Online gambling company Super Group (NYSE:SGHC) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 25.7% year on year to $557 million. Its GAAP profit of $0.19 per share was 27.3% above analysts’ consensus estimates.

Is now the time to buy Super Group? Find out by accessing our full research report, it’s free for active Edge members.

Super Group (SGHC) Q3 CY2025 Highlights:

- Revenue: $557 million vs analyst estimates of $510 million (25.7% year-on-year growth, 9.2% beat)

- EPS (GAAP): $0.19 vs analyst estimates of $0.15 (27.3% beat)

- Adjusted EBITDA: $152 million vs analyst estimates of $114 million (27.3% margin, 33.3% beat)

- Operating Margin: 23.5%, up from 5.7% in the same quarter last year

- Free Cash Flow Margin: 22.4%, up from 6.8% in the same quarter last year

- Customers: 5.51 million, up from 5.5 million in the previous quarter

- Market Capitalization: $5.86 billion

Neal Menashe, Chief Executive Officer of Super Group, commented: “We are incredibly pleased with our Q3 performance, which highlights the continued strength of our global platform and consistent execution across our core markets. Despite customer-friendly outcomes in September, we delivered record-level customer engagement, strong revenue growth, and margin expansion. Hitting six million monthly active customers was another significant milestone, a reflection of our product innovation and local execution. With continued momentum into Q4, and the highly anticipated launch of Super Coin, we are focused on driving long-term value for our shareholders and enhancing our global position.”

Company Overview

With betting operations spanning 20 jurisdictions and attracting nearly 5 million monthly customers, Super Group (NYSE:SGHC) operates global online sports betting and gaming platforms through its two primary offerings: the Betway sports betting brand and Spin multi-brand casino portfolio.

