Philip Morris has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9.2% to $172.32 per share while the index has gained 8.2%.

Is PM a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On PM?

Founded in 1847, Philip Morris International (NYSE:PM) manufactures and sells a wide range of tobacco and nicotine-containing products, including cigarettes, heated tobacco products, and oral nicotine pouches.

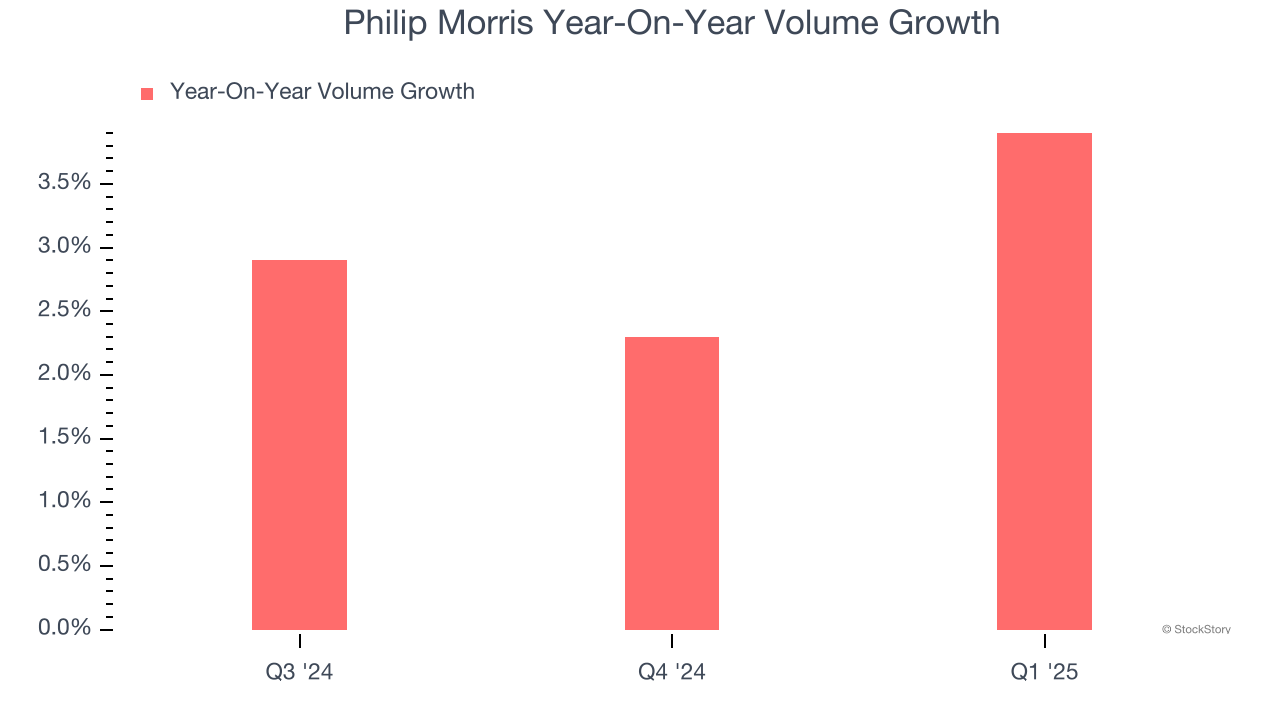

1. Rising Sales Volumes Show Elevated Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Philip Morris’s average quarterly volume growth was a healthy 3% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

