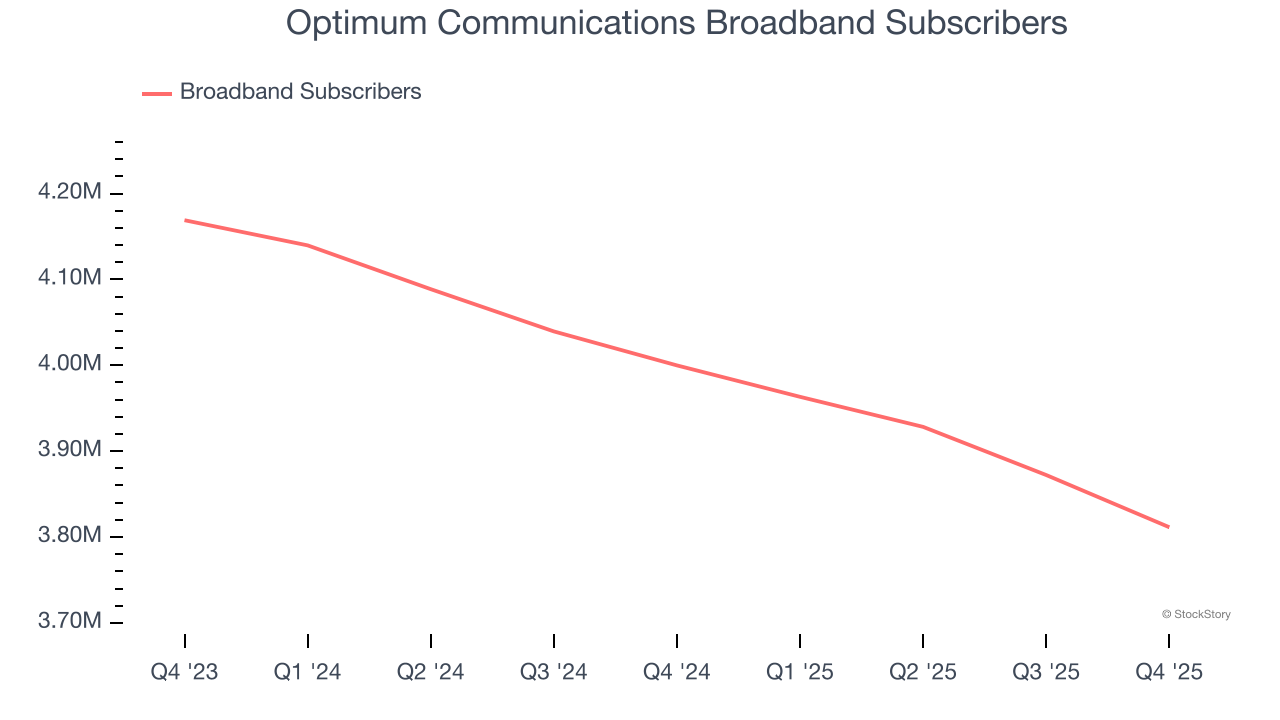

- Broadband Subscribers: 3.81 million, down 188,500 year on year

- Market Capitalization: $760.8 million

Dennis Mathew, Optimum Chairman and Chief Executive Officer, said: "In full year 2025, we achieved the goals we shared in the beginning of the year across revenue, Broadband ARPU, direct costs, operating expense, Adjusted EBITDA excluding i24 News, and capital spend, reflecting our disciplined execution at Optimum. During the quarter, we achieved year over year Adjusted EBITDA growth, driven by moderating revenue declines, higher gross margins, and disciplined expense management. We saw continued momentum across key segments, including Residential and Broadband ARPU growth, improved video trends, as well as momentum in Lightpath and Mobile. While broadband subscriber trends remain under pressure in a highly competitive market, we enter 2026 with a simpler, more competitive approach, featuring streamlined pricing and packaging and a convergence-led go-to-market strategy intended to support improvements in the broadband performance. Looking ahead, this focus on simplification extends across our operations and customer experience, positioning us to execute more efficiently, support performance over time, and support long-term shareholder value. "

Company Overview

Based in Long Island City, Optimum Communications (NYSE:OPTU) is a telecommunications company offering cable, internet, telephone, and television services across the United States.

