Shareholders of Silgan Holdings would probably like to forget the past six months even happened. The stock dropped 26.5% and now trades at $41.55. This might have investors contemplating their next move.

Is now the time to buy Silgan Holdings, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Silgan Holdings Will Underperform?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons we avoid SLGN and a stock we'd rather own.

1. Core Business Falling Behind as Demand Declines

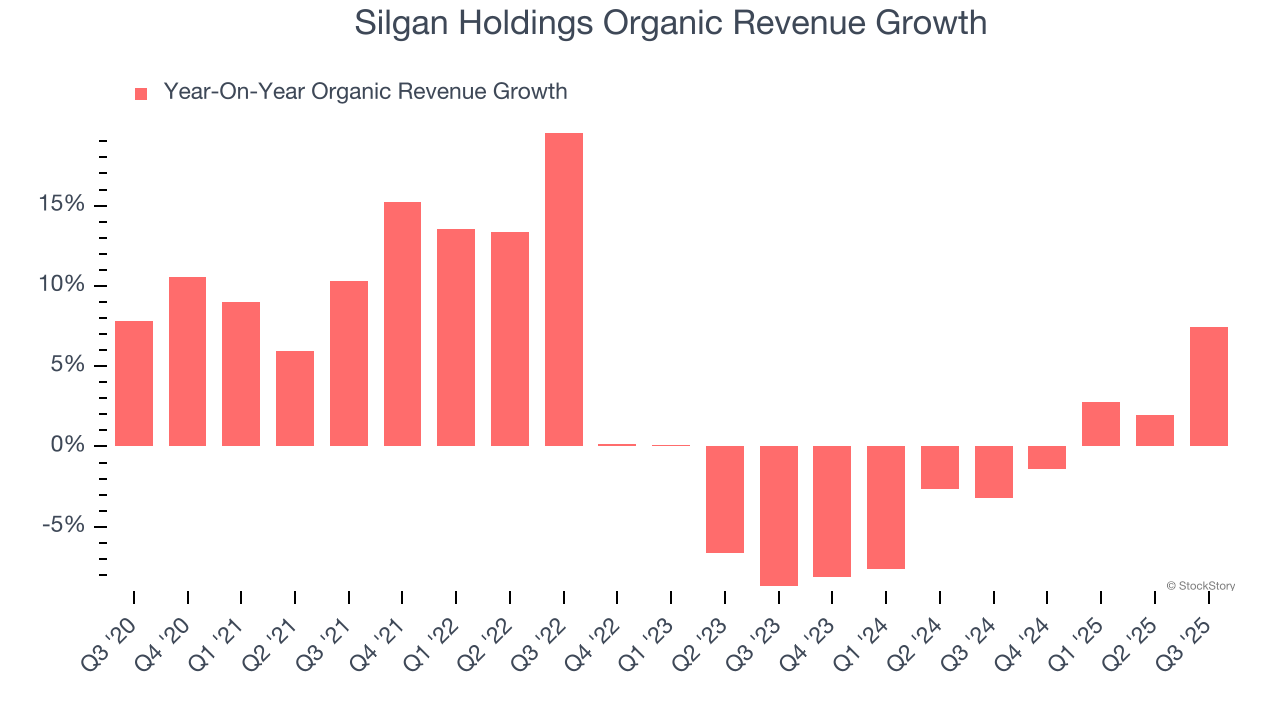

Investors interested in Industrial Packaging companies should track organic revenue in addition to reported revenue. This metric gives visibility into Silgan Holdings’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Silgan Holdings’s organic revenue averaged 1.4% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Silgan Holdings might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Low Gross Margin Reveals Weak Structural Profitability

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Silgan Holdings has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 16.8% gross margin over the last five years. Said differently, Silgan Holdings had to pay a chunky $83.21 to its suppliers for every $100 in revenue.

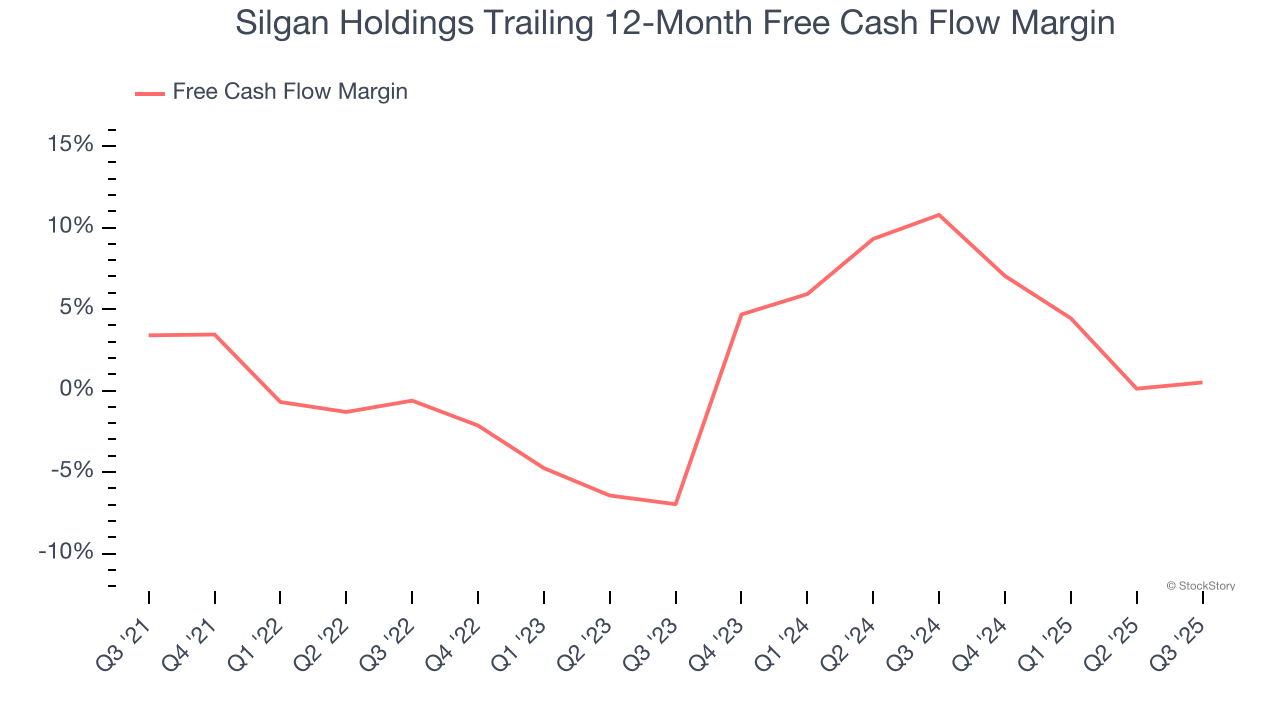

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Silgan Holdings has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.2%, lousy for an industrials business.

Final Judgment

Silgan Holdings doesn’t pass our quality test. Following the recent decline, the stock trades at 11× forward P/E (or $41.55 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Silgan Holdings

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.