Over the past six months, Universal Health Services has been a great trade, beating the S&P 500 by 26.9%. Its stock price has climbed to $235.83, representing a healthy 32.8% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy UHS? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does Universal Health Services Spark Debate?

With a network spanning 39 states and three countries, Universal Health Services (NYSE:UHS) operates acute care hospitals and behavioral health facilities across the United States, United Kingdom, and Puerto Rico.

Two Positive Attributes:

1. Outstanding Long-Term EPS Growth

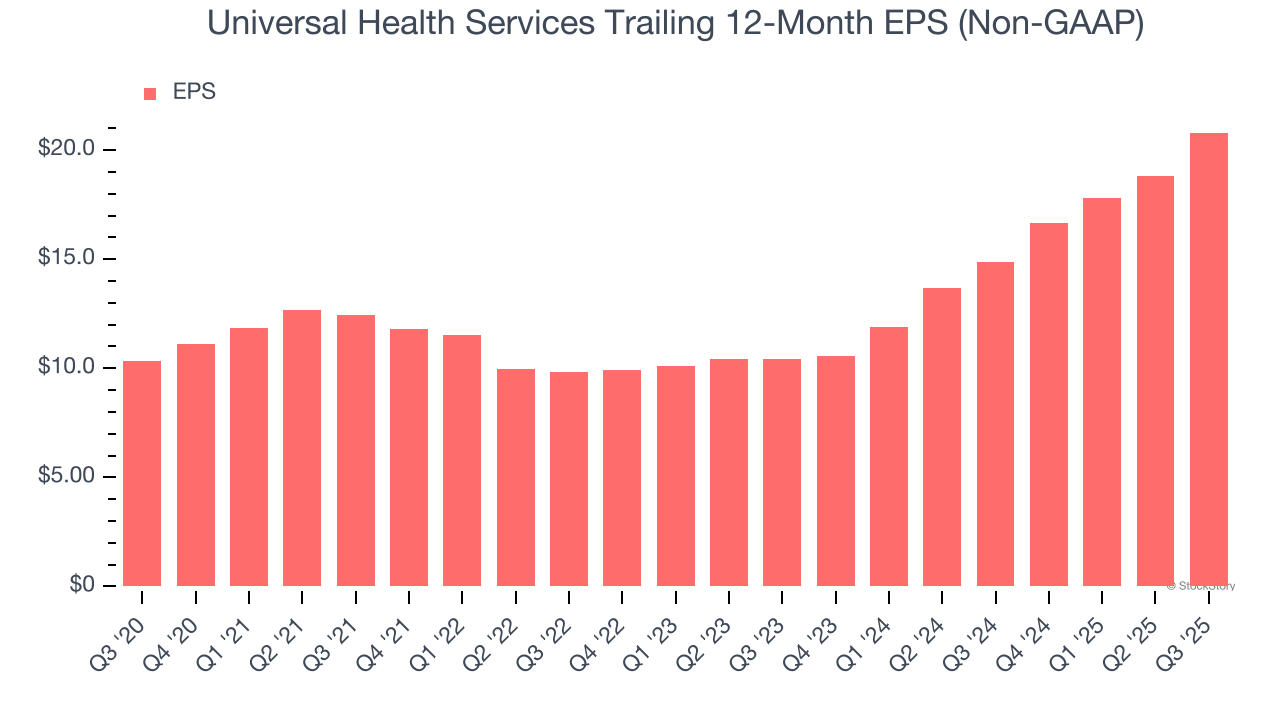

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Universal Health Services’s EPS grew at an astounding 15% compounded annual growth rate over the last five years, higher than its 8.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

