The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how leisure facilities stocks fared in Q3, starting with Sphere Entertainment (NYSE:SPHR).

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 0.9% below.

Luckily, leisure facilities stocks have performed well with share prices up 11.1% on average since the latest earnings results.

Sphere Entertainment (NYSE:SPHR)

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE:SPHR) hosts live entertainment events and distributes content across various media platforms.

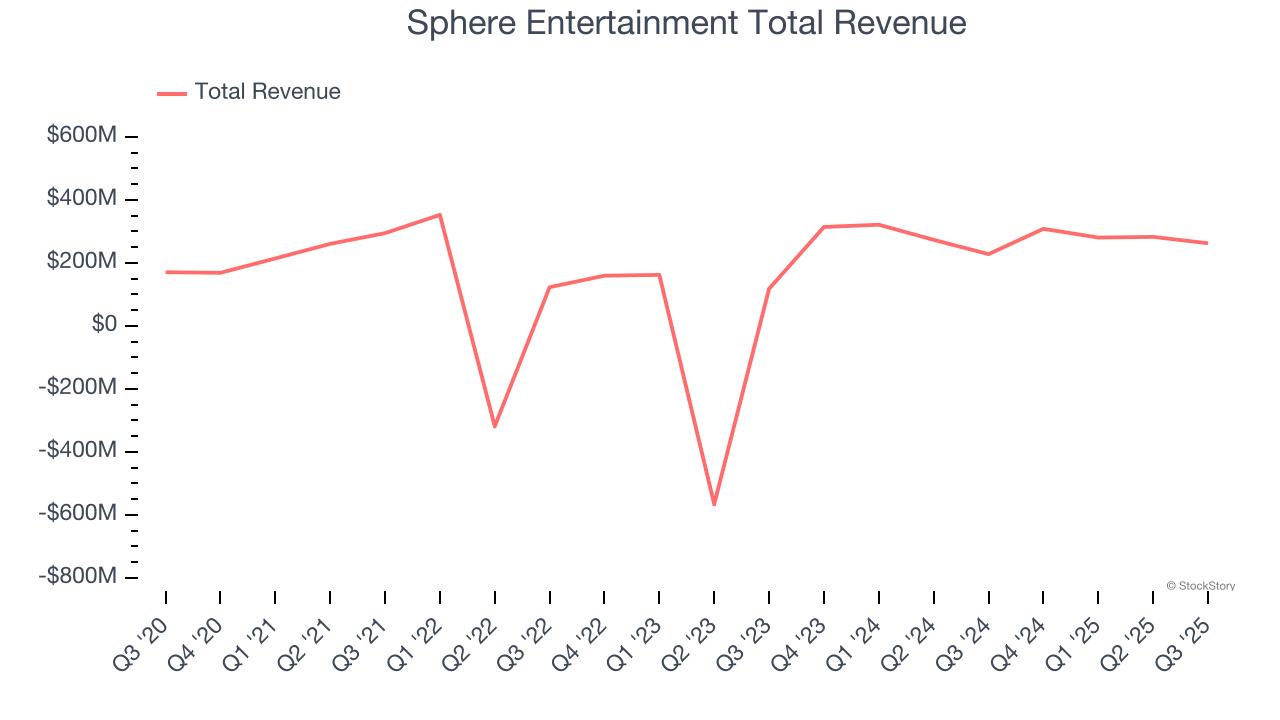

Sphere Entertainment reported revenues of $262.5 million, up 15.2% year on year. This print fell short of analysts’ expectations by 18%. Overall, it was a slower quarter for the company with a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

Executive Chairman and CEO James L. Dolan said, “The Wizard of Oz at Sphere, which is the best example to-date of experiential storytelling in this new medium, has been met with strong consumer demand. Looking ahead, we believe our Company is well positioned for long-term growth as we continue to execute on our global vision for Sphere.”

Sphere Entertainment pulled off the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is up 44% since reporting and currently trades at $95.54.

Read our full report on Sphere Entertainment here, it’s free.

