Over the past six months, Revolve has been a great trade, beating the S&P 500 by 31.2%. Its stock price has climbed to $29.96, representing a healthy 39.4% increase. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Revolve, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Revolve Will Underperform?

We’re happy investors have made money, but we're cautious about Revolve. Here are three reasons we avoid RVLV and a stock we'd rather own.

1. Change in Active Customers Points to Soft Demand

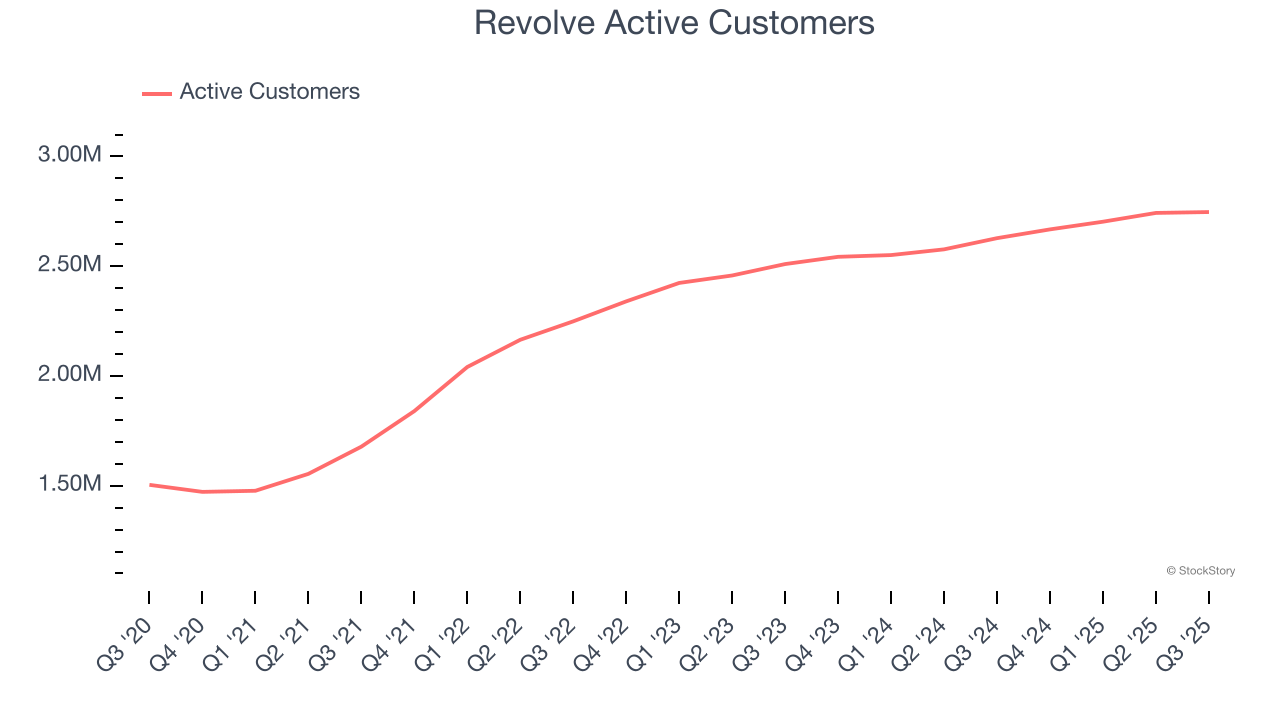

As an online retailer, Revolve generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Revolve’s active customers , a key performance metric for the company, increased by 5.7% annually to 2.75 million in the latest quarter. This growth rate lags behind the hottest consumer internet applications. If Revolve wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