Revenue Growth

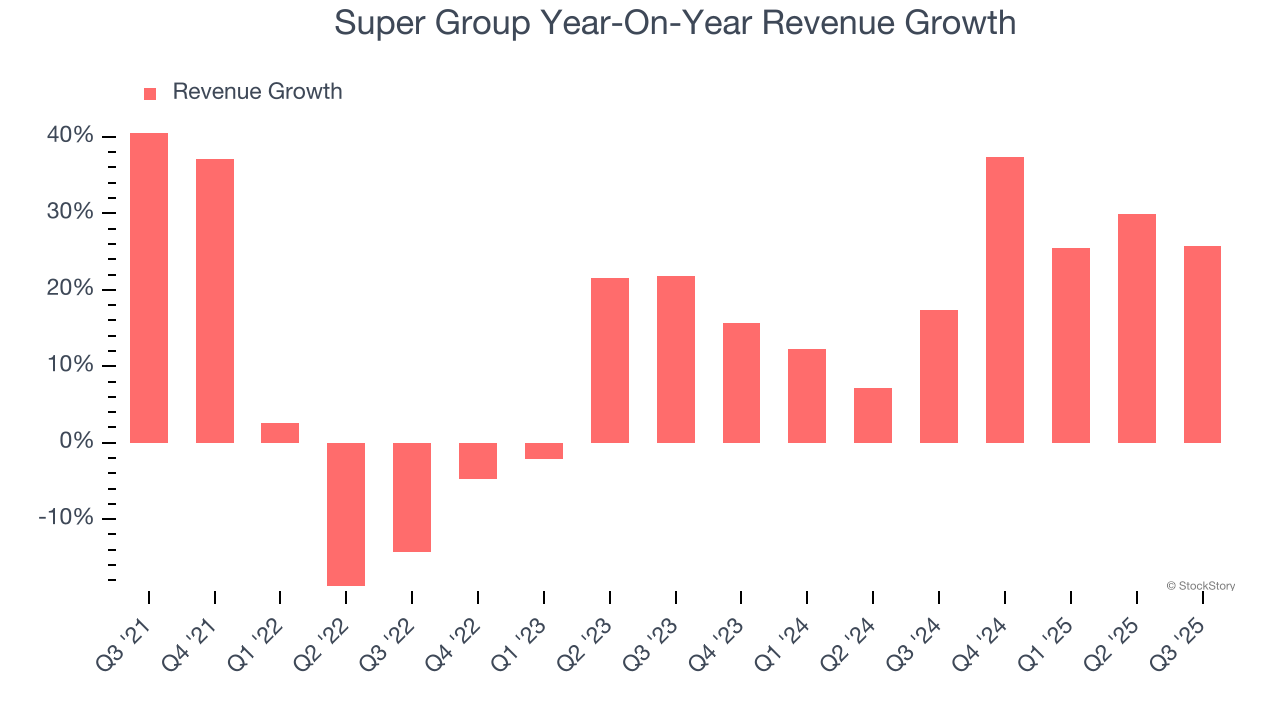

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last four years, Super Group grew its sales at a 11.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Super Group’s annualized revenue growth of 20.9% over the last two years is above its four-year trend, but we were still disappointed by the results. Note that COVID hurt Super Group’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Super Group also reports its number of customers, which reached 5.51 million in the latest quarter. Over the last two years, Super Group’s customer base averaged 22.3% year-on-year growth. Because this number is in line with its revenue growth, we can see the average customer spent roughly the same amount each year on the company’s products and services.

This quarter, Super Group reported robust year-on-year revenue growth of 25.7%, and its $557 million of revenue topped Wall Street estimates by 9.2%.

Looking ahead, sell-side analysts expect revenue to grow 9.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

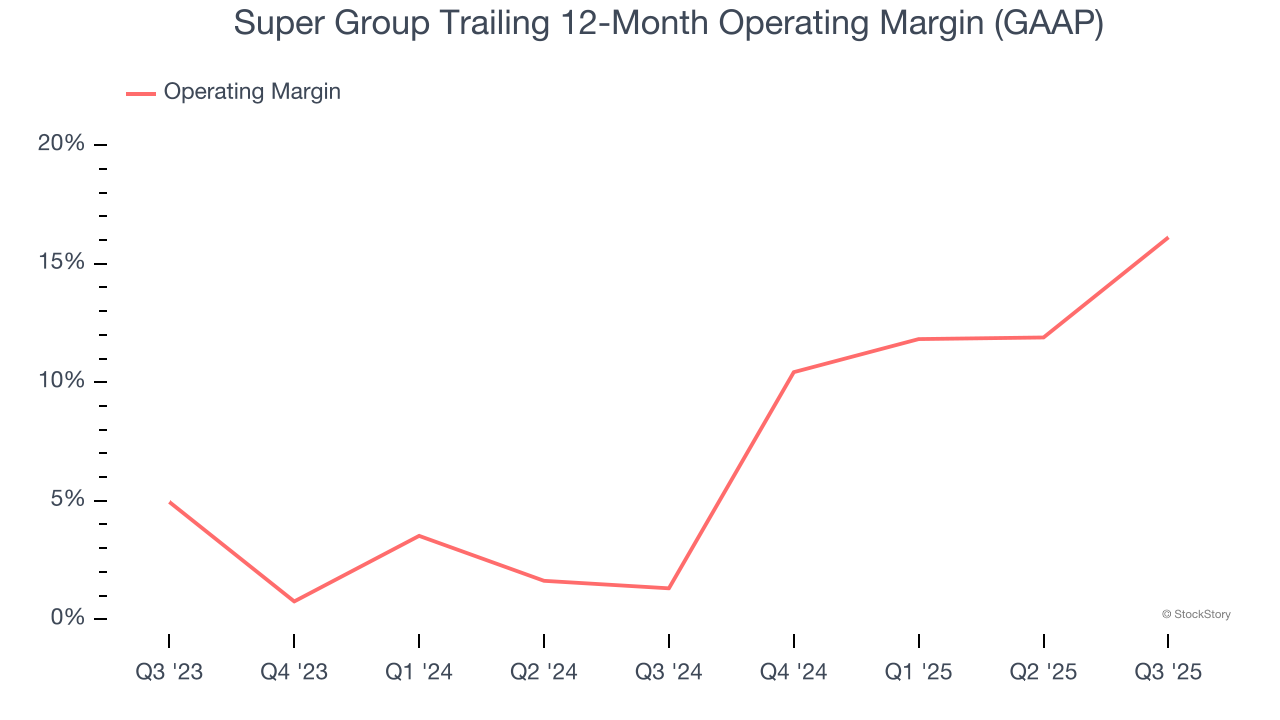

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Super Group’s operating margin has risen over the last 12 months and averaged 9.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

