TJX’s 17.6% return over the past six months has outpaced the S&P 500 by 11%, and its stock price has climbed to $155.64 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy TJX? Find out in our full research report, it’s free.

Why Does TJX Spark Debate?

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

Two Things to Like:

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

TJX’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 4% per year.

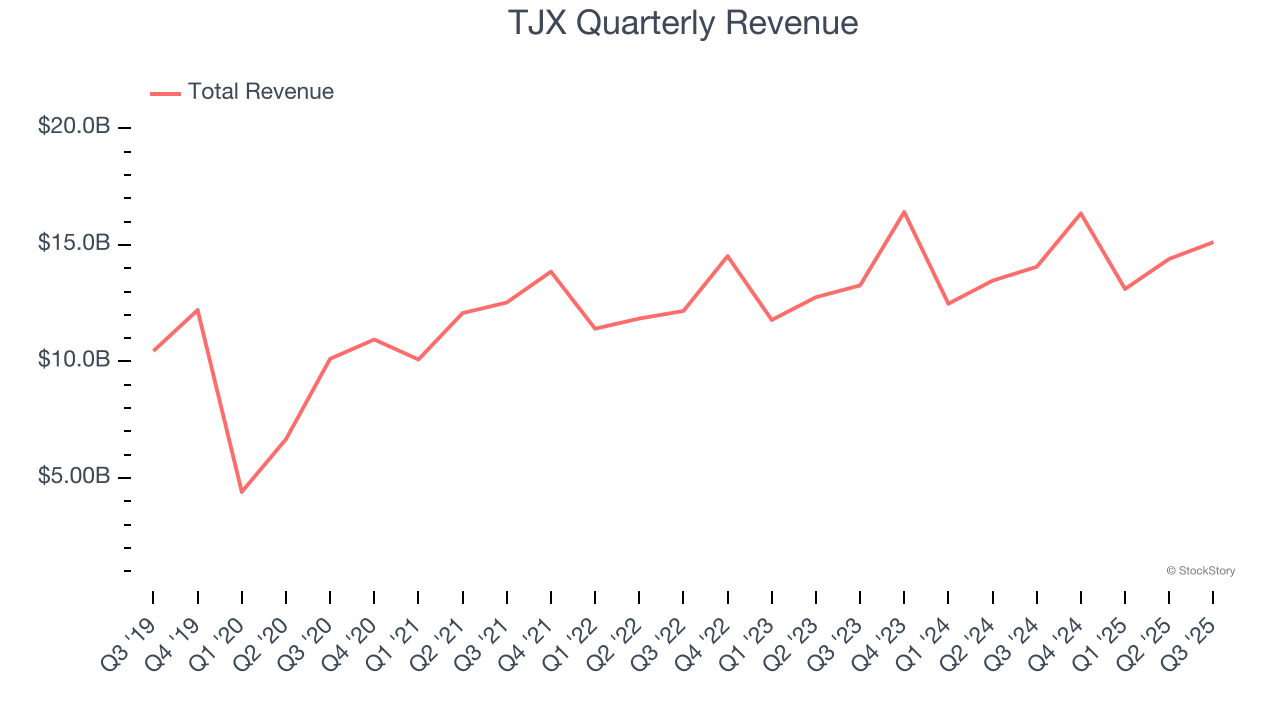

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $58.98 billion in revenue over the past 12 months, TJX is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To expand meaningfully, TJX likely needs to tweak its prices or enter new markets.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, TJX’s sales grew at a tepid 6.2% compounded annual growth rate over the last three years. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about TJX.

Final Judgment

TJX’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 31× forward P/E (or $155.64 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.