PAR Technology’s stock price has taken a beating over the past six months, shedding 42.6% of its value and falling to $35.71 per share. This might have investors contemplating their next move.

Is there a buying opportunity in PAR Technology, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is PAR Technology Not Exciting?

Even with the cheaper entry price, we're cautious about PAR Technology. Here are three reasons why PAR doesn't excite us and a stock we'd rather own.

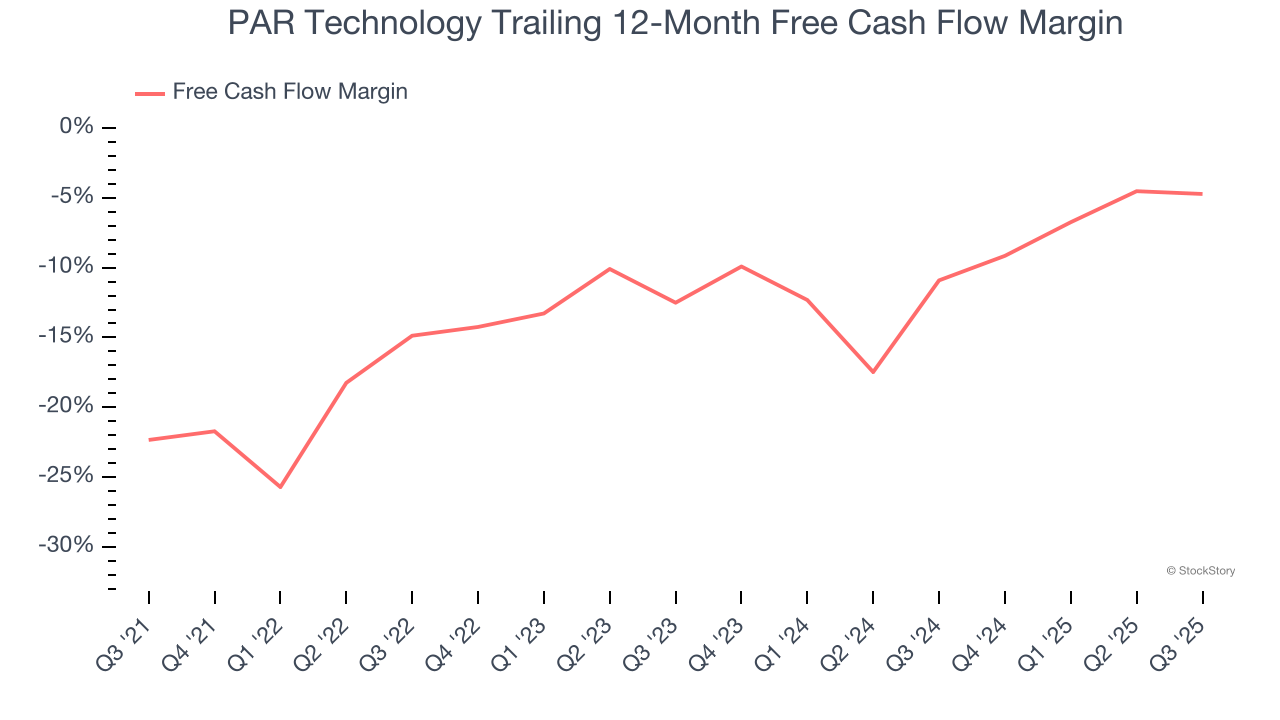

1. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While PAR Technology posted positive free cash flow this quarter, the broader story hasn’t been so clean. PAR Technology’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 12.2%, meaning it lit $12.16 of cash on fire for every $100 in revenue.