2. Increasing Free Cash Flow Margin Juices Financials

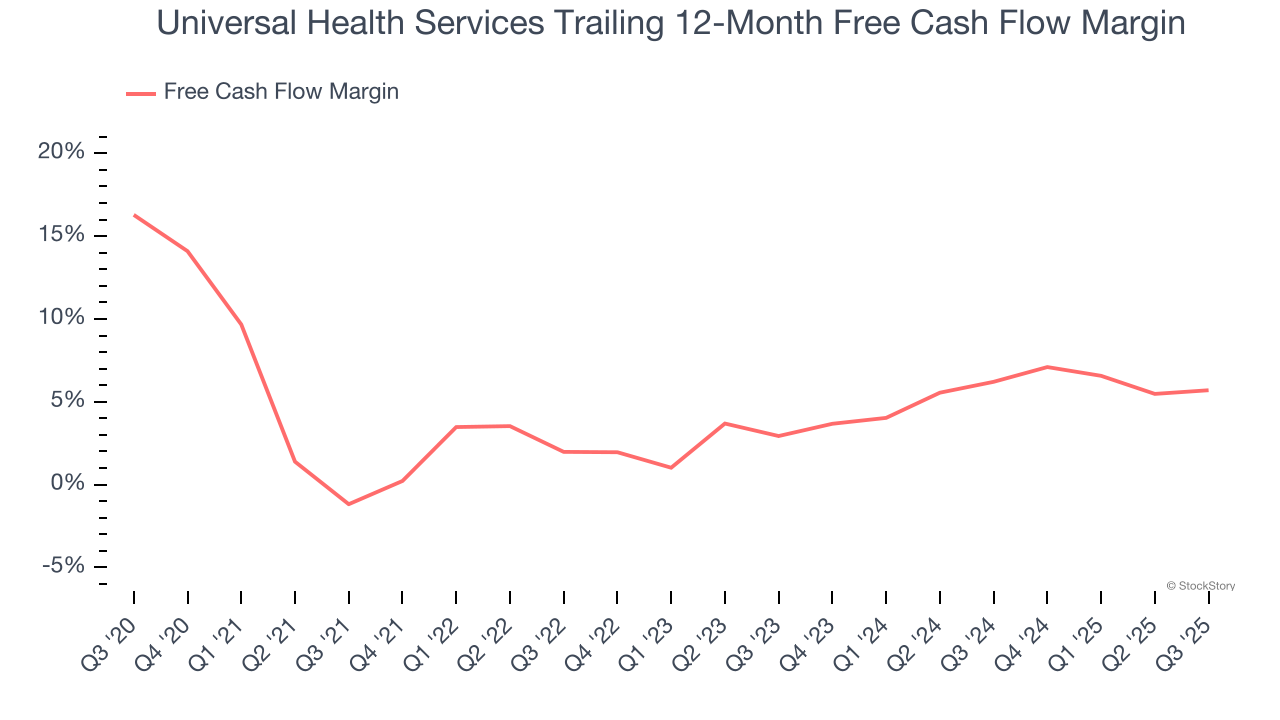

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Universal Health Services’s margin expanded by 6.9 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat. Universal Health Services’s free cash flow margin for the trailing 12 months was 5.7%.

One Reason to be Careful:

Same-Store Sales Falling Behind Peers

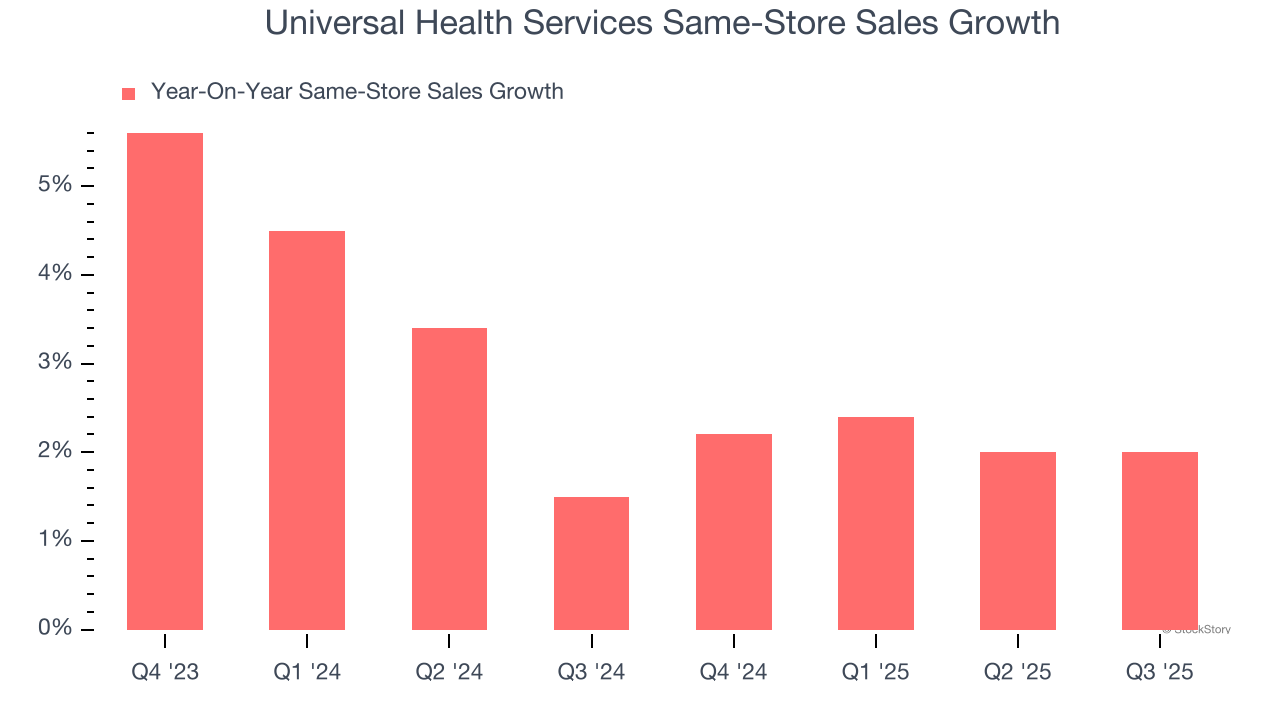

We can better understand Hospital Chains companies by analyzing their same-store sales. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Universal Health Services’s underlying demand characteristics.

Over the last two years, Universal Health Services’s same-store sales averaged 3% year-on-year growth. This performance slightly lagged the sector and suggests it might have to change its strategy or pricing, which can disrupt operations.

Final Judgment

Universal Health Services’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 10.2× forward P/E (or $235.83 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Universal Health Services

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.