2. Customer Spending Stalls, Engagement Falling?

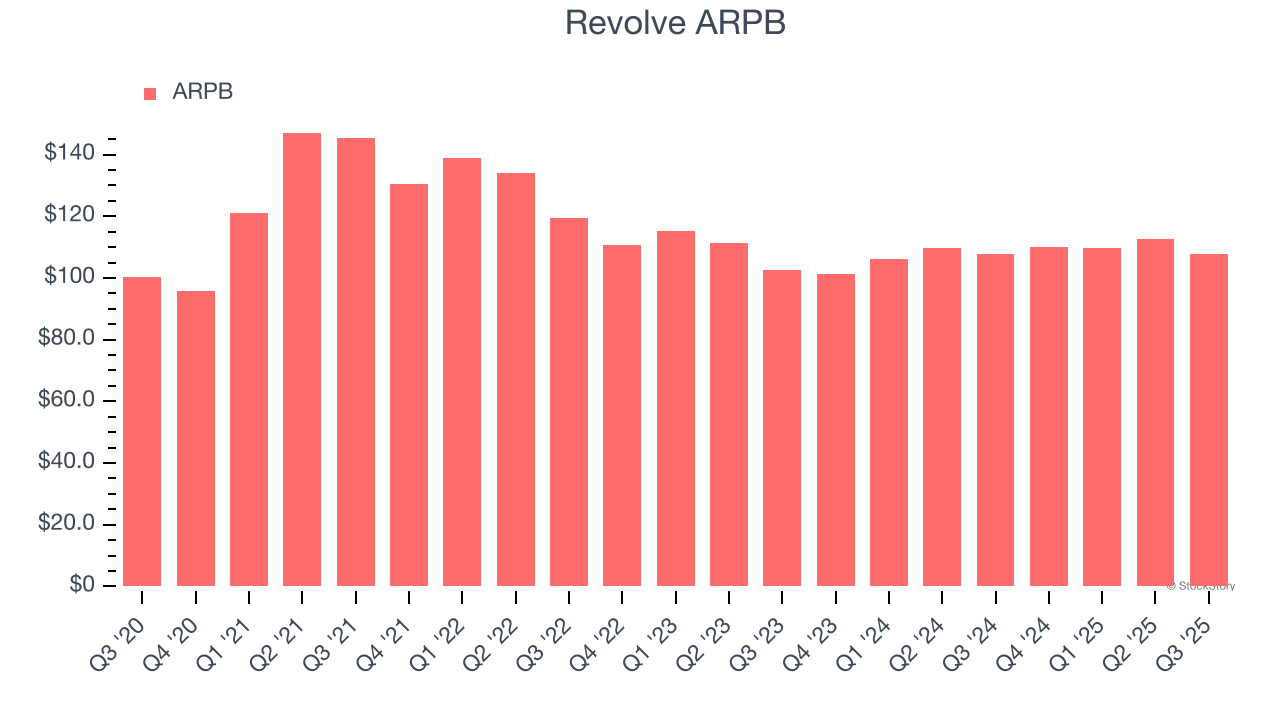

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much customers spend per order.

Revolve’s ARPB has been roughly flat over the last two years. This isn’t great when combined with its weaker active customers performance. If Revolve tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyer growth would be sustainable.

3. EPS Trending Down

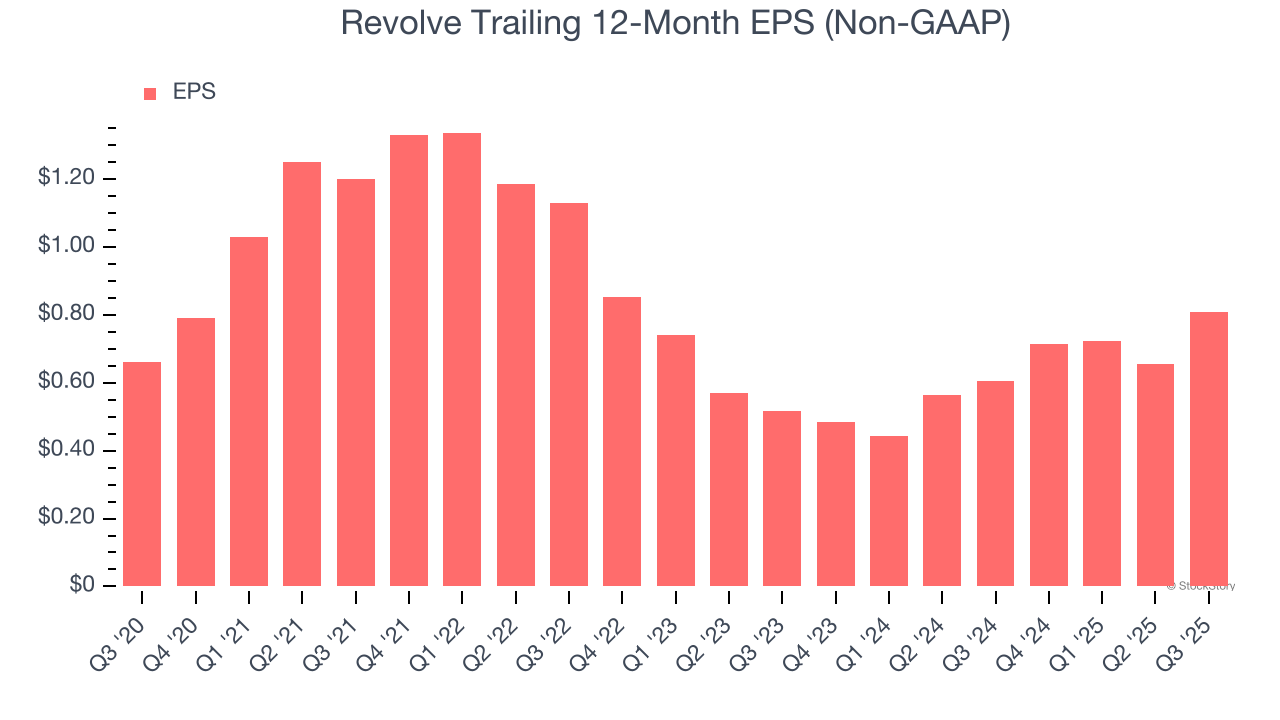

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Revolve, its EPS declined by 10.5% annually over the last three years while its revenue grew by 3.4%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Revolve doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 20.2× forward EV/EBITDA (or $29.96 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Revolve

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.