Best Q3: Callaway Golf Company (NYSE:CALY)

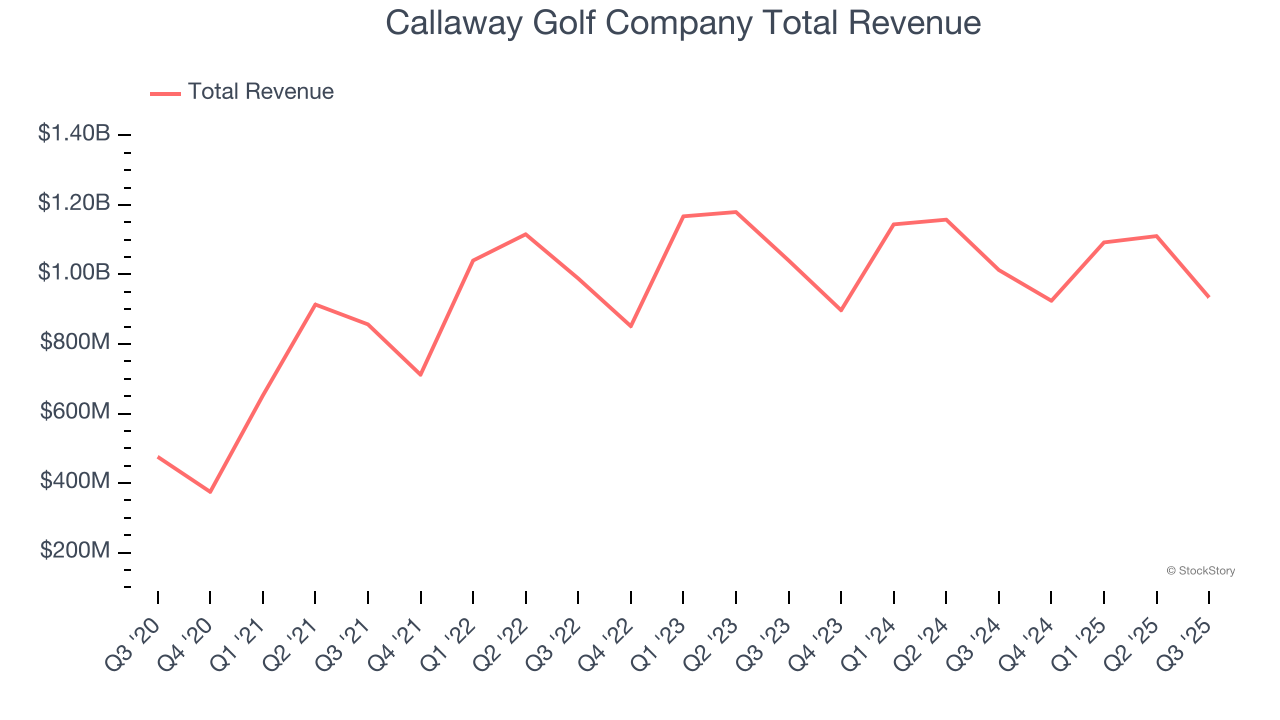

Formed between the merger of Callaway and Topgolf, Callaway Golf Company (NYSE:CALY) sells golf equipment and operates technology-driven golf entertainment venues.

Callaway Golf Company reported revenues of $934 million, down 7.8% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 59.6% since reporting. It currently trades at $14.80.

Is now the time to buy Callaway Golf Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $511.9 million, down 6.2% year on year, falling short of analysts’ expectations by 5.2%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 22.1% since the results and currently trades at $36.

Read our full analysis of United Parks & Resorts’s results here.

Live Nation (NYSE:LYV)

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE:LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $8.50 billion, up 11.1% year on year. This number lagged analysts' expectations by 0.9%. Zooming out, it was a mixed quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $151.05.

Read our full, actionable report on Live Nation here, it’s free.

Xponential Fitness (NYSE:XPOF)

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE:XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Xponential Fitness reported revenues of $78.82 million, down 2.1% year on year. This print beat analysts’ expectations by 3.9%. It was a very strong quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 32.9% since reporting and currently trades at $8.37.

Read our full, actionable report on Xponential Fitness here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.