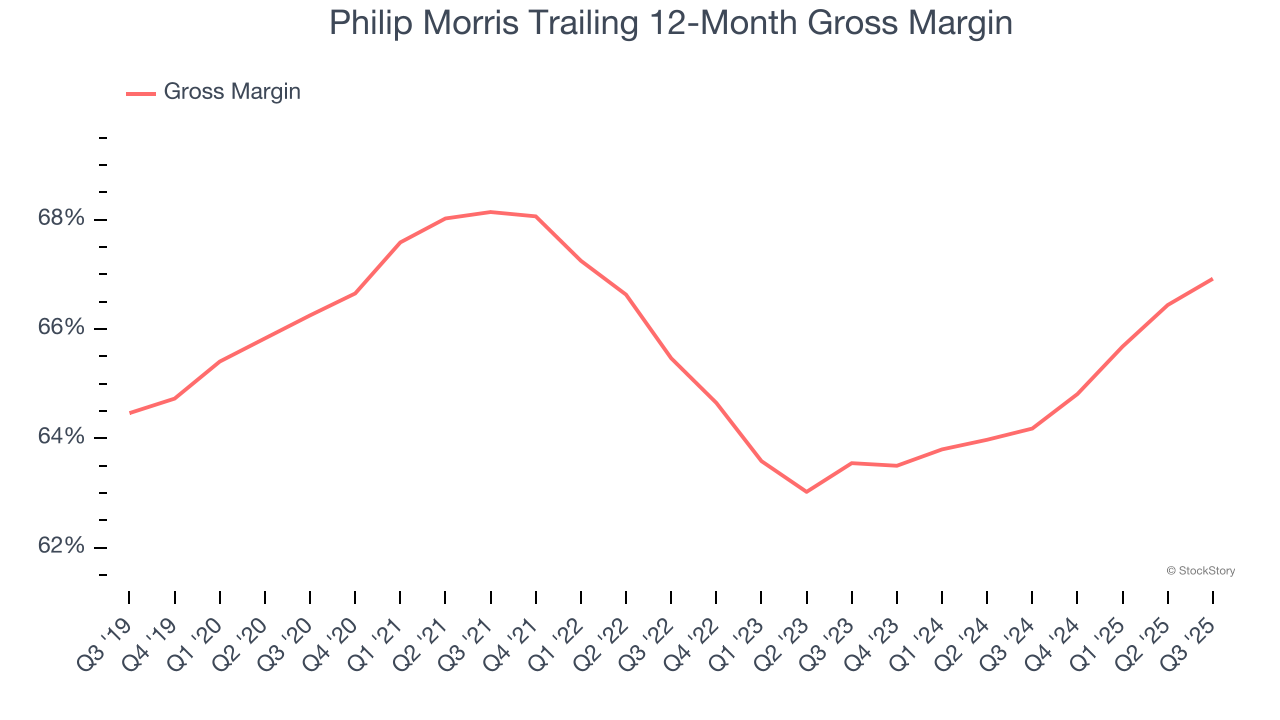

2. Elite Gross Margin Powers Best-In-Class Business Model

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Philip Morris has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 65.6% gross margin over the last two years. That means for every $100 in revenue, only $34.40 went towards paying for raw materials, production of goods, transportation, and distribution.

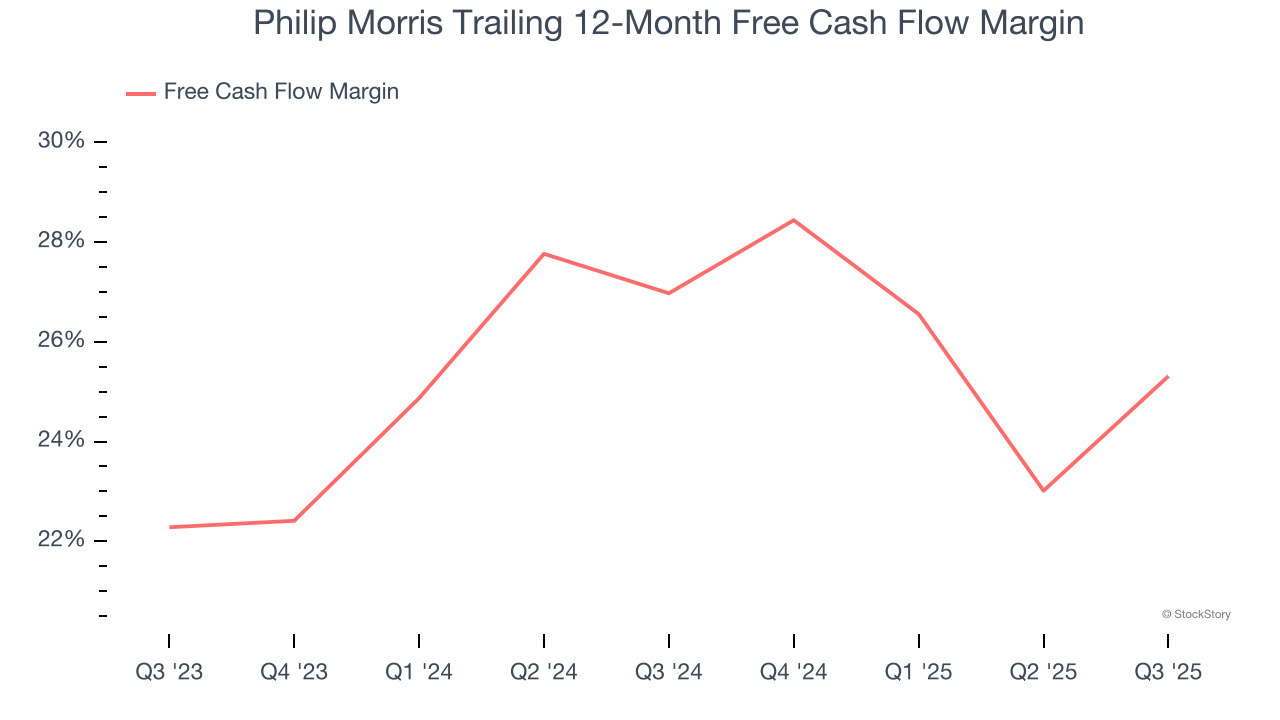

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Philip Morris has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 26.1% over the last two years.

Final Judgment

These are just a few reasons Philip Morris is a high-quality business worth owning, but at $172.32 per share (or 21× forward P/E), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.