Travelers trades at $291.86 and has moved in lockstep with the market. Its shares have returned 10.4% over the last six months while the S&P 500 has gained 8.6%.

Is now a good time to buy TRV? Find out in our full research report, it’s free.

Why Does Travelers Spark Debate?

Tracing its roots back to 1853 when it insured travelers against accidents on steamboats and railroads, Travelers (NYSE:TRV) provides a wide range of commercial and personal property and casualty insurance products to businesses, government units, associations, and individuals.

Two Positive Attributes:

1. Outstanding Long-Term EPS Growth

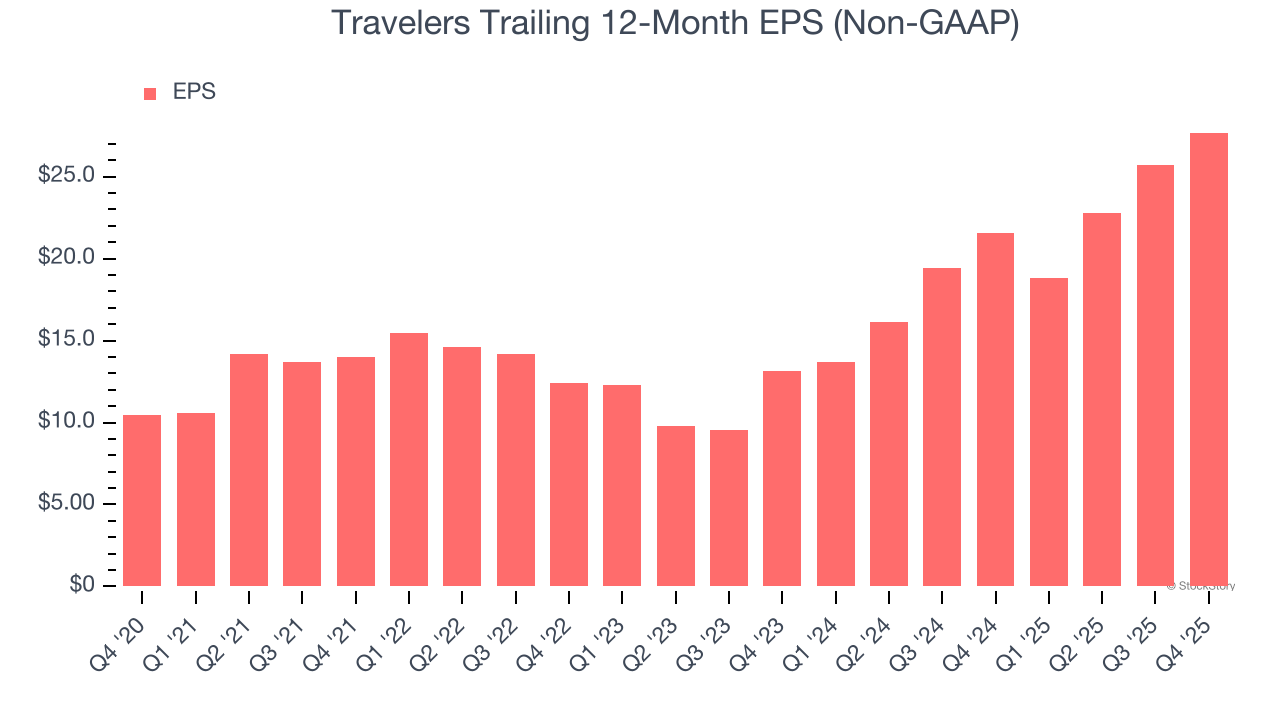

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Travelers’s EPS grew at a spectacular 21.5% compounded annual growth rate over the last five years, higher than its 8.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

2. Projected BVPS Growth Is Remarkable

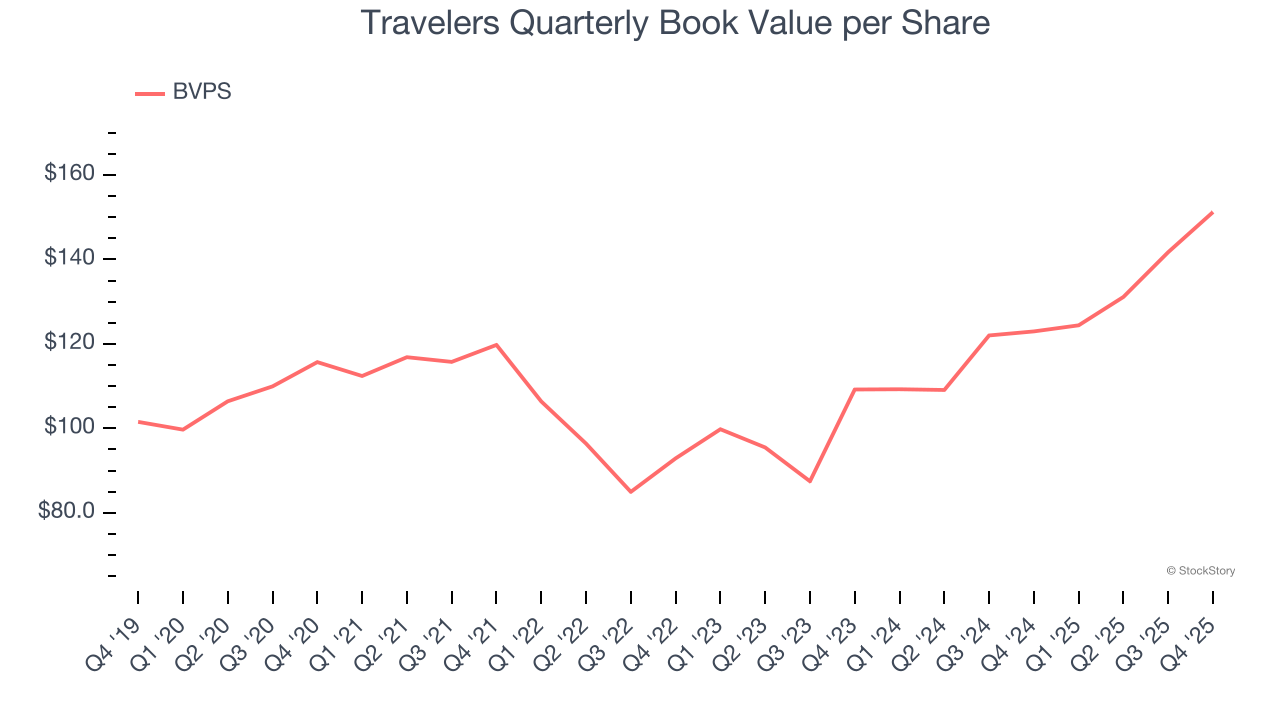

An insurer’s book value per share (BVPS) increases when it maintains a profitable combined ratio and effectively manages its investment portfolio.

Over the next 12 months, Consensus estimates call for Travelers’s BVPS to grow by 19.3% to $161.48, elite growth rate.

One Reason to be Careful:

Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Travelers’s revenue to rise by 2%, a deceleration versus its 8.6% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Final Judgment

Travelers has huge potential even though it has some open questions, but at $291.86 per share (or 1.8× forward P/B), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Travelers

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.