Since January 2021, the S&P 500 has delivered a total return of 82%. But one standout stock has more than doubled the market - over the past five years, Ralph Lauren has surged 223% to $370.10 per share. Its momentum hasn’t stopped as it’s also gained 28.1% in the last six months thanks to its solid quarterly results, beating the S&P by 17.7%.

Is there a buying opportunity in Ralph Lauren, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Ralph Lauren Will Underperform?

Despite the momentum, we're swiping left on Ralph Lauren for now. Here are three reasons there are better opportunities than RL and a stock we'd rather own.

1. Weak Constant Currency Growth Points to Soft Demand

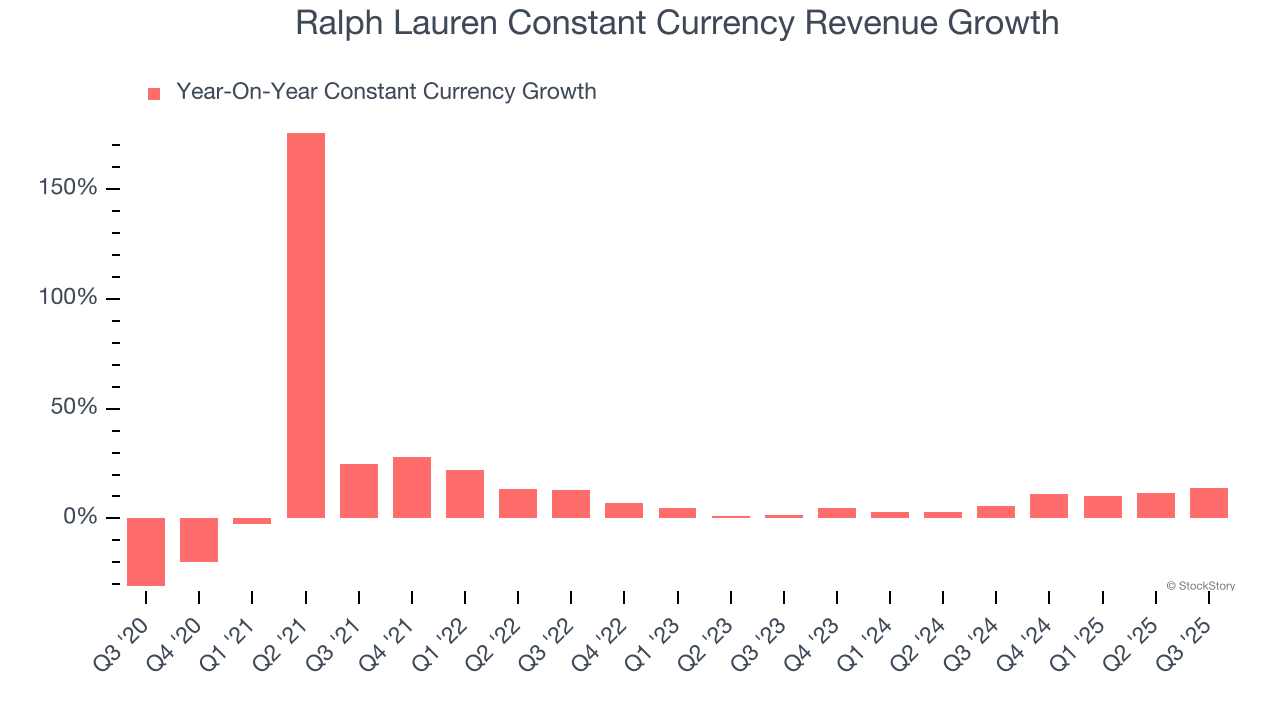

Investors interested in Apparel and Accessories companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Ralph Lauren’s control and are not indicative of underlying demand.

Over the last two years, Ralph Lauren’s constant currency revenue averaged 7.9% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Weak Operating Margin Could Cause Trouble

