PennyMac Mortgage Investment Trust has been treading water for the past six months, recording a small loss of 1.2% while holding steady at $12.58. The stock also fell short of the S&P 500’s 13.4% gain during that period.

Is there a buying opportunity in PennyMac Mortgage Investment Trust, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think PennyMac Mortgage Investment Trust Will Underperform?

We're swiping left on PennyMac Mortgage Investment Trust for now. Here are three reasons why PMT doesn't excite us and a stock we'd rather own.

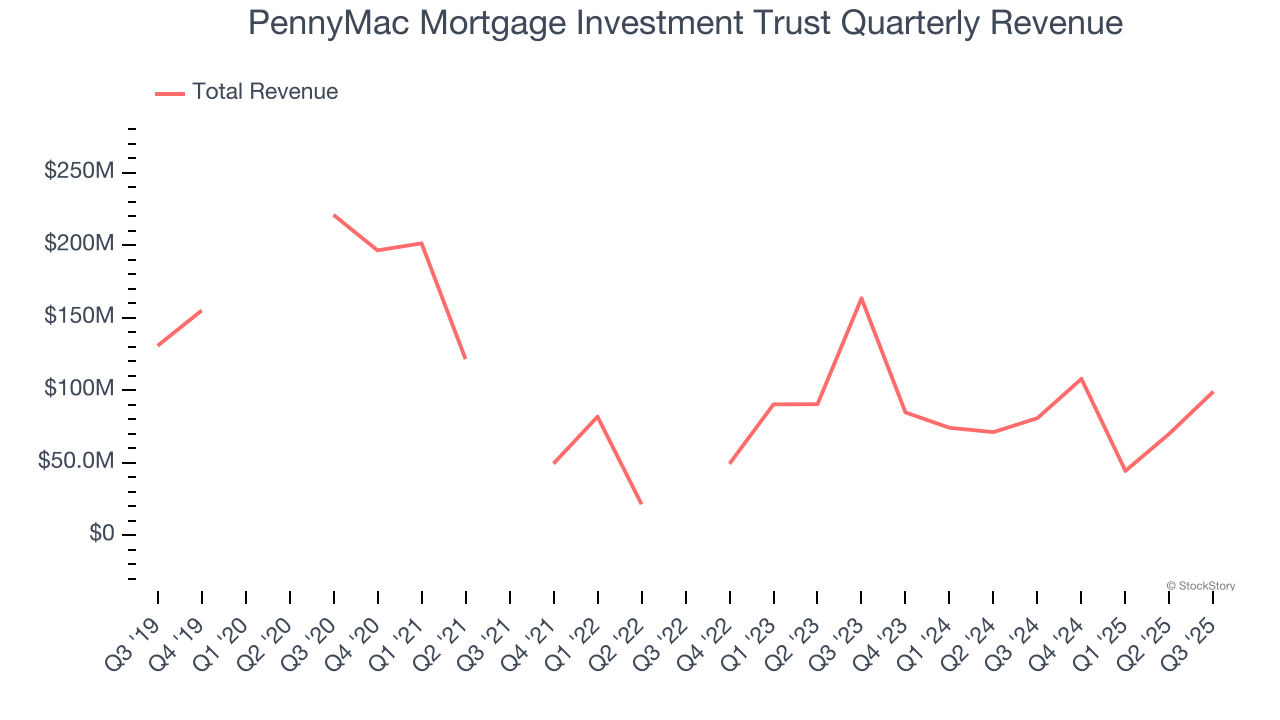

1. Revenue Spiraling Downwards

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

PennyMac Mortgage Investment Trust struggled to consistently generate demand over the last five years as its revenue dropped at a 21.6% annual rate. This was below our standards and signals it’s a low quality business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