Revenue Growth

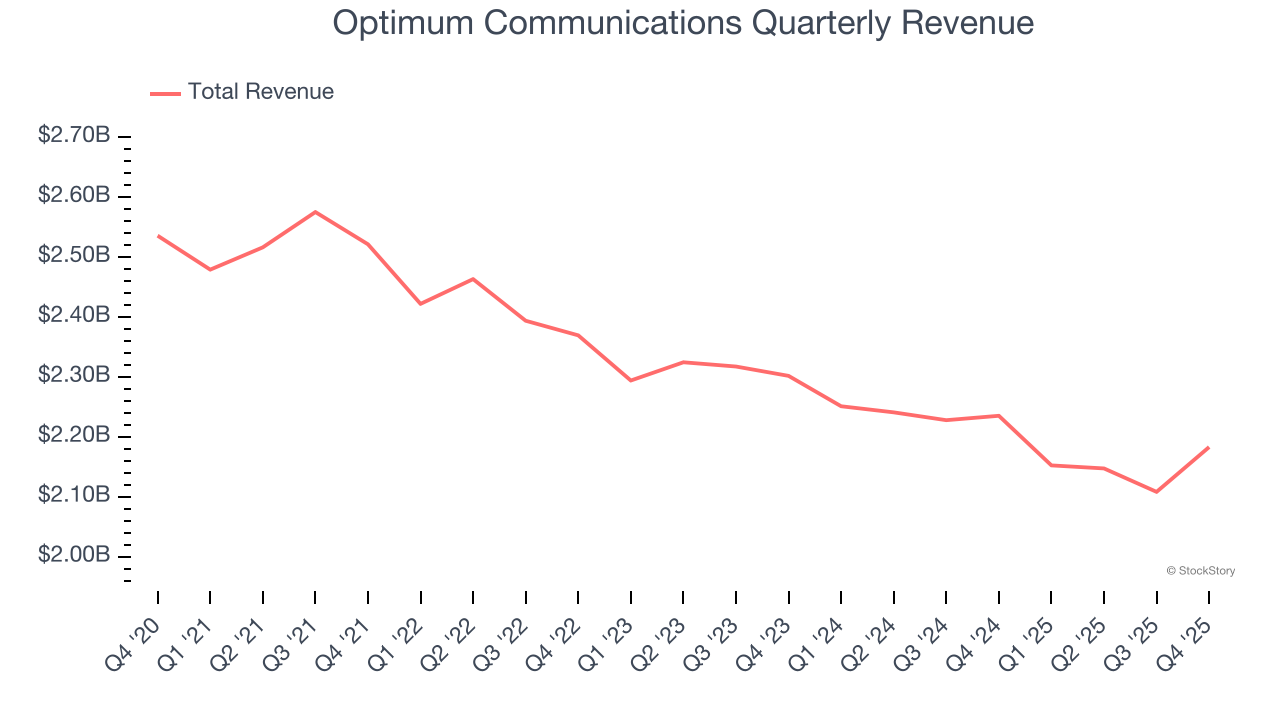

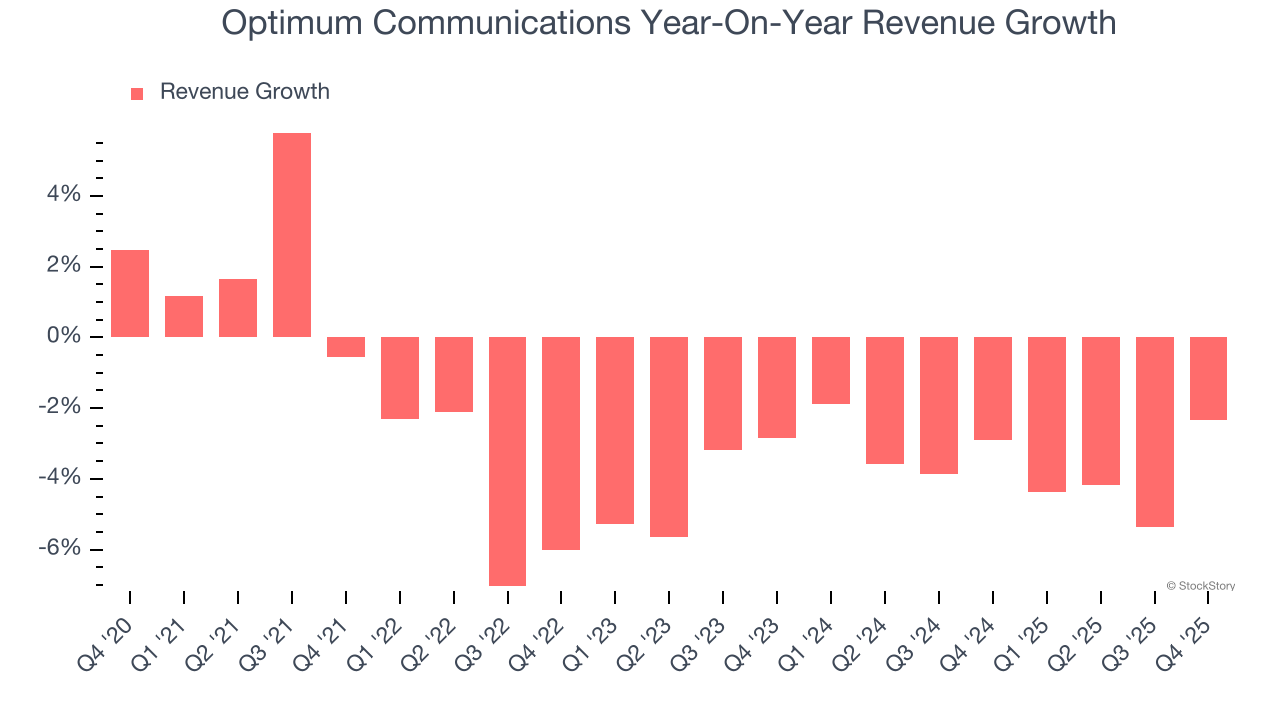

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Optimum Communications’s demand was weak and its revenue declined by 2.8% per year. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Optimum Communications’s annualized revenue declines of 3.6% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

We can dig further into the company’s revenue dynamics by analyzing its number of broadband subscribers and pay tv subscribers, which clocked in at 3.81 million and 1.63 million in the latest quarter. Over the last two years, Optimum Communications’s broadband subscribers averaged 4.2% year-on-year declines while its pay tv subscribers averaged 13.9% year-on-year declines.

This quarter, Optimum Communications’s revenue fell by 2.3% year on year to $2.18 billion but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to decline by 4.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