In Q3, Super Group generated an operating margin profit margin of 23.5%, up 17.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

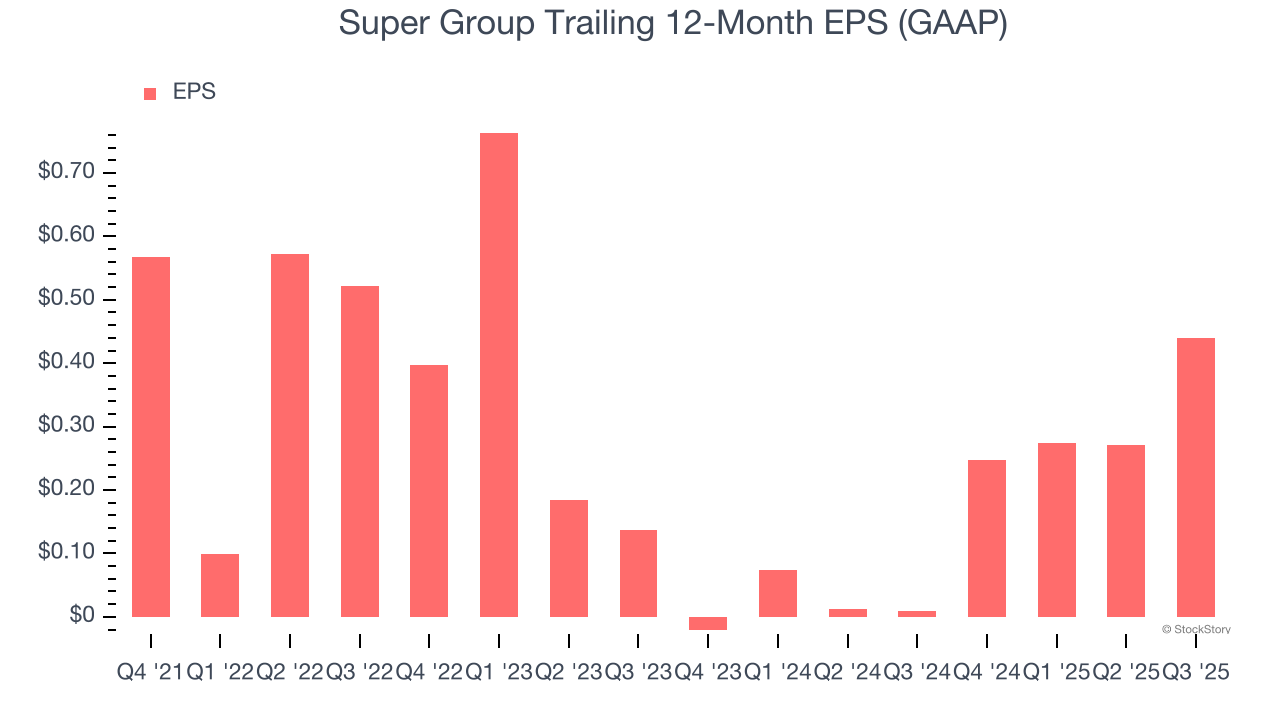

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Super Group, its EPS declined by 6% annually over the last four years while its revenue grew by 11.7%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q3, Super Group reported EPS of $0.19, up from $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Super Group’s full-year EPS of $0.44 to grow 73.8%.

Key Takeaways from Super Group’s Q3 Results

We were impressed by how significantly Super Group blew past analysts’ EBITDA expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $11.72 immediately after reporting.

Super Group had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.