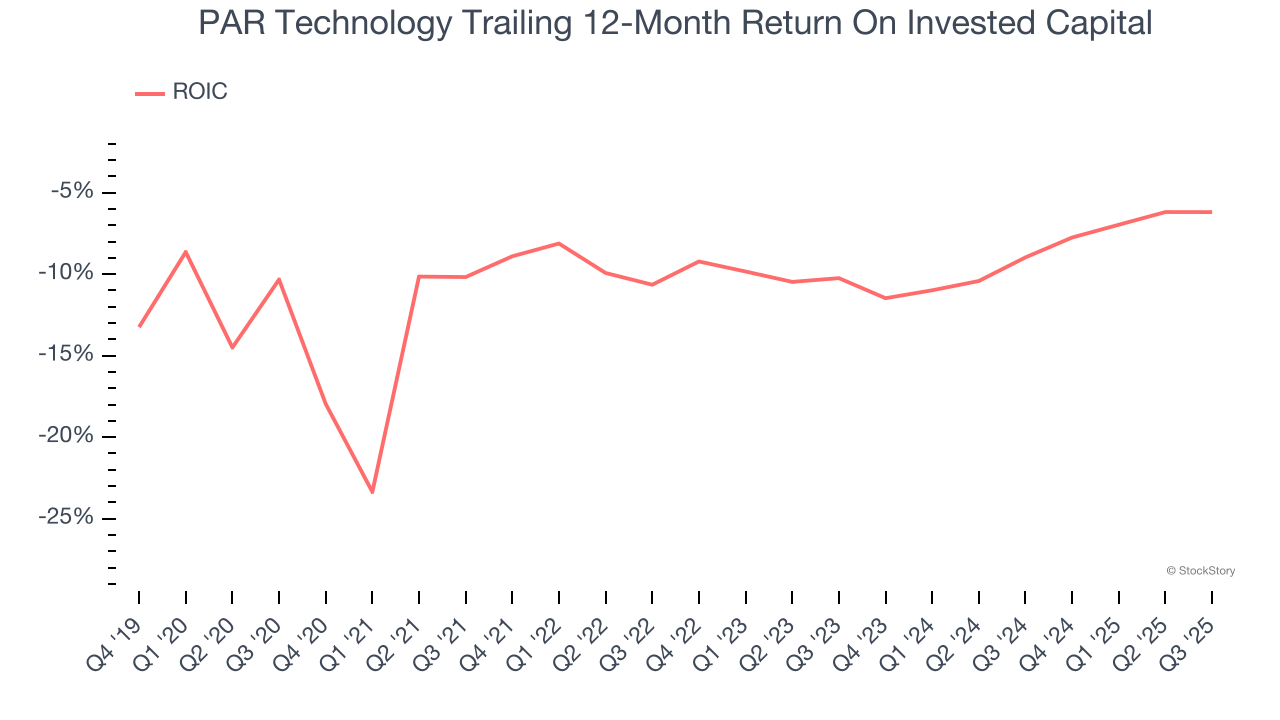

2. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

PAR Technology’s five-year average ROIC was negative 9.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

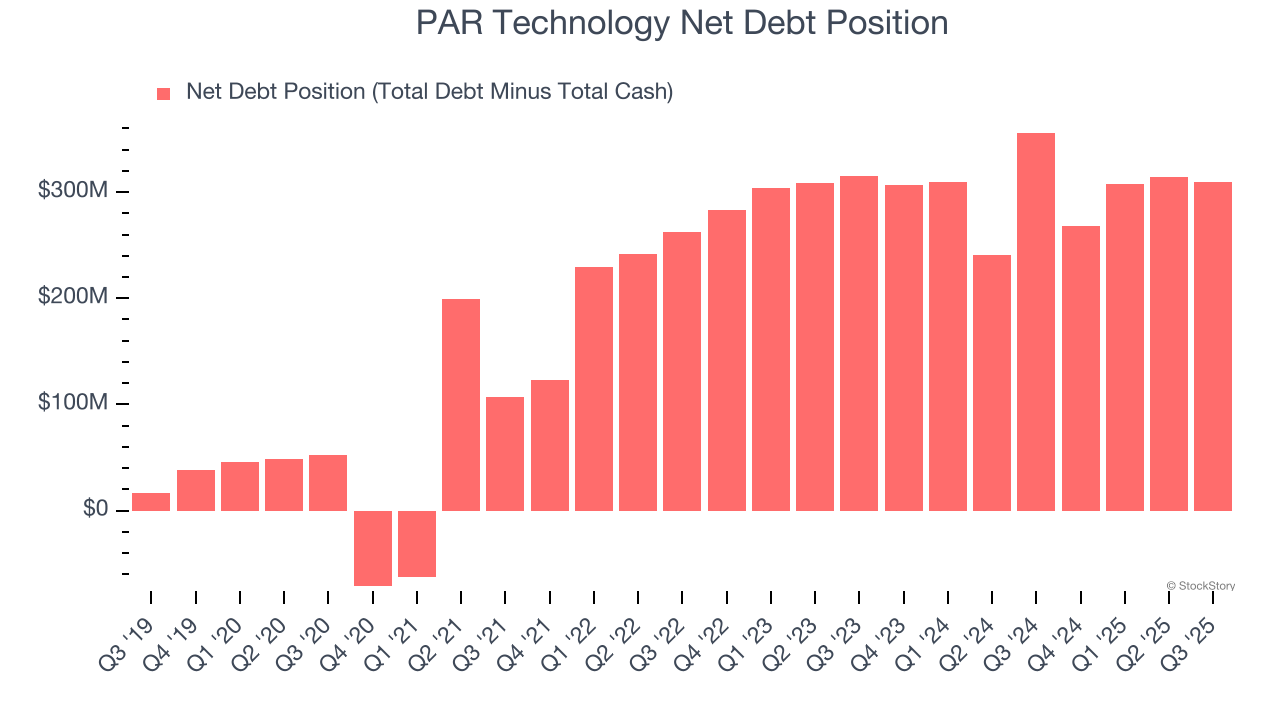

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

PAR Technology’s $402.3 million of debt exceeds the $93.01 million of cash on its balance sheet. Furthermore, its 14× net-debt-to-EBITDA ratio (based on its EBITDA of $21.7 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. PAR Technology could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope PAR Technology can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

PAR Technology isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 89× forward P/E (or $35.71 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of PAR Technology

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.