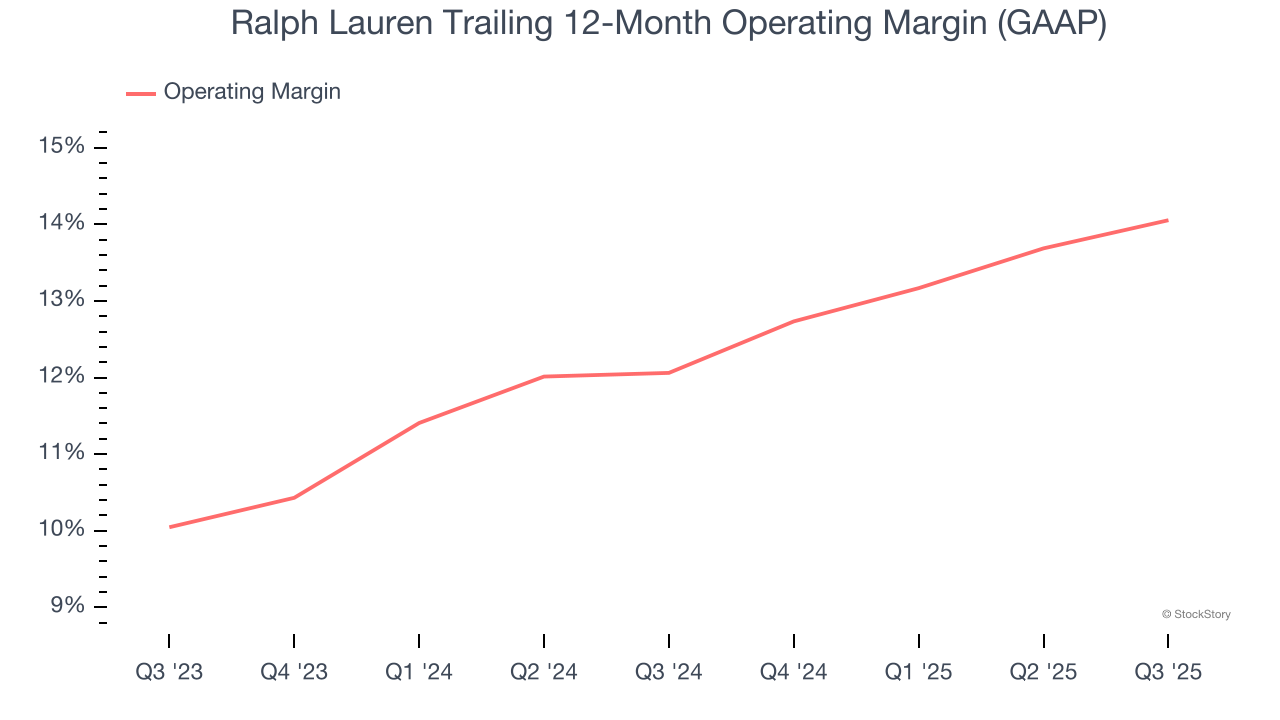

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Ralph Lauren’s operating margin has been trending up over the last 12 months and averaged 13.1% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

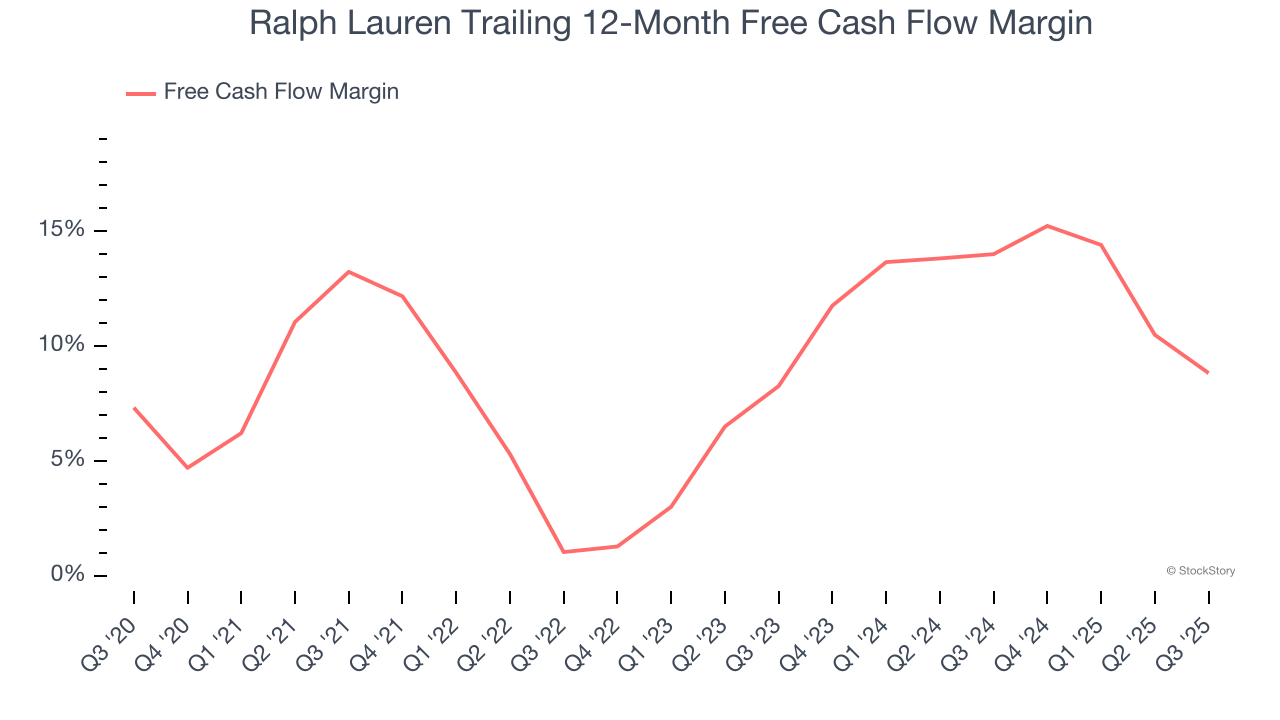

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Ralph Lauren has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.3%, lousy for a consumer discretionary business.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Ralph Lauren, we’ll be cheering from the sidelines. With its shares topping the market in recent months, the stock trades at 23× forward P/E (or $370.10 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than Ralph Lauren

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.