The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how leisure facilities stocks fared in Q3, starting with Planet Fitness (NYSE:PLNT).

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a satisfactory Q3. As a group, revenues missed analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was 0.6% below.

Thankfully, share prices of the companies have been resilient as they are up 5.9% on average since the latest earnings results.

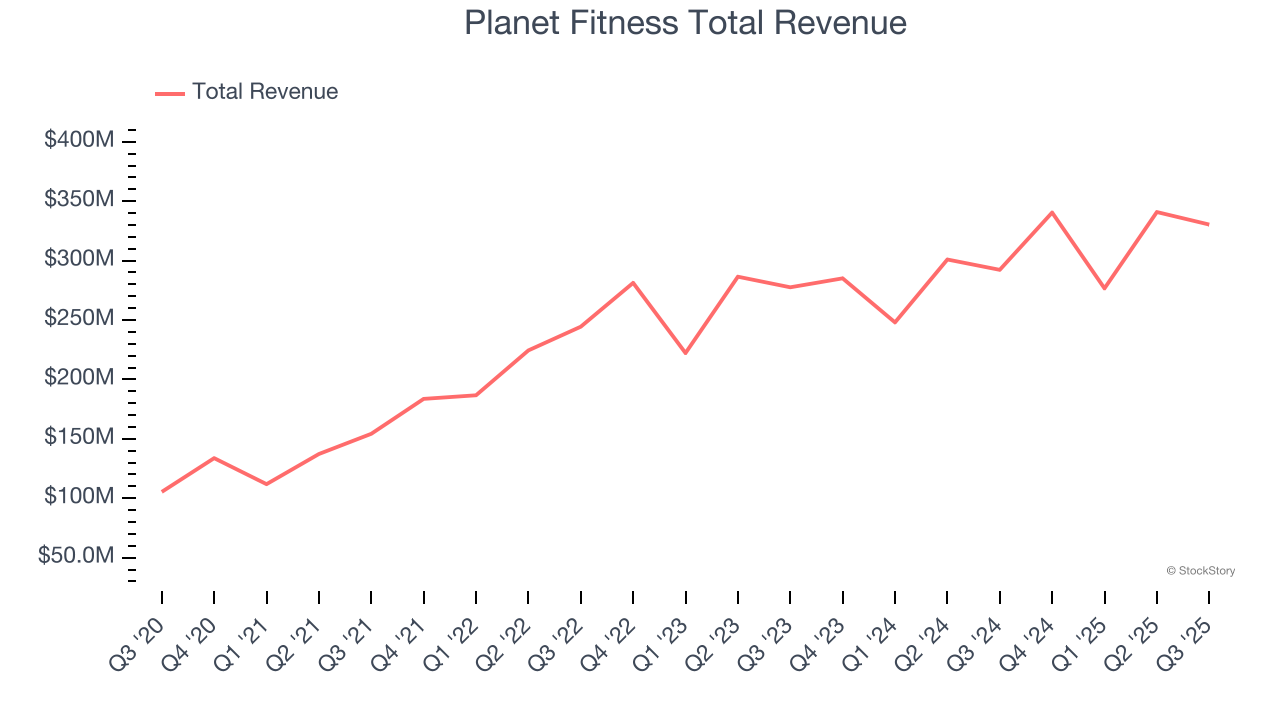

Planet Fitness (NYSE:PLNT)

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE:PLNT) is a gym franchise that caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $330.3 million, up 13% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income estimates and a narrow beat of analysts’ same-store sales estimates.

"We are making significant progress in executing on our long-term strategy, as highlighted by our strong financial performance during the quarter, which enabled us to raise certain growth targets for our 2025 outlook," said Colleen Keating, Chief Executive Officer.

Interestingly, the stock is up 19.8% since reporting and currently trades at $109.87.

Is now the time to buy Planet Fitness? Access our full analysis of the earnings results here, it’s free for active Edge members.

