Since December 2020, the S&P 500 has delivered a total return of 85.2%. But one standout stock has nearly doubled the market - over the past five years, Stifel has surged 153% to $128.73 per share. Its momentum hasn’t stopped as it’s also gained 29.9% in the last six months thanks to its solid quarterly results, beating the S&P by 16.5%.

Is now the time to buy Stifel, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Stifel Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about Stifel. Here are two reasons why SF doesn't excite us and a stock we'd rather own.

1. EPS Barely Growing

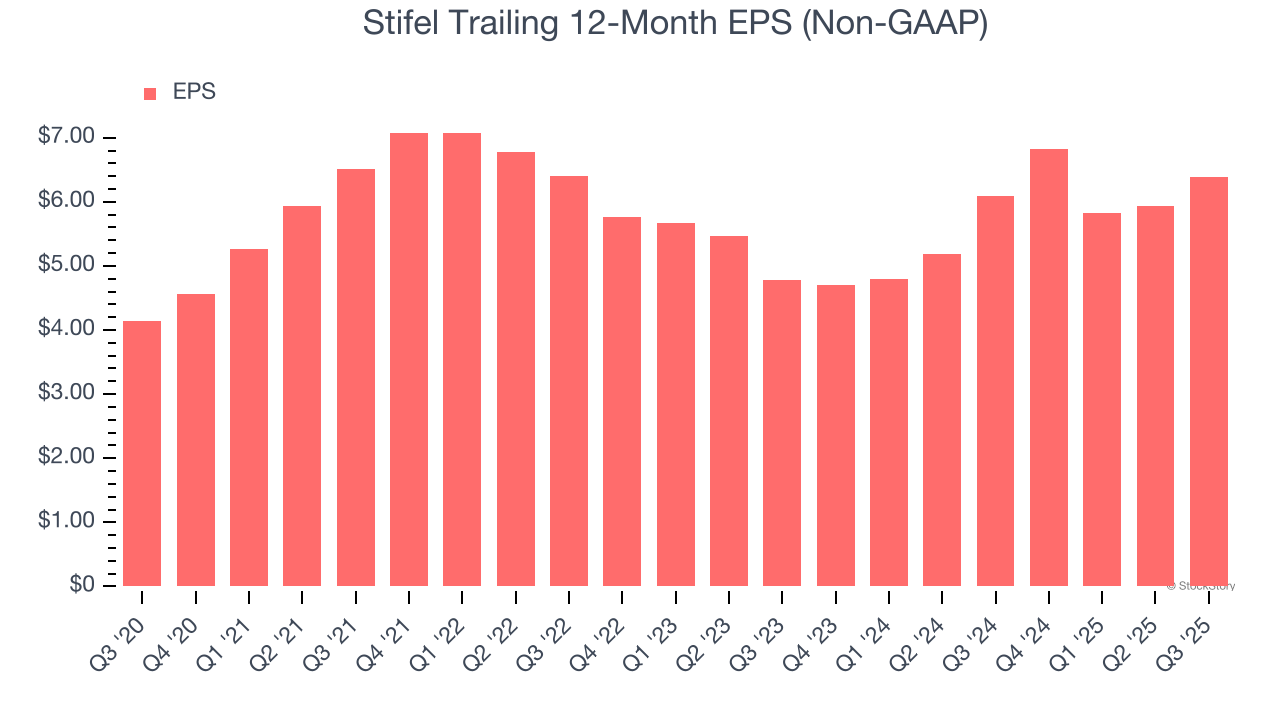

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Stifel’s unimpressive 9% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

2. Substandard BVPS Growth Indicates Limited Asset Expansion

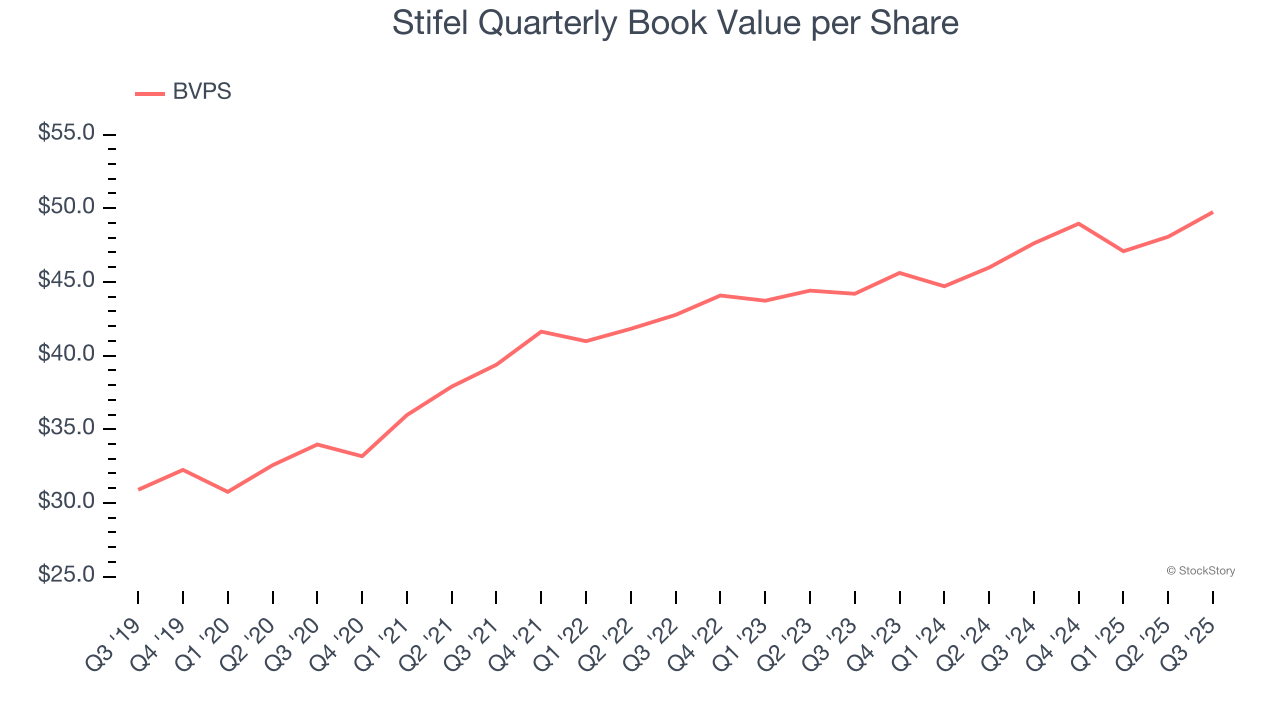

Book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities.

Although Stifel’s BVPS increased by 7.9% annually over the last five years, growth has recently decelerated a bit to a mediocre 6.1% over the past two years (from $44.20 to $49.74 per share).

Final Judgment

Stifel isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 13.7× forward P/E (or $128.73 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward the most dominant software business in the world.

Stocks We Like More Than Stifel

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.