As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the marine transportation industry, including Scorpio Tankers (NYSE:STNG) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

The 5 marine transportation stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.9%.

Luckily, marine transportation stocks have performed well with share prices up 16.9% on average since the latest earnings results.

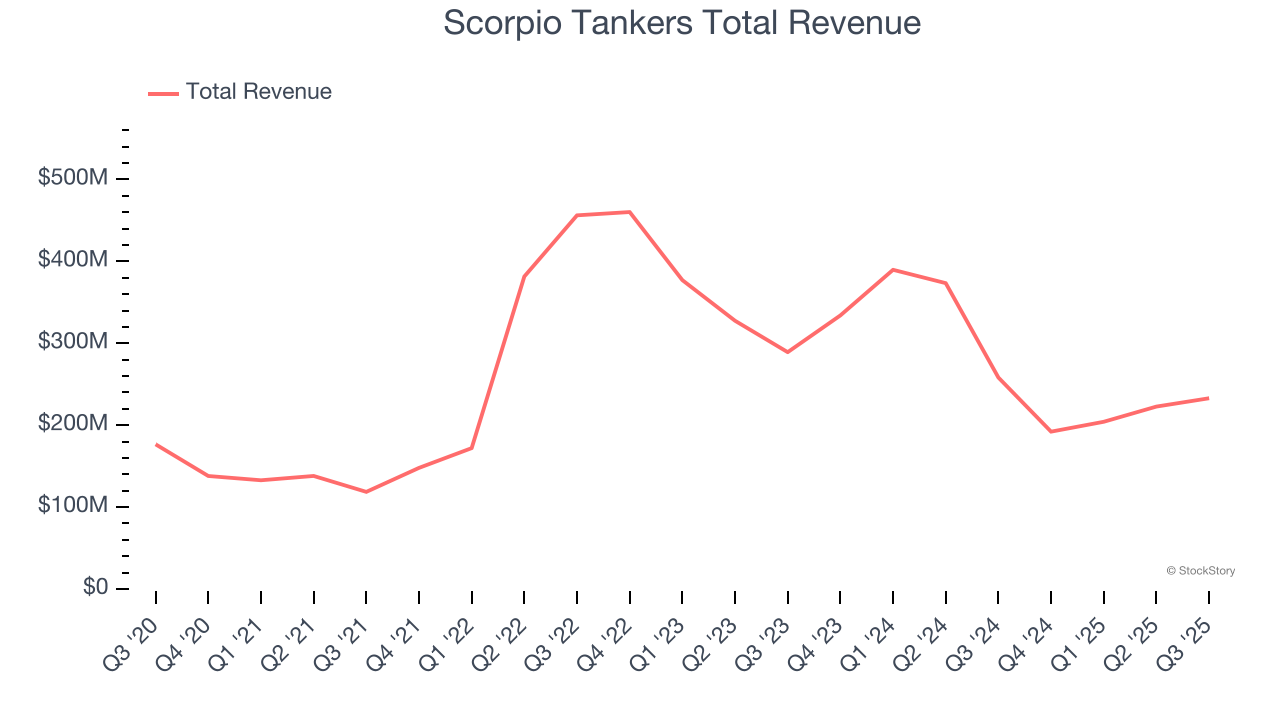

Scorpio Tankers (NYSE:STNG)

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

Scorpio Tankers reported revenues of $232.9 million, down 9.8% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

Unsurprisingly, the stock is down 17.4% since reporting and currently trades at $51.23.

Is now the time to buy Scorpio Tankers? Access our full analysis of the earnings results here, it’s free for active Edge members.