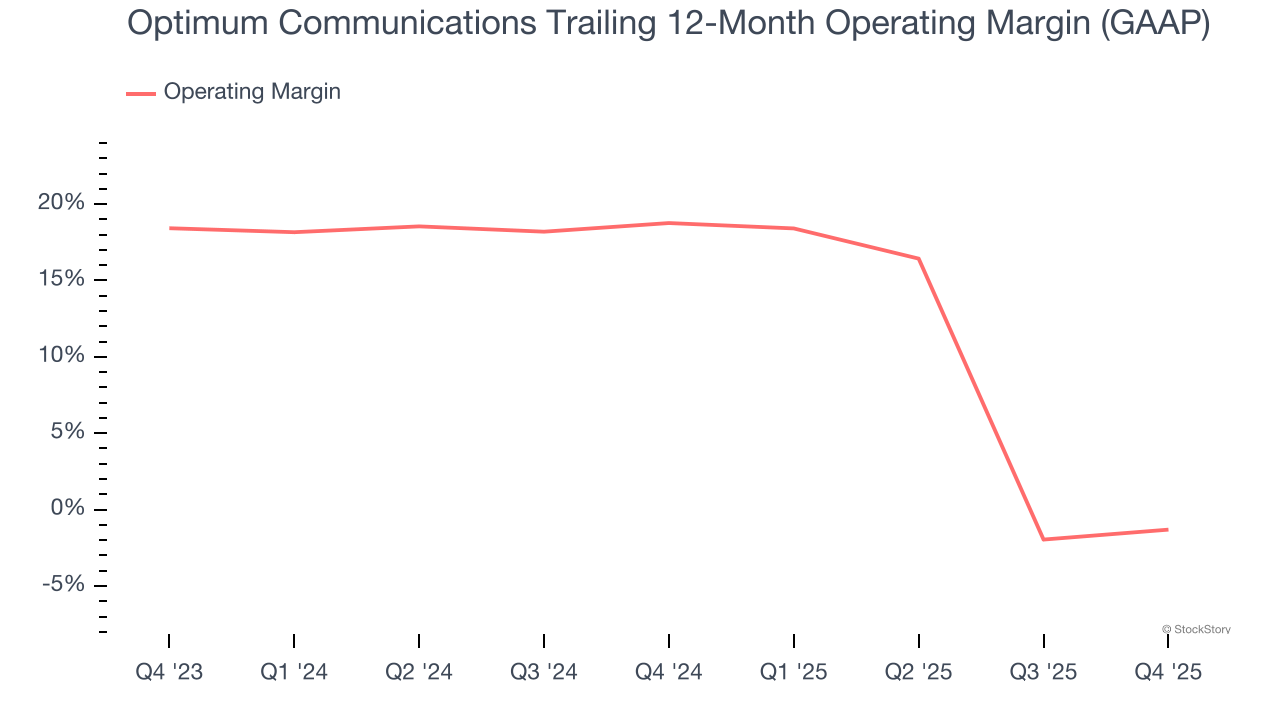

Optimum Communications’s operating margin has been trending down over the last 12 months and averaged 8.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Optimum Communications generated an operating margin profit margin of 18.2%, up 3 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

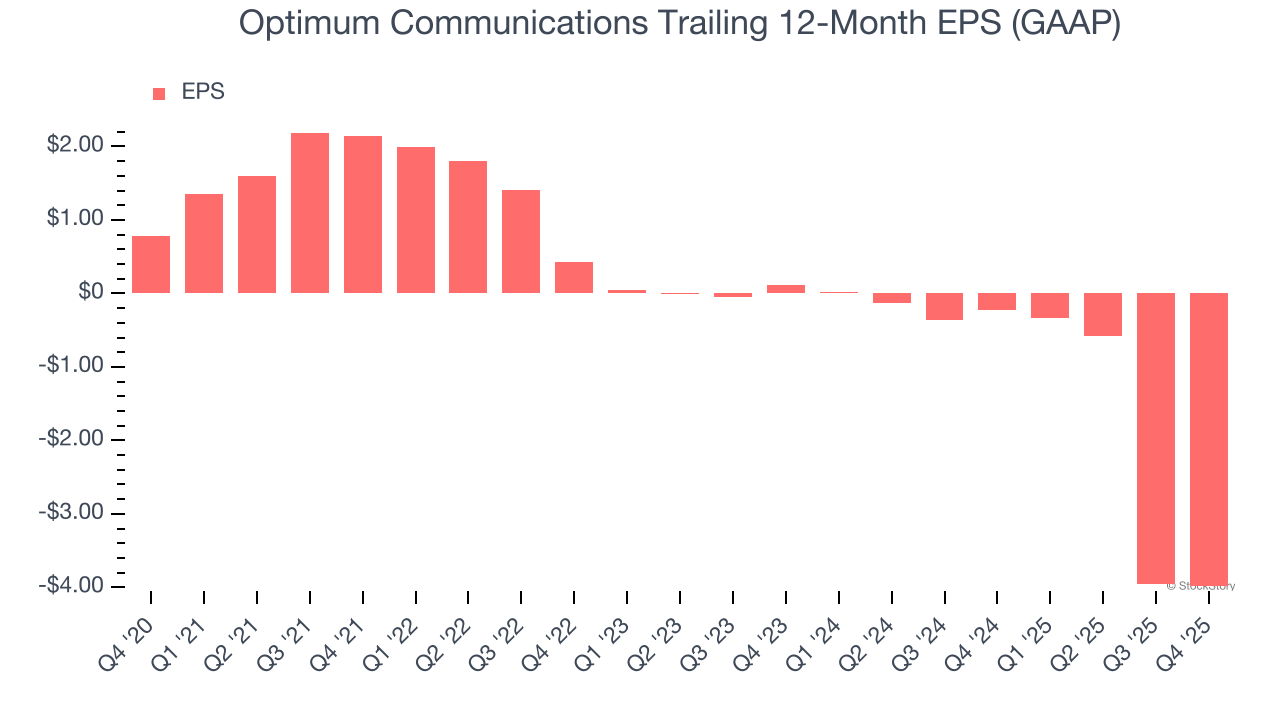

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Optimum Communications, its EPS declined by 48% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, Optimum Communications reported EPS of negative $0.15, down from negative $0.12 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Optimum Communications to improve its earnings losses. Analysts forecast its full-year EPS of negative $3.99 will advance to negative $0.23.

Key Takeaways from Optimum Communications’s Q4 Results

It was encouraging to see Optimum Communications beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock traded up 4.9% to $1.70 immediately after reporting.

Is Optimum Communications an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).