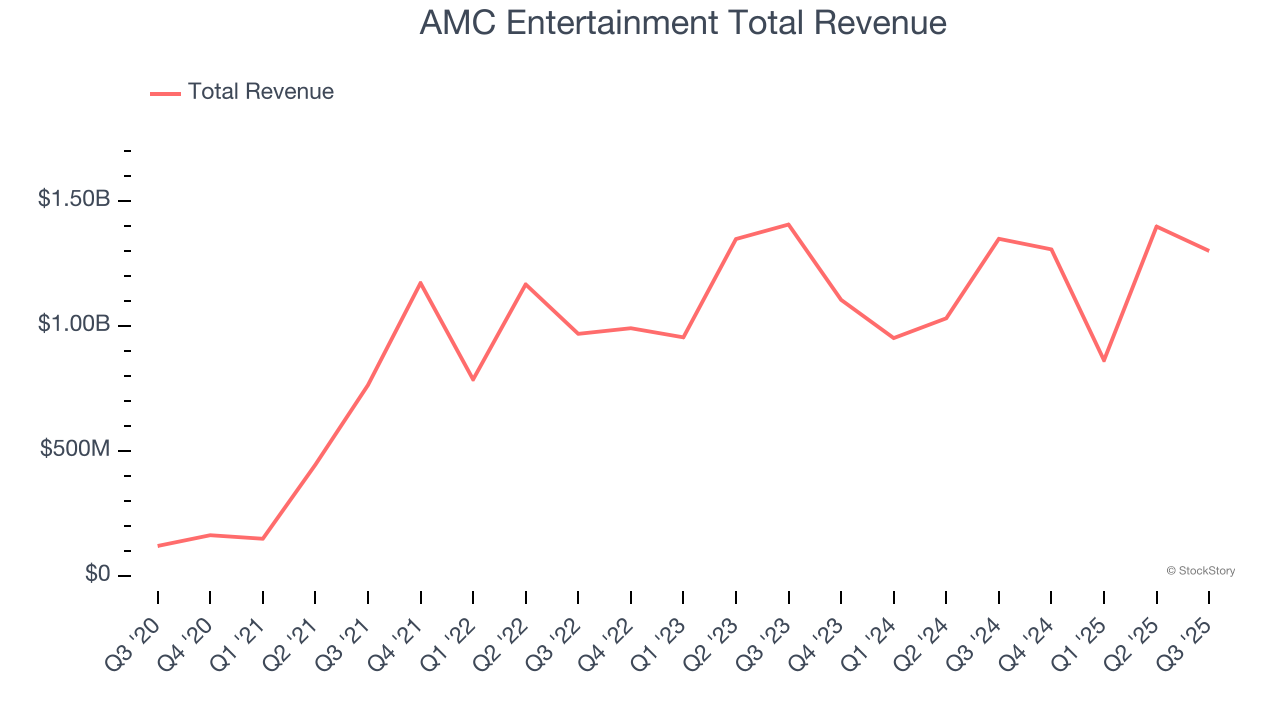

Best Q3: AMC Entertainment (NYSE:AMC)

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE:AMC) operates movie theaters primarily in the US and Europe.

AMC Entertainment reported revenues of $1.3 billion, down 3.6% year on year, outperforming analysts’ expectations by 6.3%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

AMC Entertainment scored the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 29.2% since reporting. It currently trades at $1.79.

Is now the time to buy AMC Entertainment? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $511.9 million, down 6.2% year on year, falling short of analysts’ expectations by 5.2%. It was a disappointing quarter as it posted a miss of analysts’ visitors estimates and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 24.6% since the results and currently trades at $34.84.

Read our full analysis of United Parks & Resorts’s results here.

Vail Resorts (NYSE:MTN)

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Vail Resorts reported revenues of $271 million, up 4.1% year on year. This result came in 1.2% below analysts' expectations. Aside from that, it was a mixed quarter as it also recorded an impressive beat of analysts’ skier visits estimates but a slight miss of analysts’ revenue estimates.

The stock is up 9.1% since reporting and currently trades at $154.46.

Read our full, actionable report on Vail Resorts here, it’s free for active Edge members.

Dave & Buster's (NASDAQ:PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $448.2 million, down 1.1% year on year. This number missed analysts’ expectations by 2.8%. It was a softer quarter as it also produced a significant miss of analysts’ adjusted operating income and EPS estimates.

The stock is flat since reporting and currently trades at $18.12.

Read our full, actionable report on Dave & Buster's here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.