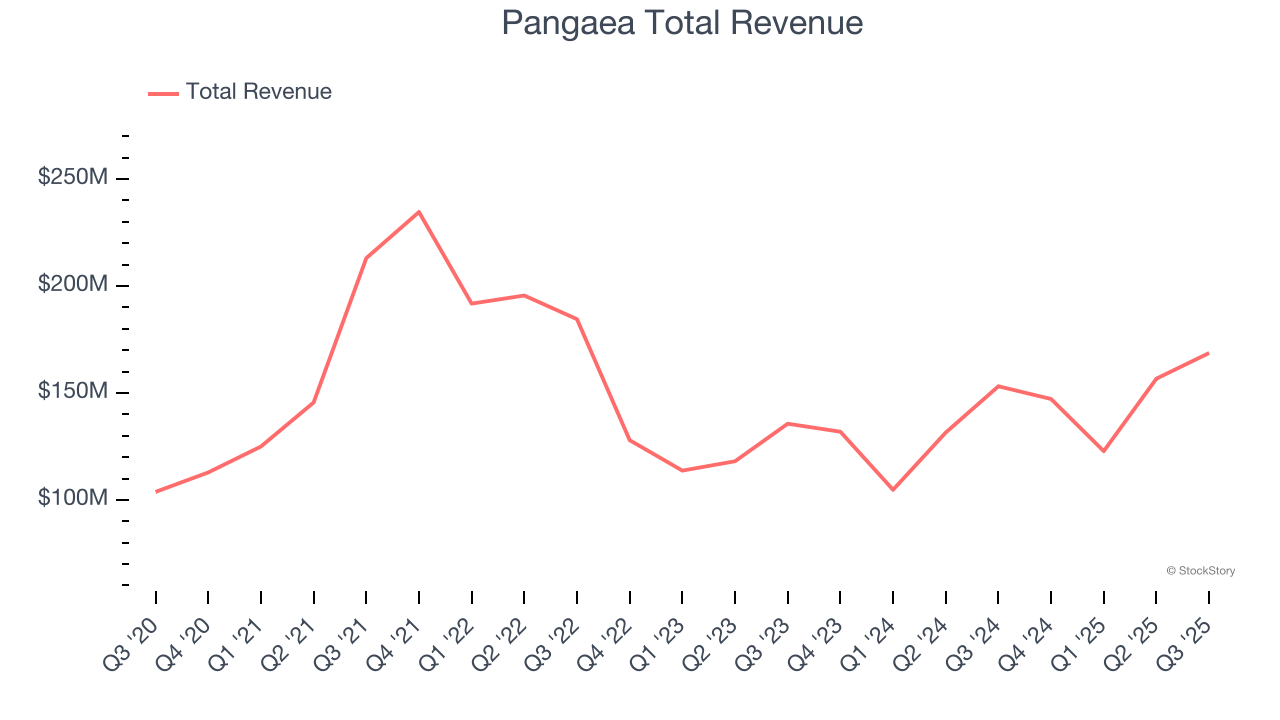

Best Q3: Pangaea (NASDAQ:PANL)

Established in 1996, Pangaea Logistics (NASDAQ:PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

Pangaea reported revenues of $168.7 million, up 10.2% year on year, outperforming analysts’ expectations by 5.9%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Pangaea delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 40.2% since reporting. It currently trades at $6.90.

Is now the time to buy Pangaea? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Genco (NYSE:GNK)

Headquartered in NYC, Genco (NYSE:GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

Genco reported revenues of $54.73 million, down 22.6% year on year, falling short of analysts’ expectations by 3.9%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Genco delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 9.9% since the results and currently trades at $18.42.

Read our full analysis of Genco’s results here.

Matson (NYSE:MATX)

Founded by a Swedish orphan, Matson (NYSE:MATX) is a provider of ocean transportation and logistics services.

Matson reported revenues of $880.1 million, down 8.5% year on year. This print surpassed analysts’ expectations by 5.1%. Overall, it was an incredible quarter as it also produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 26.7% since reporting and currently trades at $124.29.

Read our full, actionable report on Matson here, it’s free for active Edge members.

Kirby (NYSE:KEX)

Transporting goods along all U.S. coasts, Kirby (NYSE:KEX) provides inland and coastal marine transportation services.

Kirby reported revenues of $871.2 million, up 4.8% year on year. This result topped analysts’ expectations by 2.3%. It was a strong quarter as it also logged an impressive beat of analysts’ Distribution and Services revenue estimates and a solid beat of analysts’ revenue estimates.

The stock is up 25.2% since reporting and currently trades at $110.98.

Read our full, actionable report on Kirby here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.