Let’s dig into the relative performance of Tutor Perini (NYSE:TPC) and its peers as we unravel the now-completed Q3 construction and maintenance services earnings season.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 12 construction and maintenance services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

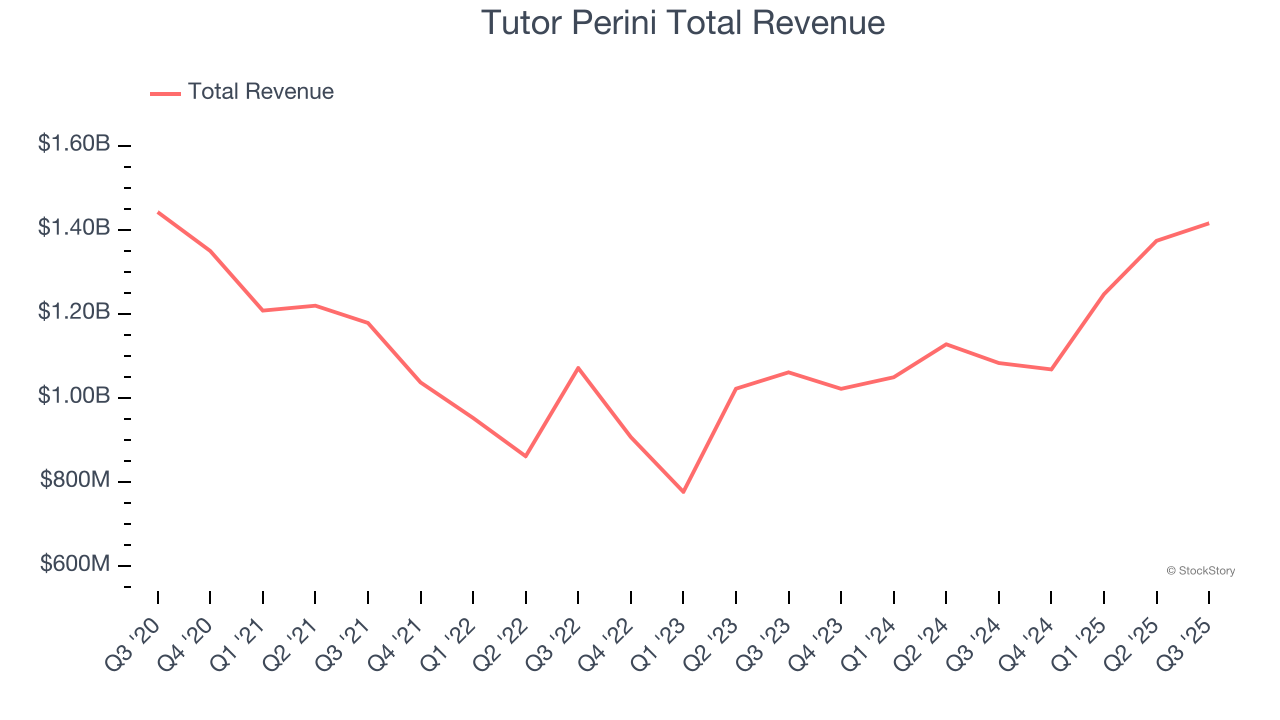

Tutor Perini (NYSE:TPC)

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE:TPC) is a civil and building construction company offering diversified general contracting and design-build services.

Tutor Perini reported revenues of $1.42 billion, up 30.7% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

Unsurprisingly, the stock is down 1.4% since reporting and currently trades at $66.97.

Is now the time to buy Tutor Perini? Access our full analysis of the earnings results here, it’s free for active Edge members.