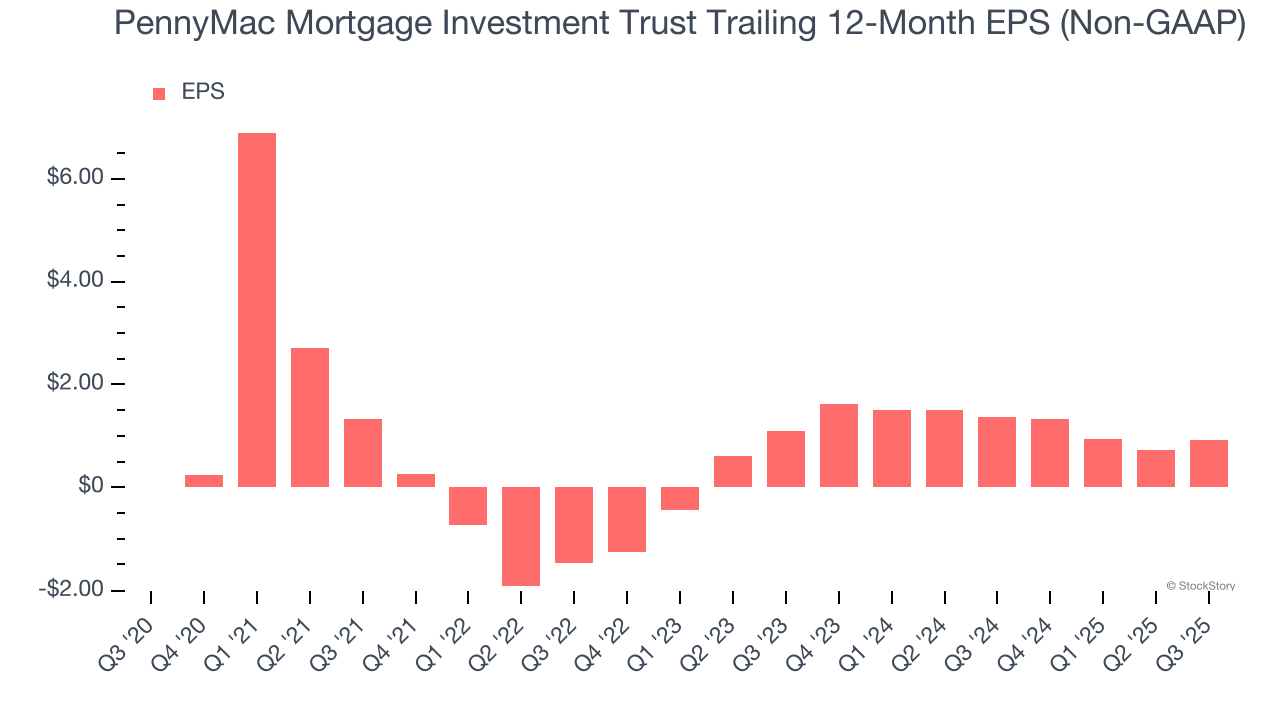

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for PennyMac Mortgage Investment Trust, its EPS and revenue declined by 9% and 9.6% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, PennyMac Mortgage Investment Trust’s low margin of safety could leave its stock price susceptible to large downswings.

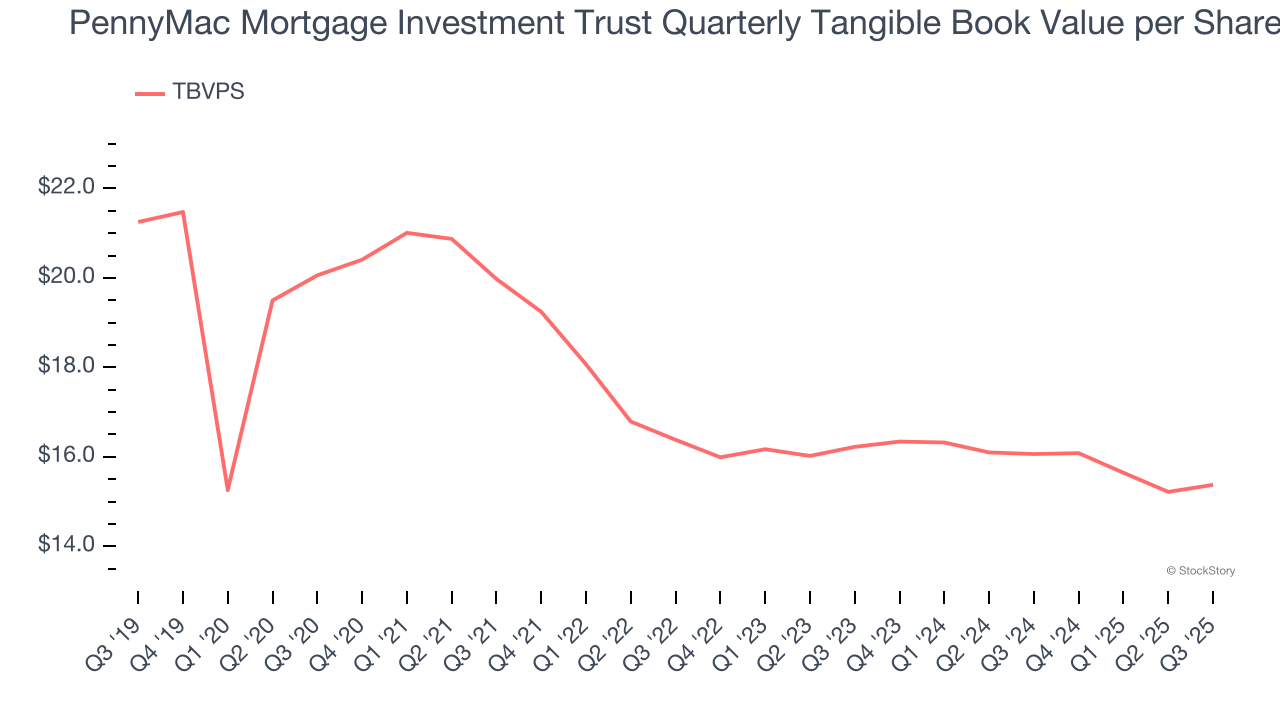

3. Declining TBVPS Reflects Erosion of Asset Value

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

To the detriment of investors, PennyMac Mortgage Investment Trust’s TBVPS declined at a 2.7% annual clip over the last two years.

Final Judgment

PennyMac Mortgage Investment Trust falls short of our quality standards. With its shares lagging the market recently, the stock trades at 0.8× forward P/B (or $12.58 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of PennyMac Mortgage Investment Trust

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.