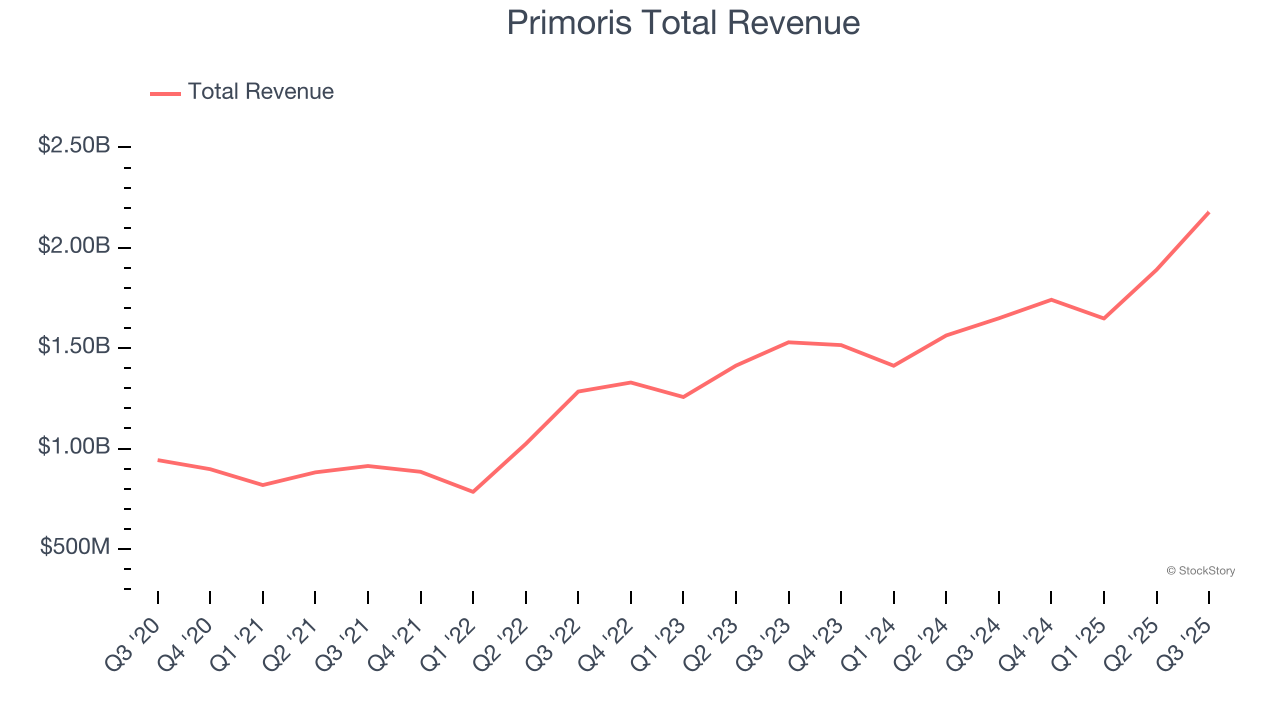

Best Q3: Primoris (NYSE:PRIM)

Listed on the NASDAQ in 2008, Primoris (NYSE:PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Primoris reported revenues of $2.18 billion, up 32.1% year on year, outperforming analysts’ expectations by 17.7%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Primoris scored the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 13.4% since reporting. It currently trades at $124.07.

Is now the time to buy Primoris? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: WillScot Mobile Mini (NASDAQ:WSC)

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ:WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

WillScot Mobile Mini reported revenues of $566.8 million, down 5.8% year on year, falling short of analysts’ expectations by 2.3%. It was a softer quarter as it posted a miss of analysts’ Delivery and Installation revenue estimates and revenue guidance for next quarter missing analysts’ expectations significantly.

WillScot Mobile Mini delivered the slowest revenue growth in the group. As expected, the stock is down 3.7% since the results and currently trades at $18.84.

Read our full analysis of WillScot Mobile Mini’s results here.

APi (NYSE:APG)

Started in 1926 as an insulation contractor, APi (NYSE:APG) provides life safety solutions and specialty services for buildings and infrastructure.

APi reported revenues of $2.09 billion, up 14.2% year on year. This number surpassed analysts’ expectations by 3.9%. It was a very strong quarter as it also logged an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ revenue estimates.

The stock is up 11% since reporting and currently trades at $38.26.

Read our full, actionable report on APi here, it’s free for active Edge members.

Comfort Systems (NYSE:FIX)

Formed through the merger of 12 companies, Comfort Systems (NYSE:FIX) provides mechanical and electrical contracting services.

Comfort Systems reported revenues of $2.45 billion, up 35.2% year on year. This print topped analysts’ expectations by 13.2%. Overall, it was an incredible quarter as it also put up an impressive beat of analysts’ backlog estimates and a beat of analysts’ EPS estimates.

The stock is up 13.4% since reporting and currently trades at $935.97.

Read our full, actionable report on Comfort Systems here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.